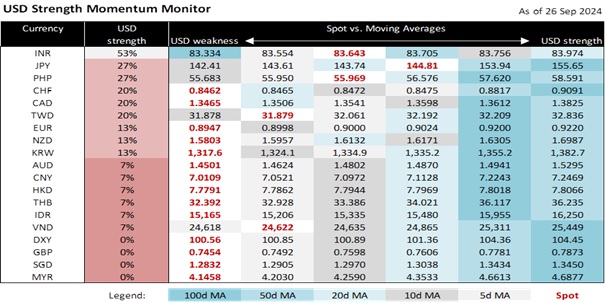

The DXY Index depreciated by 0.4% to 100.56 overnight, holding below 101 for the ninth session. In the first four days of the week, except for the JPY (-0.7%), the currencies in the DXY basket appreciated, led by the CAD (+0.8%), GBP (+0.7%), CHF (+0.5%), and EUR (+0.1%). US stock indices rallied on better-than-expected US data. The US Commerce Department updated its GDP estimates, which cited faster growth in 2021, 2022, and early 2023. It also erased the technical recession in 1H22; the quarterly contraction in 2Q22 was revised to an expansion. The Dow, S&P 500, and Nasdaq Composite indices rose by 0.6%, 0.4%, and 0.6%, respectively. S&P closed at a new record high of 5745.

The US Treasury 10Y yield firmed this week by 5.5 bps to 3.796% ahead of today’s US PCE deflators. Consensus sees headline inflation slowing to 2.3% YoY (0.1% MoM) in August from 2.5% YoY (0.2% MoM) in July. However, core inflation is seen unchanged at 0.2% MoM, lifting it in YoY terms to 2.7% from 2.6%. Last week, the Fed projected PCE headline and core inflation to average 2.3% and 2.6%, respectively, in 4Q24. However, the futures market is paying attention to next Friday’s US monthly jobs data for a possible back-to-back 50 bps cut at the November FOMC meeting. Consensus is looking for nonfarm payrolls to moderate slightly to 140k in September from 142k in August. The unemployment rate is expected to stay unchanged at 4.2%, which the Fed sees rising to 4.4% in the October-December quarter.

The Swiss National Bank’s third interest rate cut did not push USD/CHF out of its month-long range between 0.84 and 0.8550. SNB lowered the policy rate by 25 bps to 1.00% and kept the door open for more easing in the coming quarters on its new forecast for inflation to decelerate to 0.6% in 2025 from 1.2% in 2024. In June, SNB projected a modest slowdown in inflation to 1.1% from 1.3% based on its assumption of a stable 1.25% policy rate over the forecast horizon. SNB signalled its readiness to intervene in currency markets, reinforcing its concerns about the CHF’s strength as a source of significant disinflation and pressure for Swiss industries amid weak demand from Europe. SNB likely does not want EUR/CHF to post a new year’s low below 0.93.

CNY appreciated 0.5% (CNH did better with a 1.0% again) overnight on China’s stimulus hopes. Despite doubts that the stimulus would reverse China’s slowdown, the Shanghai Composite Index surged 9.7%, its best weekly rise in almost 16 years, to a three-month high of 3001. Offshore USD/CNH fell from 7.10 to 6.98, closing below 7.00 for the first time since May 2023. Onshore USD/CNY lagged at 7.01. Conversely, USD/JPY rose to 145 from 140 in the second half of this month ahead of today’s Liberal Democratic Party (LDP) party leadership elections. A run-off is expected ,with none of the top three candidates expected to secure a majority. JPY bulls would not welcome a win by Minister of State for Economic Security Takaichi Sanae or former Secretary-General Shigeru Ishiba because of their critical views on the Bank of Japan’s normalization policy. They would favour Shinjiro Koizumi, the son of former popular Prime Minister Junichiro Koizumi, who would respect the BOJ’s independence and call for a snap election if elected.

Quote of the day

“The only way to have a friend is to be one.”

Ralph Waldo Emerson

September 27 in history

In 1998, the Google internet search engine retroactively claimed this date as its birthday.

Topic

GENERAL DISCLOSURE/ DISCLAIMER (For Macroeconomics, Currencies, Interest Rates)

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

[#for Distribution in Singapore] This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 11th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.