New Capital Investment Entrant Scheme

About New CIES

With its world-class financial infrastructure, thriving innovation ecosystem and unrivalled talent pool, Hong Kong is Asia’s World City for investors seeking opportunities within one of the world's fastest-growing regions.

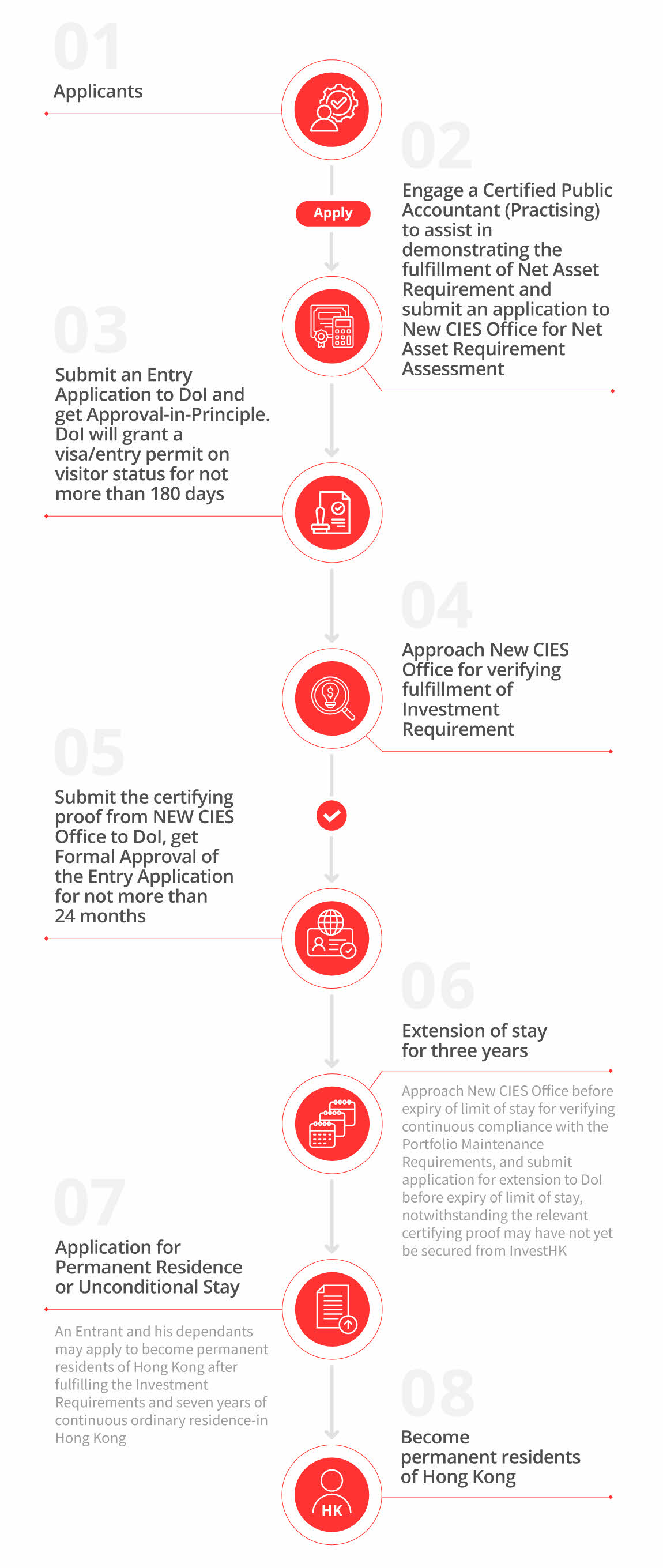

To entice global investors, the Government of the Hong Kong Special Administrative Region (“HKSAR Government”) has introduced the New Capital Investment Entrant Scheme (“New CIES”) - a programme that helps investors settle in the city and explore diverse opportunities through wealth allocation and management.

The New CIES is a joint collaboration between Invest Hong Kong and the Immigration Department of the Hong Kong Government.

Aiming new heights of success in Hong Kong?

At DBS Treasures, we are committed to helping you make the most of your wealth. Our experienced team offers personalised financial solutions to support you to capitalise on golden opportunities under the New CIES.

- Foreign nationals1;

- Chinese nationals who have obtained permanent resident status in a foreign country;

- Macao Special Administrative Region residents; or

- Chinese residents of Taiwan.

- Be aged 18 or above at the time of applying for Net Asset Assessment;

- Have net assets or net equity to which s/he is absolutely beneficially entitled with a market value of not less than HKD30 million (or equivalent in foreign currencies) throughout the two years preceding his/her application;

- Have invested not less than HKD30 million (or equivalent in foreign currencies) in permissible investment assets in Hong Kong;

- Demonstrates that s/he has no adverse immigration record and meets normal immigration and security requirements; and

- Demonstrates to Director of Immigration (“DoI”) that s/he is capable of supporting and accommodating himself/herself and his/her dependants2, if any, on his/her own without relying on any return on the Permissible investment assets, employment, self-employment, office, business or public assistance in or carried on in Hong Kong as the case may be. In addition, the entry of dependants will be subject to any other policy applicable to such entry at the time3.

To qualify, an applicant must invest not less than HKD30 million net (or equivalent in foreign currencies) in permissible investment assets to which he/she is absolutely beneficially entitled, within any of the following periods:

- FROM the launch date of the Scheme (1 March 2024) OR the 180th day before his/her application is lodged for Net Asset Assessment (whichever is later)

TO the day his/her application is lodged for Net Asset Assessment. - FROM the launch date of the Scheme (1 March 2024) OR the 180th day before his/her application is lodged for Net Asset Assessment (whichever is later)

TO the 180th day after Approval-in-Principle has been granted by the Director of Immigration ("DoI"). - FROM the day when Approval-in-Principle has been granted by the Director of Immigration ("DoI")

TO the 180th day thereafter.

Permissible financial assets include:

- Equities

shares of companies that are listed on the Stock Exchange of Hong Kong ("SEHK") and traded in Hong Kong Dollars ("HKD") or Renminbi ("RMB");

- Debt securities

- debt securities listed on the SEHK and traded in HKD or RMB (including debt instruments issued in Hong Kong by the Ministry of Finance of the People's Republic of China and local people's governments at any level in the Mainland);

- debt securities denominated in HKD or RMB, including fixed or floating rate instruments and convertible bonds4 issued or fully guaranteed by:

- the Hong Kong Special Administrative Region Government ("the Government', the Exchange Fund, the Hong Kong Mortgage Corporation, the MTR Corporation Limited, Hong Kong Airport Authority, and other corporations, agencies or bodies wholly or partly owned by the Government as may be specified from time to time by the Government; or

- listed companies referred to under paragraph A above;

- Certificates of deposits

certificates of deposits denominated in HKD or RMB issued by authorised institutions as defined in the Banking Ordinance (Cap. 155 of the Laws of Hong Kong) with a remaining term to maturity of not less than 12 months at the time of acquisition by the Applicant/Entrant, subject to a cap of 10% (i.e. HK$3 million) of the minimum investment threshold. This acquisition must take place after Approval-in-Principle has been granted by the Dol and thereafter the Applicant/Entrant be absolutely beneficially entitled to the invested certificates of deposits throughout its term. These certificates of deposits on reaching maturity must be replaced by certificates of deposits with a remaining term to maturity of not less than 12 months at the time of acquisition by the Applicant/Entrant or by other Permissible investment assets;

- Subordinated debt

subordinated debt denominated in HKD or RMB issued by authorised institutions in compliance with Schedules 4B and 4C of the Banking (Capital) Rules (Cap. 155L of the Laws of Hong Kong);

- Eligible collective investment schemes

- Securities and Futures Commission ("SFC")-authorised funds5 managed by corporations licensed by or institutions registered with the SFC for Type 9 regulated activity;

- SFC-authorised real estate investment trusts managed by corporations licensed by or institutions registered with the SFC for Type 9 regulated activity;

- SFC-authorised Investment-Linked Assurance Schemes6 issued by insurers permitted to carry on Class C business as specified in Part 2 of Schedule 1 to the Insurance Ordinance (Cap. 41 of the Laws of Hong Kong);

- open-ended fund companies ("OFCs") registered under the Securities and Futures Ordinance (Cap. 571 of the Laws of Hong Kong) and managed by corporations licensed by or institutions registered with the SFC for Type 9 regulated activity (see also paragraph F below); and

- Ownership interest in limited partnership funds ("LPFs") registered under the Limited Partnership Fund Ordinance (Cap. 637 of the Laws of Hong Kong)

The total investment amount of ownership interest in private LPFs in this paragraph and private OFCs in paragraph E IV above7 is subject to an aggregate cap of HK$10 million.

Achieving your goals in HK with DBS Treasures

DBS Treasures provides wealth management solutions for the way you live today - connected, on-the-go and decisive. You can grow your wealth anytime, anywhere with DBS digibank HK app. Our financial expertise, insights and investment tools are at your fingertips.

We offer a wide range of services to meet your financial goals:

Customised Portfolios:

We provide comprehensive permissible financial asset products aligned to your risk appetite and objectives.

Statutory Reporting:

We handle the required reporting on your assets for transparency.

Financial Planning:

From wealth management to retirement, we provide comprehensive strategies optimised for your needs.

Please contact us at (852) 3668 5010 (Mon-Fri: 09:00-17:00, excluding Hong Kong public holidays) to learn more, or provide your contact details here and we will be in touch with you shortly.

- Nationals of Afghanistan, Cuba, and Democratic People’s Republic of Korea are excluded. The list of excluded countries/regions will be reviewed by the Security Bureau/ImmD from time to time. Stateless persons who have obtained permanent resident status in a foreign country with proven re-entry facilities will be eligible under the Scheme.

- "Dependants" refer to his spouse or the other party to a same-sex civil partnership, same-sex civil union, "same-sex marriage", opposite-sex civil partnership or opposite-sex civil union entered into by him in accordance with the local law in force of the place of celebration and with such status being legally and officially recognised by the local authorities of the place of celebration; and his unmarried dependent children aged under 18 years. For the avoidance of doubt, the terms "civil partnership" and "civil union" above mean a legal institution of a nature which is akin to spousal relationship in a marriage. The same-sex civil partnership, same-sex civil union, "same-sex marriage", opposite-sex civil partnership and opposite-sex civil union entered into in accordance with laws outside Hong Kong are limited to only relationships which are legally and officially recognised in the places of celebration. Such relationships normally have the following features: (a) the entering into and dissolution of the relationship are governed by legislation of the place where it is entered into; (b) the relationship requires registration by the competent authority specified by the legislation of the place where it is entered into; (c) the registration is evidenced in a written instrument issued by the competent authority; and (d) parties to the relationship have a mutual commitment to a shared life akin to spouses to the exclusion of others on a permanent basis. Such relationships do not include de facto spouse, partners in cohabitation, fiancé/fiancée, etc.

- Under existing policy, dependants are allowed to join the Entrant (i.e. the sponsor) provided that (i) there is reasonable proof of a genuine relationship between the dependants and the sponsors; (ii) there is no known record to the detriment of the dependants; and (iii) the sponsors are able to support the dependants' living at a standard well above the subsistence level and provide them with suitable accommodation in Hong Kong.

- If an Applicant/Entrant exercises the option to convert the bonds to shares, the investment would be regarded as equities and treated as such afterwards.

- Referring to unit trusts and mutual funds authorised by the SFC under the Code on Unit Trusts and Mutual Funds.

- Referring to investment-linked assurance schemes authorised by the SFC under the Additional Guidance on Internal Product Approval Process.

- Private OFCs and private LPFs refer to those OFCs and LPFs which are not authorised by the SFC for offering to the public and the offer of which falls within an exemption under Section 103 of the Securities and Futures Ordinance, e.g. offers made only to professional investors.

Disclaimer

The information provided herein is intended as a general guide for reference only and not exhaustive. For the latest information on New CIES, please visit the website of the New CIES Office at https://www.newcies.gov.hk/en/index.html.