Latest offer

DBS e$aver is a great way to help you grow your money. Save early & Grow more!

Accelerate your savings to unlock extra bonus interest rate!

Deposit Eligible New Funds# to enjoy DBS e$aver interest

Receive a lump sum cash reward from designated account so you can plan your finances with ease and earn more interests

Access your money flexibly when the right opportunity comes along

Diversify your savings into foreign currencies

Join DBS Treasures3 and deposit Eligible New Funds to enjoy DBS e$aver interest rate and cash rewards^

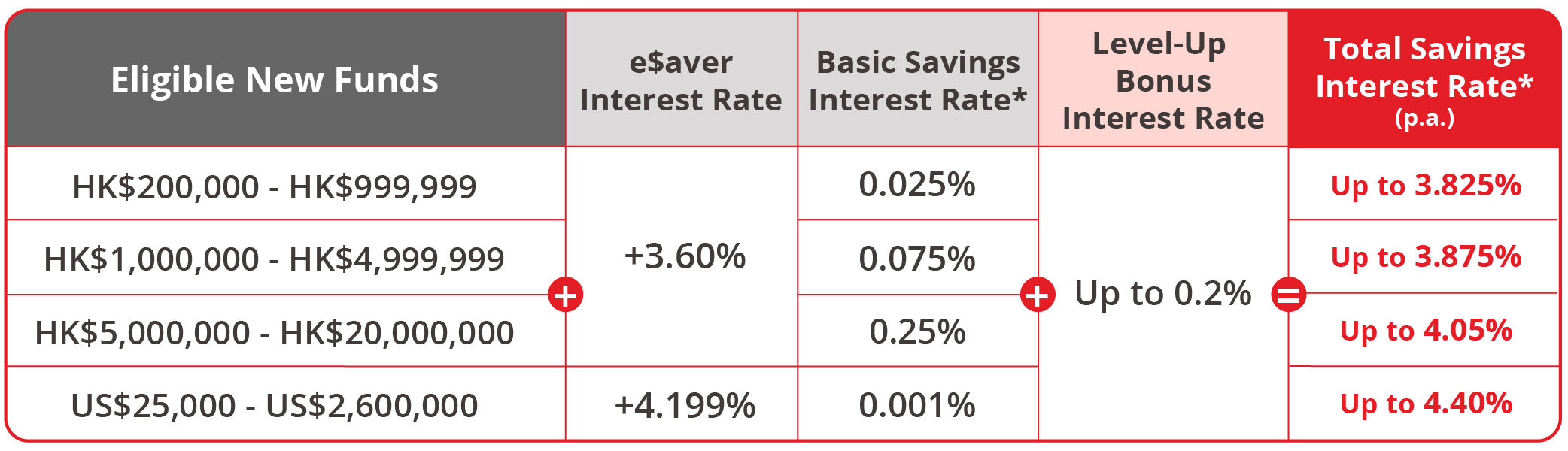

Total Savings Interest Rate up to 4.4% p.a.

#“Eligible New Funds” refers to the incremental balance comparing the MCY Account Balance within the Reward Counting Period to:

a.For New Customers: HKD / USD Deposit Balance on 28 February 2025, default to be zero; OR

b.For Upgraded Customers: HKD / USD Deposit Balance on 28 February 2025, according to the Bank’s record.

“HKD or USD Deposit Balance” is the total of HKD or USD deposits that Eligible Customer maintains with the Bank in the HKD or USD Designated Current & Savings Accounts including Wealth Management Accounts ("WMA”) -> HKD, USD Current Accounts and/or Savings Accounts and/or Multi-Currency Savings Accounts(“MCY Account”), excluding any Time Deposits, regardless it is solely or jointly owned by the Eligible Customer.

Total Savings Interest Rate up to HKD 4.15% p.a. | USD 4.4% p.a.︰

Enjoy below Total Savings Interest Rate within the Reward Counting Period~:

Currency | Eligible New Funds | Reward Counting Period | Total Savings Interest Rate (p.a.)* | Level-up Bonus Interest Rate (p.a.)4 | |

| HKD | $200,000 - $20,000,000 | 1 March2025 – | Up to 3.95% | +Up to 0.2% | |

| USD | $25,000 - $2,600,000 | 4.2% | |||

~Interest rate is calculated in daily basis and New Customer who fails to maintain such Eligible New Funds HK$200,000 and/or US$25,000 or above at the end of the Promotion on 31 May 2025 is not eligible to earn the Rewards.

*Total Savings Interest Rate includes Basic Savings Interest Rate and e$aver Interest Rate. The Total Savings Interest Rate above is as of 28 February 2025 and it is for reference only. The Basic Savings Interest Rate is not guaranteed, please click here for more details.

How to calculate Total Savings Interest Rate?

*All Total Savings Interest Rate above is as of 28 February 2025 and it is for reference only. Basic Savings Interest rate is calculated based on respective HKD / USD Deposit Balance in Multi-Currency Savings Account.

Please click here for more details and examples.

Timetable of your fund in period

| Join month | Benchmark Date (Upgraded Customers) | Fund-in Period | Terms and Conditions |

March 2025 | 28 February 2025 | 1 March 2025 – | Please click here for details |

- The Promotion runs from Now until 31 March 2025 (“Promotion Period”).

- The Promotion is applicable to customers who have successfully set up or upgrade to new DBS Treasures customer (individual “Eligible Account”) with DBS Bank (Hong Kong) Limited 星展銀行(香港)有限公司 (the “Bank”).

- For details of “New DBS Treasures Customer Promotion”, please click here.

- The Level-up Bonus Interest is only applicable to eligible customer who has completed any designated challenge(s) during the Reward Counting Period.

- e$aver Interest and corresponding Level-Up Bonus Interest will be credited directly to the MCY Account of the New Customer on or before 31 August 2025.

- Terms and Conditions apply. Please click here for more details.

Do more to unlock a Level-Up Bonus Interest Rate up to 0.2%p.a.!

Challenge 1: Complete the following mission to earn a 0.1%p.a. Level-Up Bonus Interest

Eligible Foreign Currency Exchange Transaction

- Completes a single FX transaction of HK$100,000 or above (or equivalent in foreign currency), excluding any currency exchange transaction that buy currency is Japanese Yen (JPY).

Challenge 2: Complete the following mission to earn an extra 0.1%p.a. Level-Up Bonus Interest

Eligible Investment Transaction

- Conducts any Eligible Investment Transaction as defined below with an aggregate investment transaction amount of HK$100,000 or above (or equivalent in foreign currency) via the Eligible Customer’s WMA

- Subscription of ELP (i.e. equity linked investments and/or equity linked notes); or

- Lump sum subscription or switching (with minimum subscription of 1.2% or switching fee of 1%) of Investment Funds; or

- BUY and SELL Local and Overseas Securities Transaction (Hong Kong Securities, U.S. Securities, Canadian Securities, Singapore Securities, Australian Securities, Japan Securities or United Kingdom Securities) conducted through DBS online banking platforms.

DBS UnionPay Diamond Debit Card

- Become DBS Treasures customer and apply debit card to enjoy HK$200 cash rewards

- Deposit new funds and spend with debit card in Hong Kong to enjoy up to HK$500 cash rewards

- Enjoy up to HK$500 cash rebates on your oversea spending and enjoy exclusive UnionPay privileges

Learn More

Payroll Reward

- Successfully receives Eligible Payroll Fund in his/her Designated HKD Current & Savings Payroll Account to get HK$800 cash reward

Learn More!

Overseas Transfer Reward

- Earn up to HK$400 cash rewards upon completion of foreign exchange transaction(s) and online overseas funds transfer of designated currencies (AUD, CAD, EUR, GBP, SGD and USD) in a single transaction.

Learn More

e$tamp Reward

- Earn HK$200 worth of eStamps by completing eligible digital and investment transactions plus a chance to multiply your rewards to HK$800 cash reward!

Learn More

Government Bill Payment Reward

- Register and settle your government bills online including tax payment, government rent, rates and Transportation Department bills with HK$10,000 or above to enjoy up to HK$450 cash rewards!

Learn More

Expired Promotions

DBS e$aver Deposit Promotion for New Customers and Upgraded Customers (February 2025)

DBS e$aver Deposit Promotion for New Customers and Upgraded Customers (January 2025)

DBS e$aver Deposit Promotion for New Customers and Upgraded Customers (December 2024)

DBS e$aver Deposit Promotion for New Customers and Upgraded Customers (November 2024)

DBS e$aver Deposit Promotion for Selected Individual Customers (January 2025)

DBS e$aver Deposit Promotion for Selected Individual Customers (November 2024)

DBS e$aver Deposit Promotion for Selected Individual Customers (October 2024)

DBS e$aver Deposit Promotion for Selected Individual Customers (September 2024)

Frequently Asked Questions

For new customer: Successfully join DBS Treasures to enjoy the exclusive welcome rewards. New DBS Treasures customers needs maintain monthly Total Relationship Balance of HK$1,000,000 or above. Please click here to join us. You may deposit and maintains eligible new funds in your Multi-Currency Savings Accounts within the reward counting period to get the e$aver interest rate. Please refer to the terms and conditions for details.

For existing customer: Please review the terms and condition before register for the promotion. You may simply deposit and maintain eligible new funds in your Multi-Currency Savings Accounts within the reward counting period to get the e$aver interest rate. Please refer to the terms and conditions for details.

Registration via the designated link is only necessary to existing customer. You will receive a confirmation email from the bank after registration. If you do not receive a confirmation email, please check your spam folder, or register again within the registration period.

Total Savings Interest Rate includes Basic Savings Interest Rate & e$aver Interest Rate. Please click here for details of Basic Savings Interest Rate. The e$aver Interest rate is calculated daily based on the day-end Eligible New Funds balance in the Multi-Currency Savings Account accrued during the Reward Counting Period.

Basic Savings Interest Rate is subject to revision in light of prevailing market conditions. The Basic Savings Interest Rate is not guaranteed, and the Bank reserves the right to revise the Basic Savings Interest Rate at any time and from time to time for any reason without any prior notice or giving any reason therefor. The Basic Savings Interest will be credited directly on or before the last day of each month.

For New Customer: Eligible New Funds = Daily available balance in HKD / USD MCY Accounts

For Upgrade to DBS Treasures / Existing Customer: Eligible New Funds = Daily available balance in HKD / USD MCY Accounts - HKD or USD Deposit Balance on Benchmark Date.

Risk Disclosure and Important Notice:

Foreign exchange involves risks. Customers should note that foreign exchange may incur loss due to the fluctuation of exchange rate.

Investment Funds and Equity Linked Products (together “the Products”) are investment products and some of them may involve derivatives. The investment decision is yours but you should not invest in the Products unless the intermediary who sells them to you has explained to you that the Products are suitable for you having regard to your financial situation, investment experience and investment objectives. The Products are NOT equivalent to and are not treated as substitutes for time deposits, and are not principal protected. Equity Linked Products and some Investment Funds are classified as complex products by the Bank. You are advised to exercise caution prior to investing.

Securities trading is an investment which involves risks. The prices of stocks fluctuate, sometimes dramatically. The price of a stock may move up or down and may become valueless. It is as likely that losses will be incurred rather than profits made as a result of trading stocks. You should also be aware that investing in foreign securities market involves foreign exchange risk, you may incur loss due to the fluctuation of exchange rate. The investment decision is yours but you should not invest in any stock unless you have taken into account that the relevant stock is suitable for you having regard to your financial situation, investment experience and investment objectives. Customers should be aware that the prices of the Callable Bull / Bear Contracts, Warrants and Exchange Traded Funds may fall in value as rapidly as they may rise and holders may sustain a total loss of their investment. The Bank does not provide securities advisory service.

The Products are NOT protected deposits and are NOT protected by the Deposit Protection Scheme in Hong Kong.

Any person considering an investment should seek independent advice on the investment suitability when considered necessary.

Disclaimer:

Investment involves risks. The above information is not and shall not be considered as investment advice. It does not constitute any offer or solicitation of offer to subscribe, transact or redeem any investment product. Past performances are not indicative of future performances. You should carefully read the product offering documentation, the account terms and conditions and the product terms and conditions for detailed product information and risk factors prior to making any investment. If you have any doubt on this material or any product offering documentation, you should seek independent professional advice.