- Equities: The US Federal Reserve kept rates unchanged; US and Europe posted lacklustre performances while China markets declined

- Credit: Asymmetric upside in IG bonds supports a barbell duration strategy to balance certainty of returns in 2-3Y credit with favourable risk-reward in 7-10Y credit

- FX: FOMC has failed to provide a USDpositive impetus

- Rates: Tariff uncertainty and stagflation risks point to flatter curves and increased demand for 5Y–10Y USTs if sentiments falter further

- The Week Ahead: Keep a lookout for US Change in Initial Jobless Claims; Singapore CPI

US and Europe equity markets posted lacklustre performances while China markets declined. The US Federal Reserve left interest rates unchanged and stated in its March policy meeting that it considered the impact of tariffs on inflation transitory while expecting 50 bps of interest rate cuts this year. The dovish tone boosted market sentiment. The Dow Jones, S&P 500, and NASDAQ gained 1.2%, 0.5%, and 0.2% respectively for the week. In Europe, concerns over US tariffs were offset by optimism on anticipated spending by countries on defense. The STOXX 600 gained 0.6% and the FTSE climbed 0.2% over the week. The BOJ left rates unchanged but the market expects gradual rate hikes; the Nikkei 225 gained 1.7%. China markets retreated after their sharp run-up. The SHCOMP declined 1.6% and the Hang Seng Index dropped 1.1%.

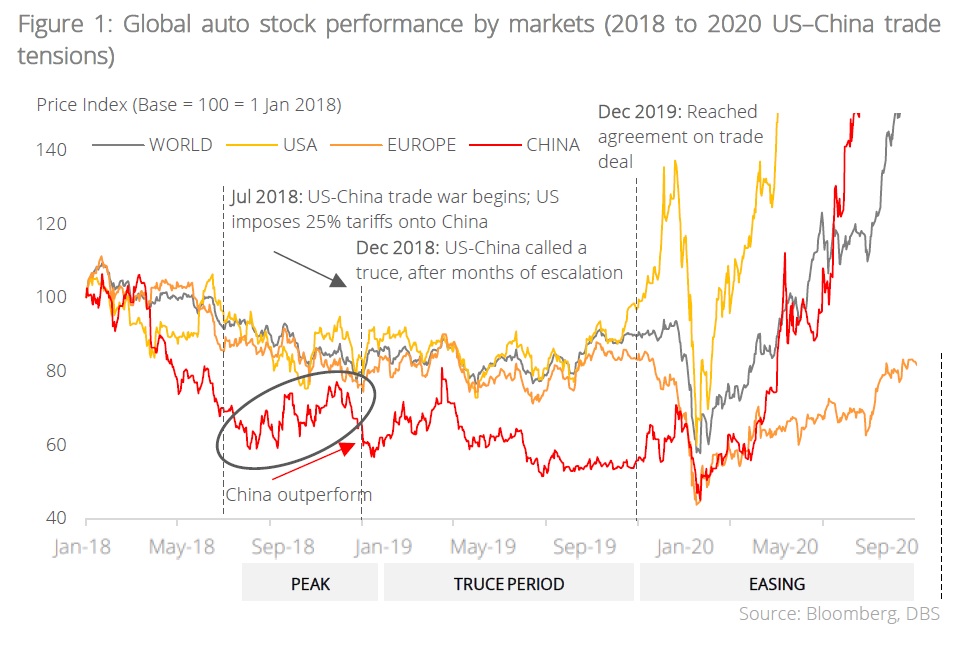

Topic in focus: Trump 2.0 to bring volatility to global autos. US-based automakers could be more vulnerable to trade escalations given their reliance on (i) Mexico/Canada auto production and (ii) imported auto parts. Based on our estimates, Mexico/Canada production make up 10-20% of group production/sales for GM, Honda, and Ford and <10% for Toyota, Volkswagen, and BMW. In the past, US-based automakers (e.g. Ford and Honda) had also cited earnings warnings due to tariffs on steel and aluminium. These concerns were also highlighted in recent 4Q24 earnings calls where US automakers (e.g. GM, Ford, Tesla) delivered a cautious 2025 outlook on weakening Average Selling Price (ASP) pricing, Inflation Reduction Act (IRA) roll-back risks, and tariff uncertainty. Toyota, on the other hand, upgraded its outlook on firm US pricing power and reduced incentives, given its tight inventory.

Furthermore, to position for Trump 2.0, we advocate investors to consider diversification outside of US, such as in China. During 2018-2019 trade war, Chinese automakers outperformed global autos on the back of strong growth drivers such as robust xEV sales. Going forward, we believe Chinese automakers are poised to outperform global autos. This is driven by a robust demand backdrop, driven by key factors such as (i) government auto stimulus extension, (ii) firm xEV demand, and (iii) autonomous driving tailwinds.

Download the PDF to read the full report which includes coverage on Credit, FX, Rates, and Thematics.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.