- Chinese enterprises are increasingly present in major technological sectors as the country embraces digital innovation, disruption, enablement, and adaptation

- China’s technology and platform industries have demonstrated resilience despite trade tariffs, signalling that the global tech landscape is evolving

- The trend of population migration is driving the rise of new upper tier-2 cities, corresponding to the growth of new technology enterprises

- Investors’ lightweight positioning in China equities and its technology stocks is projected to reverse, potentially boosting stock prices and driving positive revaluation

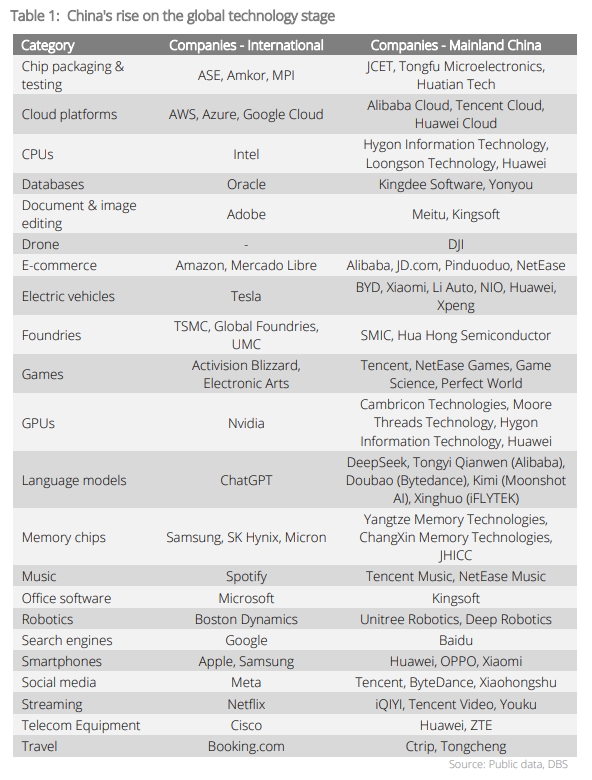

Chinese companies are making their presence felt on the global technological stage. As shown in Table 1, Chinese enterprises are present in nearly every major technological sector − from language models and cloud platforms, to semiconductor hardware and electric vehicles – as China commits to digital innovation, disruption, enablement, and adaptation.

International companies, with their years of experience and expansive networks, continue to dominate several key fields, such as cloud computing, software development, and advanced hardware. However, the rise of Chinese companies is disrupting this status quo, gradually narrowing the gap and emerging as formidable competitors, particularly in areas such as artificial intelligence, semiconductors, electric vehicles, and mobile technology.

In the semiconductor integrated circuit field, despite the longstanding dominance of international giants, Chinese companies, such as SMIC (Semiconductor Manufacturing International Corporation) and its peers, are making rapid strides by actively engaging in research and development to steadily bridge the technological gap. Meanwhile, in the field of artificial intelligence and large language models, the emergence of DeepSeek has been a notable milestone, highlighting China's swift progress in this area.

While China's tech industry has faced challenges such as global trade tariffs and technological barriers, it has nonetheless demonstrated remarkable resilience. This dynamic growth indicates that the global tech landscape is evolving, with Chinese companies playing an increasingly influential role. Additionally, in some other sectors, Chinese enterprises even hold an undisputed leadership position, such as in the fields of drones, robotics, EV and batteries.

China’s new little giants: SRDI (“专精特新” − Specialised, Refined, Distinctive, Innovative).

The development of China's technology industry is also inseparable from the support of its cities. A prime example is the recent rise of the "Six Little Dragons" of Hangzhou —technology companies spanning various sectors that are becoming the city's new hallmark — comprising names such as Unitree, DeepSeek, Game Science, Manycore, BrainCo, and Deep Robotics.

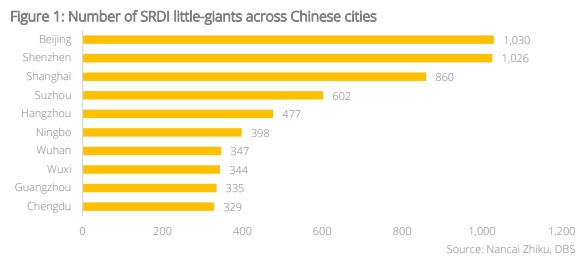

A virtuous cycle, where urban development fuels industrial growth and vice versa, is taking shape across cities in China. Local governments are therefore focusing on nurturing enterprises with specialised, refined, distinctive, and innovative capabilities to spearhead the future development of technology (Figure 1). These companies are no longer confined to traditional first-tier cities but are instead taking root in vibrant cities like Suzhou, Hangzhou, and Ningbo.

In line with the flourishing of new technology enterprises, these cities are continuously attracting top-tier talent from across the country. As a result, there is a dramatic rise in demand for advanced infrastructure, from modern transportation to stylish residential complexes and schools, all of which contribute to the urban landscape. Meanwhile, the influx of skilled, high-income workers further stimulates domestic demand in these cities. A byproduct is the booming of high-end retail, fine dining, and demand for a diverse array of cultural experiences, injecting powerful momentum into the local economy for sustained and quality growth.

Population migration and the rise of upper tier-2 cities. The trend of population migration is closely linked to the rise of new upper tier-2 cities. Over the past few years, Chengdu, Wuhan, and Changsha have attracted a large influx of talent through appealing talent recruitment policies. These include housing subsidies, preferential treatment for high-technology entrepreneurs, and access to quality educational resources for families.

Similarly, policies supporting the development of technology, such as tax incentives and research funding, have made these cities hotbeds of innovation. Additionally, the relatively lower cost of living in these upper tier-2 cities has created favourable conditions for young people to settle down and thrive, further accelerating population migration from traditional first-tier cities to these upper tier-2 cities. Over time, this shift will significantly reshape China's demographic and economic landscape.

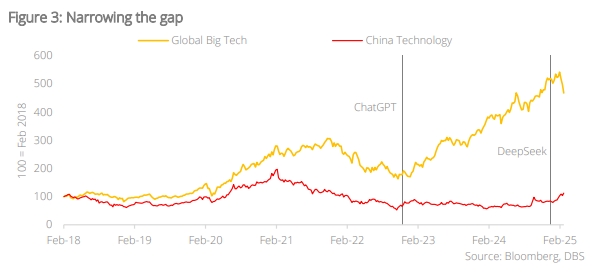

Narrowing the gap. From the perspective of capital markets, the return gap between US and Chinese technology stocks is expected to narrow. Over the years, the NYFANG index, which tracks US technology stocks, has outperformed the Hang Seng Tech Index, which reflects Chinese technology stocks listed in Hong Kong. This disparity became especially pronounced in 2022 after the launch of ChatGPT by OpenAI, which attracted a massive influx of funds, driving index prices sharply upward.

Over the past decade, China has strategically focused its development efforts on 10 pivotal industries:

- New energy vehicles (with a particular focus on automotive sector in Jiangsu-Zhejiang regions)

- Energy and power generation

- Shipbuilding

- High-speed rail

- Aerospace and related systems

- Biotechnology and advanced materials

- Robotics

- Large enterprises

- Semiconductors, high-end CNC machine tools

- Agricultural machinery

Collectively, these sectors form a highly integrated industrial ecosystem, reflecting China’s enterprising push for technological advancement and self-sufficiency.

With the advent of DeepSeek, investors are beginning to reassess the potential of Chinese technology companies, and this is just the start of a new cycle. As noted by the People's Daily: "Standing at the threshold of the AI era, DeepSeek is a milestone, but its true significance lies in its ability to break barriers, inspire, and provide insights."

Investors’ lightweight positioning in China equities and its technology stocks are projected to reverse, potentially boosting stock prices and driving positive revaluation. At the current pace, this could gradually reduce the price-performance gap between Chinese and US technology stocks, reshaping the landscape.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.