New Foreign Exchange Online Trading Platform

DBS FX Online Trading Platform

Exchange currencies via DBS digibank HK app and DBS iBanking and leverage the online functions below to facilitate your trading:

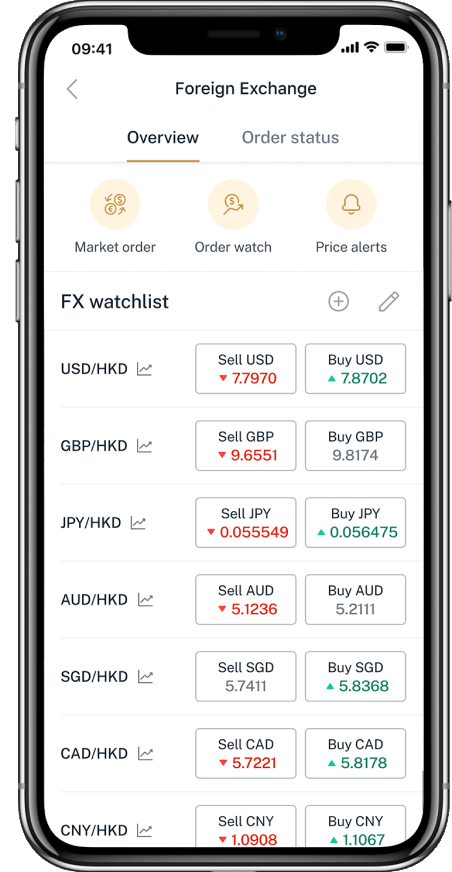

- Stay on top of market movement by viewing live FX rates

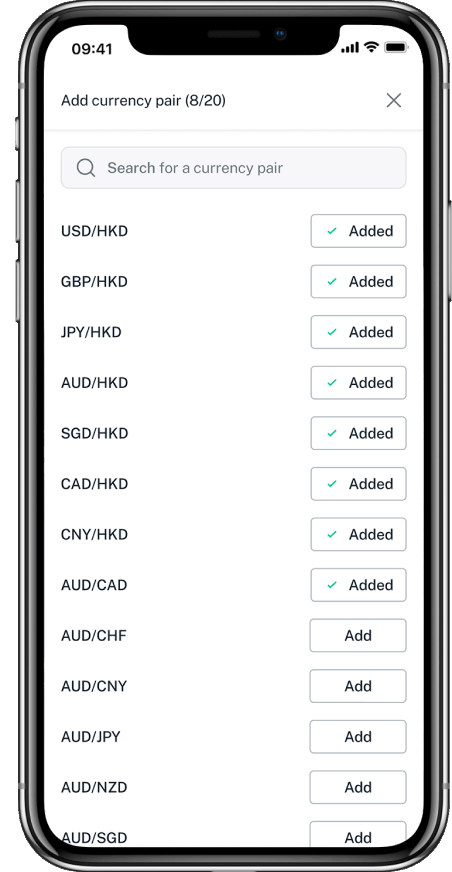

- Track your favourite currencies by adding up to 20 currency pairs of your choice to your personalised watchlist

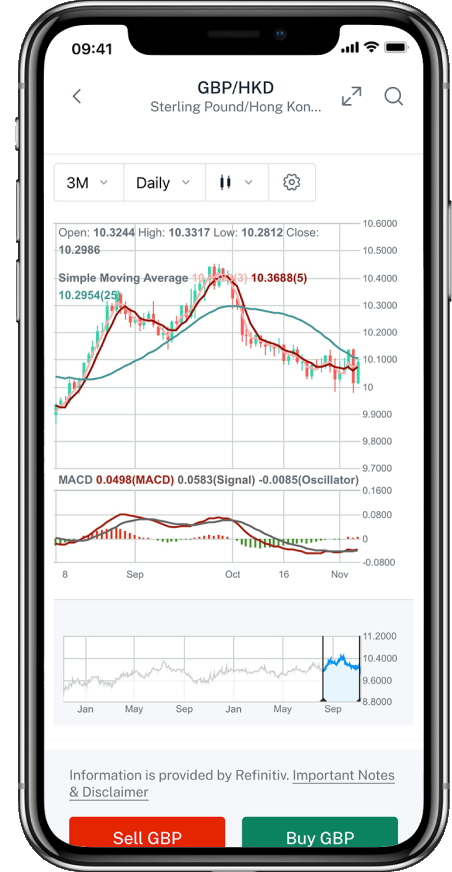

- View holistic currency trends of up to 10 years via candlesticks, line chart or open-high-low-close chart

- Analyse with common technical indicators, including RSI, SMA, MACD, etc.

- Buy and sell currencies automatically or receive Price Alerts via email, SMS or push notification when your pre-set target rates are hit in the market

- Save you the hassle of monitoring the market

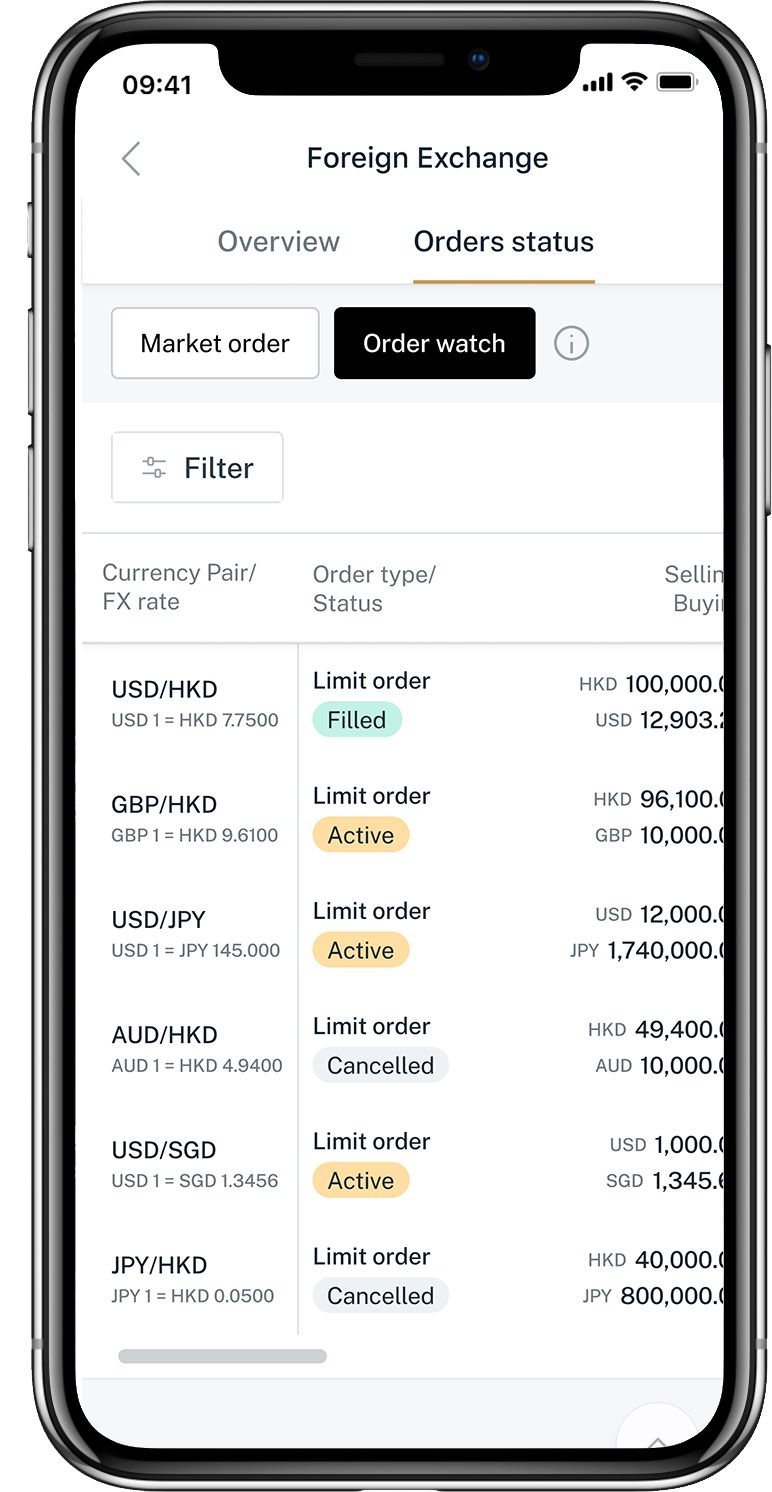

- Monitor the order status and transaction details of Order Watch and market orders on a consolidated page

24x7 real time FX Trading Service

Make the most of market conditions with our 24x7 FX online trading platform*. Seize trading opportunities any time of day or night.

Up to 14 of the most common currencies, including HKD, AUD, CAD, CHF, CNY (Offshore), DKK, EUR, GBP, JPY, NOK, NZD, SEK, SGD and USD.

*The crediting of funds may vary depending on the system cut-off time. For more details, please refer to www.dbs.com.hk/ibanking/ft-time1.html.

View the video to learn more:

Online FX Promotion

Enjoy HK$100 cash rewards with a single online FX transaction at HK$20,000 or above (or its equivalent) for customers who had no online FX transaction from 1 October 2024 to 31 March 2025.

Promotion period is from 1 April to 30 June 2025. Terms and Conditions apply.

By joining DBS Treasures, you can enjoy extra HK$800 cash rewards with a single FX transaction at HK$200,000 or above (or its equivalent, excluding USDHKD pair)!

Promotion period is from 1 April to 30 June 2025. Terms and Conditions apply

User Guide

FAQ

- What kind of online FX services does DBS provide?

DBS provides comprehensive online 24/7 FX services on DBS iBanking and DBS digibank, which includes real-time rate streaming, FX watchlist, FX price alert, FX Order watch service and FX chart. - Who can use FX services?

Any DBS customers with a deposit account (including Current Account, Savings Account, Save and Cheque Account, Multi-Currency Savings Accounts & Renminbi Savings Account) or a Wealth Management Account can use the new online FX service. - Where can I locate FX services?

You can get into the FX services via the following entry points.

DBS digibank HK:- Home page Quicklink > Foreign Exchange

- Pay & Transfer > Foreign Exchange

- Invest > Foreign Exchange

DBS iBanking:- Invest > Foreign Exchange

- Banking > Quicklink > Foreign Exchange

- Banking > Transfer > Foreign Exchange

- Banking > Invest > Foreign Exchange

- What are the operating hours of the online FX services?

FX Market Order and FX Order Watch are available 24x7, so you can submit your FX order anytime.

*Please note that all the FX services between Wealth Management Account and deposit account are unavailable from 11:59pm on the last bank business day of the month to 3:00am on the first bank business day of next month.

- What is FX Watchlist?

FX Watchlist allows you to easily monitor the market trend of FX currency pairs. You can customise your own FX watchlist by adding new currency pair(s) or removing existing currency pair(s). The FX Watchlist can be found on the landing page, and the currency rate is refreshed regularly*, so that you can get the most updated rate of your preferred currency pair(s).

*The currency rates on the FX Watchlist will be refreshed every 5 seconds and lasts for 3 minutes. After 3 minutes, you will need to click the “Refresh” button to continue the rate refreshing function. - How many currency pairs can be added to the FX Watchlist?

Up to 20 currency pairs.

- What is FX Price Alert?

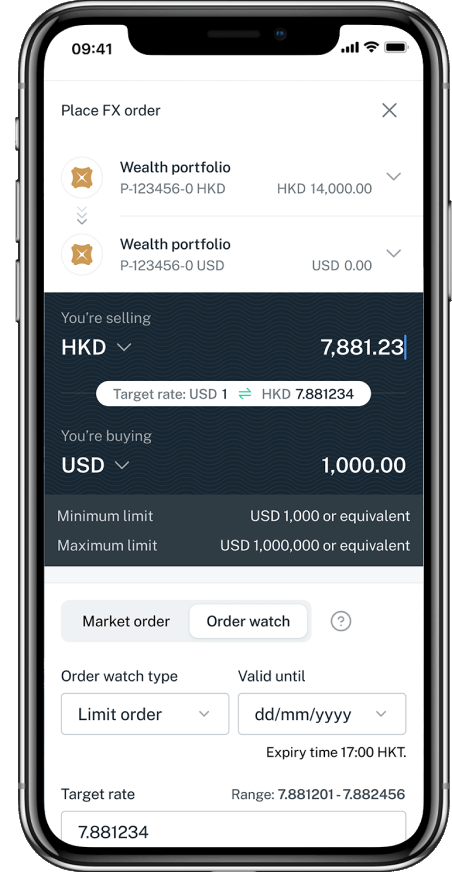

You can set a target rate of currency pair(s) online. Once the target rate is reached, you will receive a notification in accordance with your notification settings. You can turn on your device setting to receive push notifications in DBS digibank HK, or you can subscribe for SMS or email notification in DBS iBanking under “Preference”. - What is FX Order Watch?

FX Order Watch is an online service that allows you to place a good till date order, i.e. limit order with target FX rate. From the moment we accept the order to the “Valid until” date, the order will be executed automatically when the target rate of the currency pair is reached.

*Please note that you can place the FX Order Watch between your own deposit accounts (e.g. HKD Current Account to Multi-Currency Savings Account USD wallet). FX Order Watch is currently not available for Wealth Management Accounts (P-xxxxxx). Support for Wealth Portfolio accounts is planned for a future phase. - What is the selection range for the valid until date of the FX Order Watch?

Future 30 calendar days. - What is the expiry time of FX Order Watch on valid till date?

17:00 HKT of the selected date. - What is the maximum & minimum limit of online FX Order Watch?

Maximum USD 1,000,000 & minimum USD 1,000 per transaction. - How do I check the latest status of orders placed on FX Order Watch?

You can see the status of all the placed orders on FX Order Watch under “Order Status” (FX landing page on DBS iBanking & DBS digibank HK > Order Status), or you can click “Order Details” to view the specific order details.

*Please note that, if your order on FX Order Watch involves a joint account (debit from or credit to), only the account holder who submitted the order can see the order record under “Order Status”. The other joint account holder will only see the debit or credit record on the joint account details page once the FX Order Watch is executed. - Will I receive any notification after placing an order on FX Order Watch?

After you submit an order on FX Order Watch in DBS digibank HK or DBS iBanking, you will receive a confirmation at your email address registered with the Bank. Afterwards, if your order has been Executed, Expired, Cancelled or Rejected, you will also receive an email notification of the above status update. - Why is my order on FX Order Watch not executed even though the target rate has been reached according to market FX rate?

The target rate for each executed order on FX Order Watch is inclusive of all the applicable margins prevailing at the time of the placement, including the spread charged by the Bank and market spread.

Also, the execution of any FX order at the target rate cannot be guaranteed due to the possibility of unexpected market fluctuations. - What is the difference between FX Price Alert and FX Order Watch?

FX Price Alert: Once the target rate of a currency pair is reached, you will receive a notification.

FX Order Watch: Once the target rate of a currency pair is reached, your FX order will be executed automatically.

- What is FX Chart?

FX Chart provides an interactive graphical representation of the price movement of currency pairs, helping you to conduct analyses and make informed trading decisions. Three popular chart types and seven common technical indicators are available. You can customise timeframes, technical indicators and other features to view and study FX markets flexibly.

What’s more

|

|

Foreign Exchange Time Deposit OfferHighlights

|

|

|

DBS UnionPay Diamond Debit CardHighlights

|

- Terms and Conditions apply.

- The Period of Insurance/Policy Year means one (1) year from the date that DBS issued the DBS UnionPay Diamond Debit Card to you)

- The above insurance plan is underwritten by Chubb Insurance Hong Kong Limited.

Experience our FX Trading Service Now

| Exchange Foreign Currency Now | on DBS iBanking |

- Not yet a DBS iBanking customer? Register now

- Trade on DBS digibank HK app

Download DBS digibank HK

Useful Links

Risk Disclosures and Important Notice

Foreign exchange involves risks. Customers should note that foreign exchange may incur loss due to the fluctuation of exchange rate.

RMB currently may not be freely convertible and is subject to exchange controls and restrictions. There is no guarantee that RMB will not depreciate. If you convert Hong Kong Dollar or any other currency into RMB so as to invest in a RMB product and subsequently convert the RMB sale proceeds back into Hong Kong Dollar or any other currency, you may suffer a loss if RMB depreciates against Hong Kong Dollar or other currency.