Related Insights

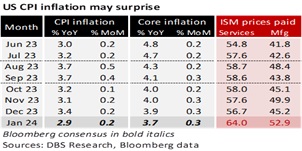

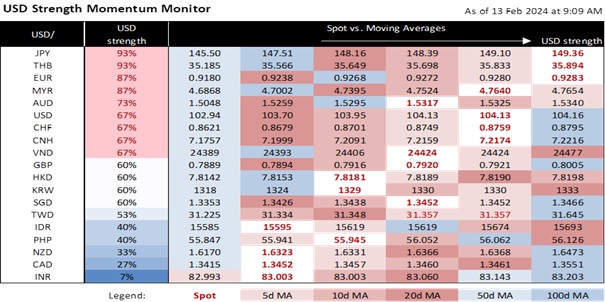

With good reasons, the DXY Index found support at 104 for the past week. Richmond Fed President Thomas Barkin warned of continued inflationary pressure from the reluctance of US businesses to give up raising prices. His concern was substantiated by the spikes in the prices paid indices in January’s ISM PMI Surveys for the services and manufacturing sectors. ISM also reported a jump in the services employment index to 50.5 in January from 43.8 in December, consistent with the above-300k readings in the nonfarm payrolls.

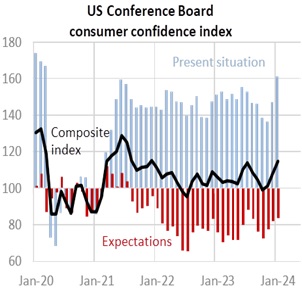

According to the New York Fed’s Survey of Consumer Expectations for January, US consumers were also more optimistic about their financial situation and credit access. The percentage of respondents expecting to be financially the same or better off 12 months from now was 76.5%, the highest level since September 2021. The findings were consistent with the spike in the Conference Board’s consumer confidence index from 105.8 in December to 114.8 in January, its highest level since December 2021. Over the next 6 months, consumers were less worried about fewer jobs, a decrease in income, or a weaker business outlook, obviously buoyed by stronger payrolls data, the record high US stock markets, and the market’s aggressive rate cut bets.

With many risks still on the table for the Fed’s inflation fight, Fed Governor Michelle Bowman reckoned it was too soon to project when and how much the Fed would cut rates, echoing Fed Chair Jerome Powell’s view that a rate cut was not the base scenario at the FOMC meeting on 20 March. Look for the same message from the Fed Presidents speaking this week, i.e., Austan Goolsbee (Chicago) on 14 February, Raphael Bostic (Atlanta), and Mary Daly (San Francisco) on 16 February.

On 15 and 16 February, Fed Vice Chair for Supervision Michael Barr will comment on monetary policy, bank regulation, and supervision. He will likely echo US Treasury Janet Yellen’s message to the Senate Banking Committee that the stress and losses from falling valuations in the commercial real estate sector was unlikely to pose a systemic risk to the banking sector. However, Yellen is closely monitoring the non-bank mortgage lenders, which lack access to deposits and the Fed’s discount window, rendering them reliant on short-term financing and vulnerable to having their credit lines pulled in stressful times.

Quote of the day

”If you want to conquer the world, you best have dragons.”

George R.R. Martin

13 February in history

In 1973, the USD devalued by 9% and 6% vs. the JPY and the DEM, respectively.

Topic

GENERAL DISCLOSURE/ DISCLAIMER (For Macroeconomics, Currencies, Interest Rates)

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

[#for Distribution in Singapore] This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 11th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.