- US shale oil firmly back in the game with market share gains after a couple of muted years

- Volume growth has been above expectations since 2H23; The prospect of a price war with OPEC is unlikely, allowing the US shale industry to benefit from both higher production and firm oil prices

- M&A deals are back, and further consolidation in the US shale industry looks likely, as bigger players look to lock in future growth prospects

- Share prices to benefit from strong operational performance and guidance in upcoming results, in addition to the possibility of geopolitical risk premium returning to oil prices

- Remain Neutral on the Oil & Gas industry

Related Insights

- Equinix Inc 26 Jul 2024

- Strong 2Q GDP Highlights Economic Resilience26 Jul 2024

- Research Library26 Jul 2024

US shale oil makes a strong comeback. A slowdown in US shale production in the last few years has enabled the OPEC+ cartel to hold greater sway over the global oil market. This is due to listed independents veering towards tighter capex and focusing on profitability and shareholder returns.

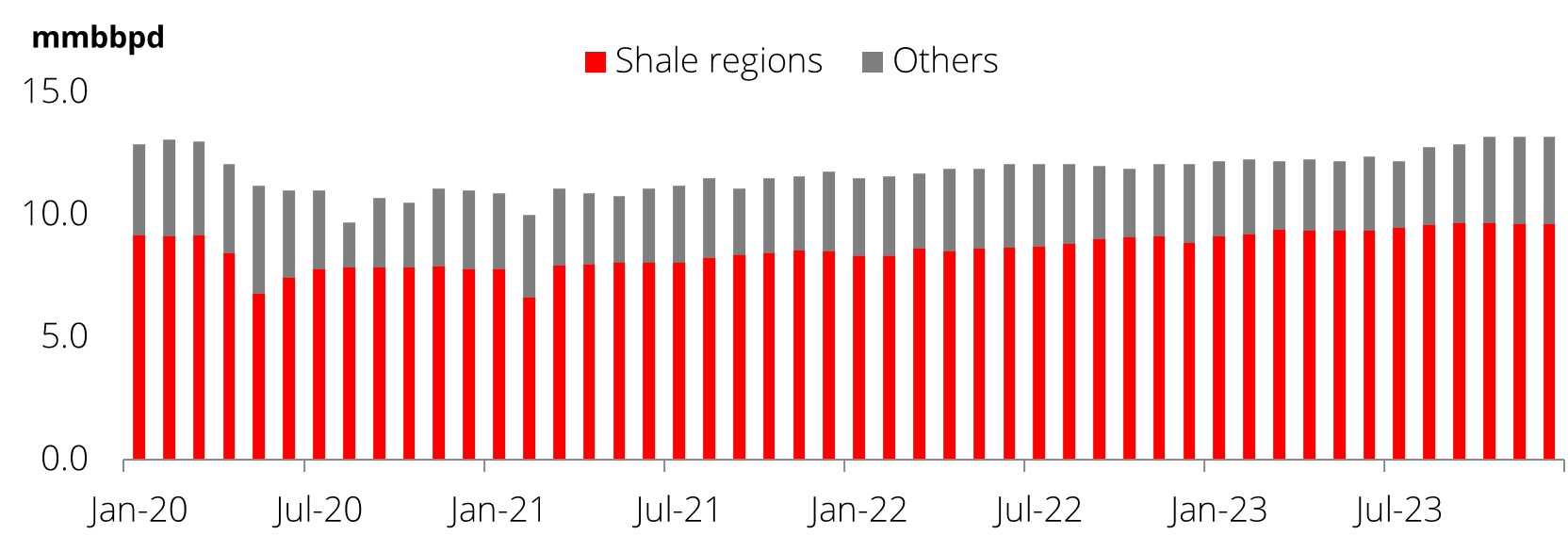

But US oil production growth has recently seen a surprise jump. After averaging around 12.3mmbpd for the first seven months of 2023 (not too far from the 2022 exit rate of 12.1mmbpd), US oil production has jumped since August and exited 2023 at a run rate of 13.2mmbpd. This was much higher than street estimates earlier in the year, and close to prior record levels last seen in early 2020.

The increase was driven by higher production from the shale patch on the back of sustained high prices and an opportunity to gain market share at the expense of OPEC. This implies that average US production would grow at c.0.7mmbpd for 2023, and this kind of y/y growth rate could be maintained in 2024 as well.

Recent deals show oil majors’ commitment to the shale patch for long-term growth. The US shale patch remains in focus as a key growth pillar for oil majors, with ExxonMobil and Chevron both announcing sizeable acquisitions of independent players in recent months. This would put the US’s shale production growth as a key driver for supermajor growth strategies going forward. While key listed US shale patch players have remained disciplined on capex in recent years, the lesser lure of dividends for investors amid the high interest rate environment could divert cash flows towards growth hereon.

While much of the production increase in 2H23 has been driven by increase in drilling, fracking efficiencies and drawdowns in drilled but uncompleted wells (DUCs) inventory, we are likely to see increases in both rig counts and frac spreads in recent weeks after falling for much of 2023. Deal activity could also remain elevated in 2024, as much of the increase in shale oil production has been driven by privately held producers like Mewbourne and Endeavour, while bigger listed players could also look to boost production volumes through the inorganic route.

Upside risk to near-term oil prices remain from geopolitical developments. Shale players are expected to maintain steady returns in 2024 as oil prices remain elevated in the USD75-80/bbl range despite economic slowdown risks. Organic growth through production gains and potential of inorganic growth through M&A will further drive prospects for the sector.

As ESG investing loses some sheen in the US and clean energy stocks suffer due to supply chain issues and oversupply concerns, oil and gas plays continue to be a relatively safe-haven investment in the energy space, given that global energy demand and energy security concerns will continue to ensure hydrocarbons stay relevant for a long time. In the near term, share prices could be supported by oil price spikes in case the crisis in the Middle East escalates further.

Figure 1: US oil production makes a strong comeback in recent months

Source: Bloomberg, DBS

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.

Related Insights

- Equinix Inc 26 Jul 2024

- Strong 2Q GDP Highlights Economic Resilience26 Jul 2024

- Research Library26 Jul 2024

Related Insights

- Equinix Inc 26 Jul 2024

- Strong 2Q GDP Highlights Economic Resilience26 Jul 2024

- Research Library26 Jul 2024