Portfolio performance at a glance

Detailed breakdown of holdings

Keep track of transactions in your portfolio

- Portfolio performance at a glance

- Detailed breakdown of your portfolio by Asset Type, Favourites, Currency

- Keep track of pending or settled transactions in your portfolio

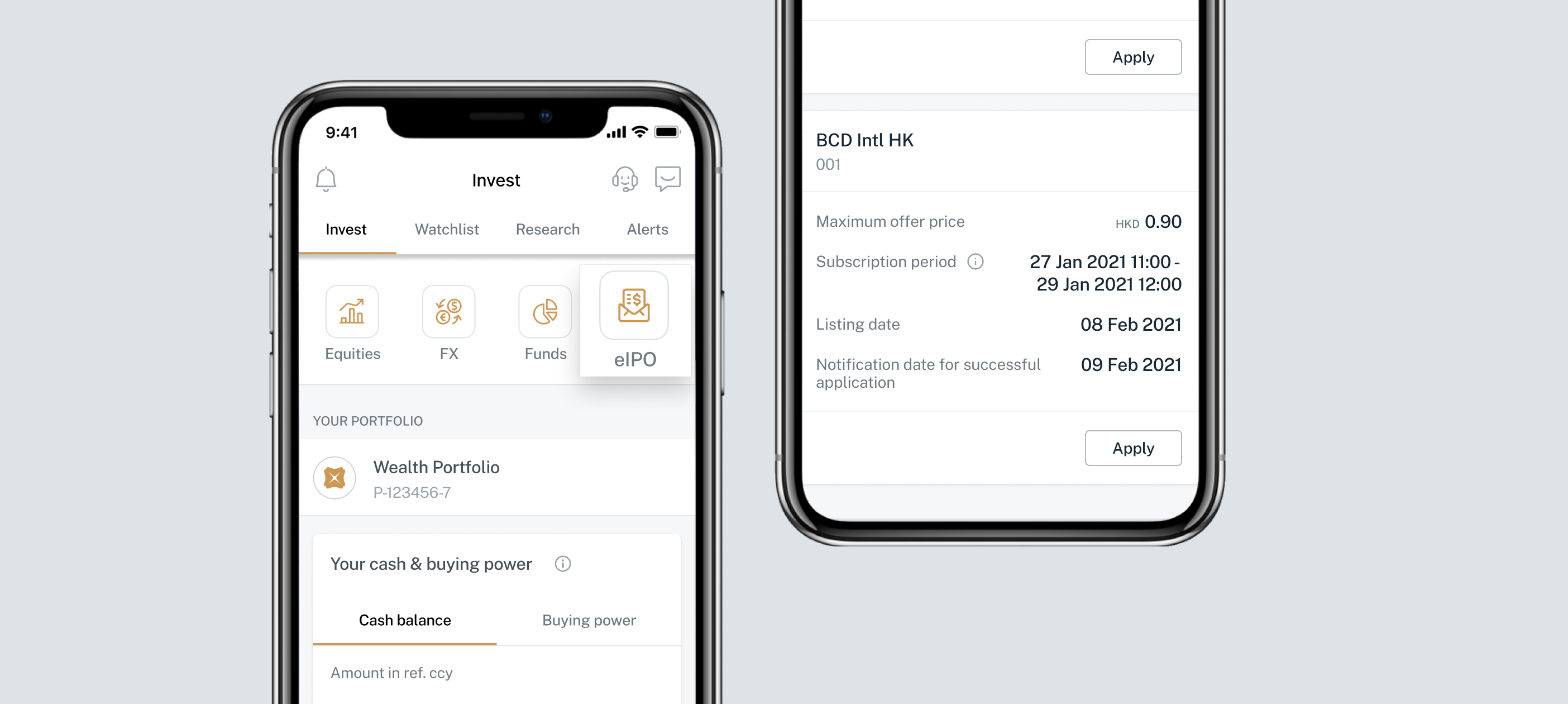

Subscribe to Hong Kong Initial Public Offering (IPO) with a few clicks

Snapshots of your portfolio performance and in one place

Visualise and analyse stock performance easily with Clovers Model

Trade stocks across 7 stock markets in a few taps

Real time profit and loss tracking of all your holdings

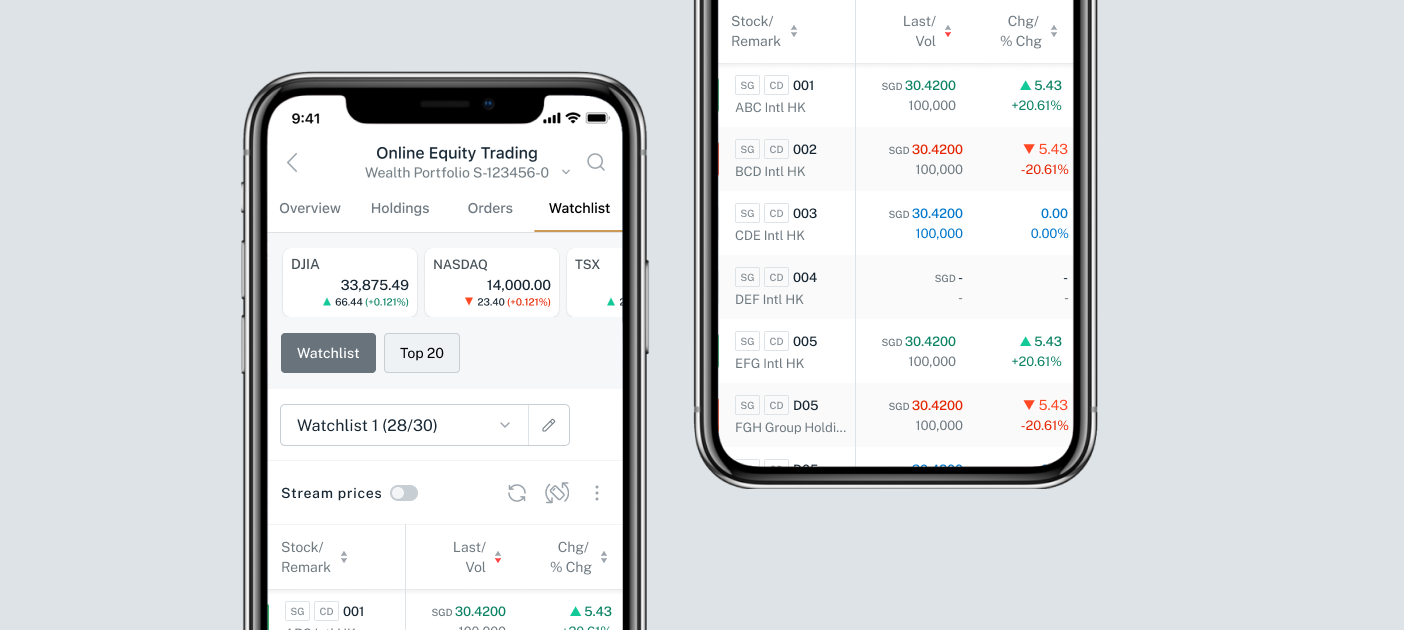

Create your personal Equity Watchlist

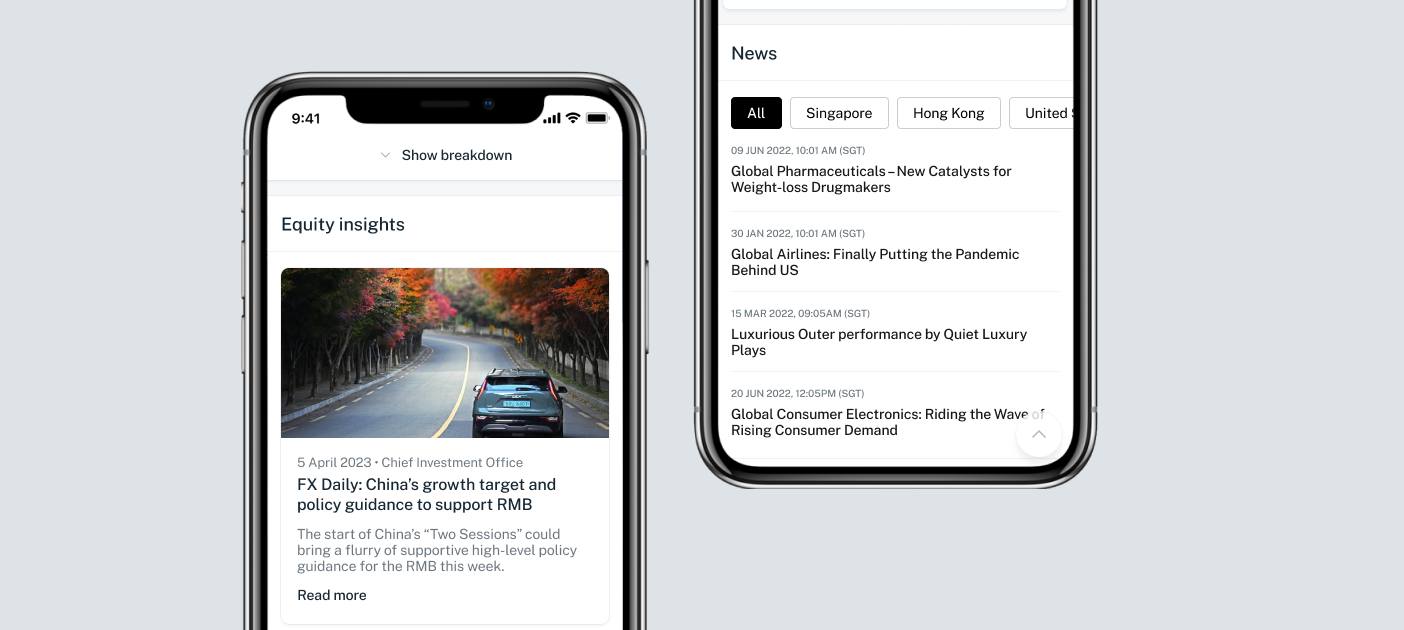

Stay ahead of the market with research and latest news

- International access to trade equities across Hong Kong, Singapore, United States, Canada, Japan, Australia and the United Kingdom stock markets

- Charting tools to analyse stock performance

- Set price alerts and equity watchlist

- Market analyses and commentaries: Keep your finger on the pulse of the market so you can make every opportunity count

View Fund Details before you trade

Filter funds by currency, fund house, asset types or DBS product risk rating

- 1.5% preferential subscription fee with HK$5,000 minimum subscription amount

- View detailed fund information and documents

Trade FX in a few clicks

Choose different settlement date

Never miss an opportunity with FX price alerts

- Seize the moment by making trades any time of day or night via our 24x7 FX Trading Platform*.

- Spread your holdings by trading in up to 14 of the most common currencies, including HKD, AUD, CAD, CHF, CNY, DKK, EUR, GBP, JPY, NOK, NZD, SEK, SGD and USD.

*An FX instruction placed within Wealth Management Accounts or within Multi-Currency Savings Accounts before the relevant cut-off time will be processed instantly in general. However, the crediting of funds may vary depending on the cut-off time and local public holidays. For cross currency transactions between Wealth Management Accounts and Multi-Currency Savings Accounts, this will be subject to the service hours of 09:00-21:00, Monday to Friday. For more details, please refer to www.dbs.com.hk/ibanking-zh/ft-time1.html.

Market research at a glance

Customised in-depth analysis

- View our latest global equity ideas

- Get customised market research related to your portfolio

Frequently Asked Questions

All you need is any smartphone with iOS 12.0 or higher (for Apple) or v7.0 or higher (for Android). Simply search and download DBS digibank HK from Apple App Store, Google Play Store or Huawei App Gallery.

We recommend you use a mobile device with a 64-bit processor. Please note DBS digibank HK is not optimised for usage on tablets.

Yes. Simply use your existing DBS iBanking username and password to log in to DBS digibank HK.

You can retrieve your username via DBS digibank HK. Please click Forgot "Username" on the login page to retrieve your username.

Get ready your:

- ATM Card number and ATM PIN, or

- Credit Card number and Card Expiry Date, or

- Cashline Card number and Card Expiry Date, or

- Secure Device

You may also contact our 24-hour Customer Service Hotline at (852) 2290 8888 or complete and return the DBS iBanking Service Request Form to any of our branches to retrieve your username.

You can reset your password via DBS digibank HK. Please click Forgot "Password" on the login page to reset it.

Get ready your:

- ATM Card number and ATM PIN, or

- Credit Card number and Card Expiry Date, or

- Cashline Card number and Card Expiry Date, or

- Secure Device

You may also complete and return the DBS iBanking Service Request Form to any of our branches to reset your password.

Peek Balance lets you check your preferred account balance with a simple swipe on your smartphone or Apple Watch. No login required! You can select your preferred account from your DBS deposit or credit card accounts.

Yes, you have a choice. Peek Balance requires a one-time setup after you log in to DBS digibank HK under “Peek Balance” in “More” tab . Without performing this setup, Peek Balance will not be turned.

Your fingerprint is your password. With fingerprint login, accessing your accounts is faster, easier and more secure.

Fingerprint login is available on Touch ID enabled Apple smartphone running on iOS 12.0 or higher and fingerprint enabled and designated Android smartphone operating on v7.0 or higher.

We recommend you use a mobile device with a 64-bit processor. Please note DBS digibank HK is not optimised for usage on tablets.

For technical support of Apple iPhone Touch ID, please refer to Apple’s article If Touch ID isn't working on your iPhone or iPad.

For technical support of Android Fingerprint Login, please refer to the website of the relevant Android Smartphone Brand.

Yes. You can enable Face ID under “Face ID” in “More” tab in DBS digibank HK on iPhone X or later.

To use Face ID in DBS digibank HK, you will need to turn on Face ID for DBS digibank HK app in your OS Settings.

We will provide app updates to support the latest models of mobile devices from time to time. You are advised to update the DBS digibank HK app once available for best experience.

For features and usage of Face ID, please refer to Apple’s article About Face ID advanced technology.

If you have not performed the one-time setup on your new iPhone X or later to enable Face ID, you will not be able to use Face ID and you can continue using your username and password to log in-to DBS digibank HK. If you have performed the one-time setup to enable Face ID, you can always turn it off under “Face ID” in “More” tab

For technical support of Face ID, please refer to Apple’s article If Face ID isn't working on your iPhone X or later.

Useful Links for Deposits

Useful Links for iBanking

- Online Privileges

- Did you know?

- Online Demo

- Important Notes

- Online Security

- Online Money Safe Guarantee

- System Maintenance

- User Guide

- FAQ

Talk to our Staff

24-hour Hotline:

(852) 2961 2338

Or let us contact you- Other hotlines

Others

- Feedback Form

- All Latest Offers

- Forms

- Benefits & Privileges

- Join DBS Treasures

- Foreign Exchange Rates

- Welcome Kit

Need help?

Ways to get our

Help & Support