- Given shifting geopolitical winds and divergent valuations, we downgrade US equities to 3-month Underweight while upgrading Europe to 3-month Overweight

- US equities to face near-term pain as escalation of trade tensions weigh on confidence and consumption; Keep a constructive view on US technology given long-term secular tailwinds

- The rise of an “America First” policy will see European nations spending more on defence; Resurgent European policy stimulus, coupled with its valuation discount, are positive tailwinds for Europe equities

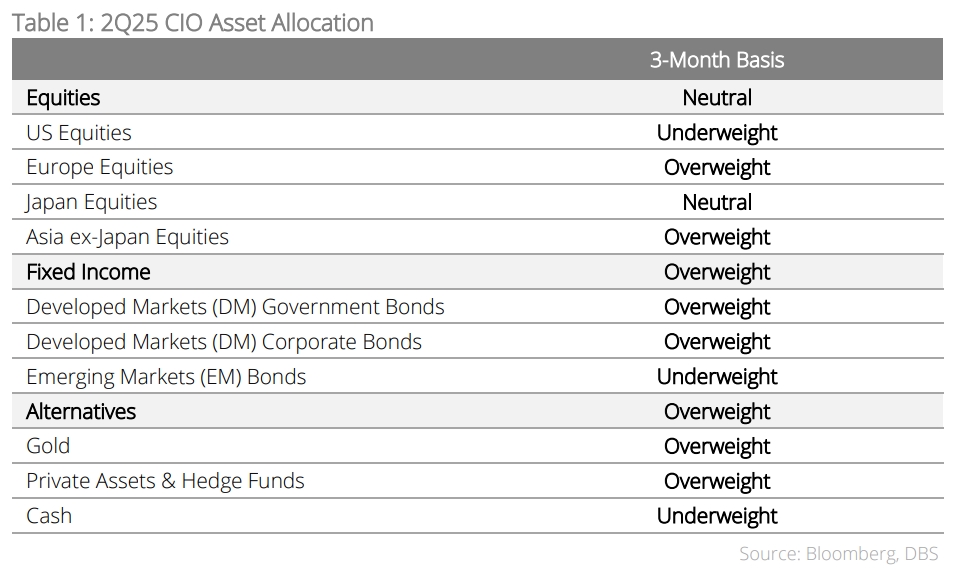

Navigating policy headwinds in Trump 2.0. We have advised investors to seek opportunities beyond S&P 500 amid policy uncertainties and early signs of moderation in the US macro momentum. On the flipside, just as “US exceptionalism” is facing severe headwinds, Europe is showing strong signs of resurgence with Germany’s “whatever it takes” moment signalling the rise of policy stimulus in Germany and other parts of Europe. Given the changing geopolitics and divergent valuations between the two markets, we are making the following tactical switches for our upcoming 2Q25 CIO asset allocation:

- Downgrading US equities to 3-month Underweight while maintaining 12-month Overweight

- Upgrading Europe equities to 3-month Overweight while maintaining 12-month Underweight

- Seek opportunities in China (eg technology). Investors are warming up to Chinese equities as DeepSeek’s technological breakthrough spurs a reconsideration of the market’s attractiveness (trading at steep valuation discount to the rest of the world).

- In the US, seek defensive exposure to healthcare while staying engaged on technology. Capitalise on volatility to add to core positions via structured products.

US equities – Near-term pain on policy uncertainties; But positive view on US technology stays intact. The initial enthusiasm surrounding fiscal easing in Trump 2.0 faded fast as the S&P 500 gave up all its post Presidential election gains. For the upcoming quarter, we advise investors to look beyond US equities given the revival of growth and policy headwinds. The escalation of trade tensions will weigh on consumer confidence and drive domestic consumption lower. The same can be said for business confidence and corporate capex. As analysts start to revise their earnings forecasts down in the coming months, it will be difficult for S&P 500 to sustain its valuation premium relative to other developed markets. On a forward P/E basis, the US trades at c.46% premium to developed markets (excluding US). However, despite our 3-month downgrade, we maintain a constructive view on US technology given their long-term secular tailwinds.

Europe equities – Impending rise in defence spending to drive economic and earnings growth higher. We are upgrading Europe to 3-month Overweight as shifting geopolitical winds with US adopting an “America First” policy will see European nations spending more on defence in the coming years. According to Kiel Institute, GDP growth could increase by 0.9-1.5% per year if nations (a) Increase defence spending to 3.5% of GDP (vs. NATO’s target of 2%) and (b) Purchase weapons manufactured domestically in Europe. The resurgence of European policy stimulus is coming at a time when the region’s macro momentum is on the rebound and yet, the domestic equity market is trading at a discount to the rest of the developed markets.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.