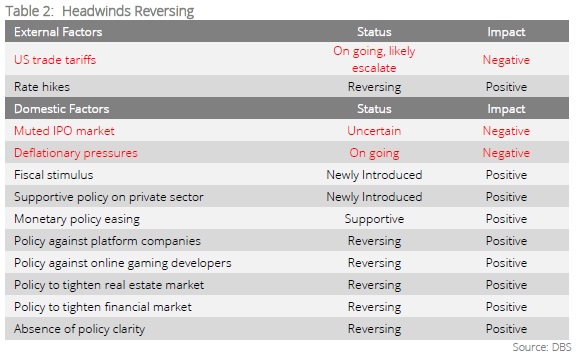

- Implementation of new rounds to trade tariffs will lead to heightened volatility across Asia markets and weigh on sentiment. Investors can expect a bumpier US-China relationship and market gyrations

- There remain sufficient fundamental drivers to support a constructive investment stance on China and Asia ex Japan, including green shoots from earnings revisions, improving fund flows to the region, and the market has pre-conditioned the possibilities of tariffs

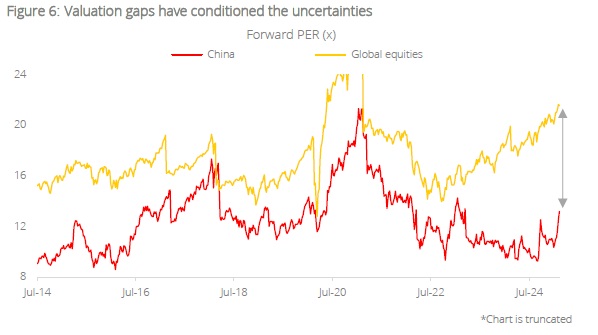

- The evidently wide valuation gap since 2022 already reflects investors’ preexisting cautious view on the ongoing trade spat over the foreseeable horizon. This low-expectation backdrop presents an opportunity for re-rating

- China has rebalanced its economy towards more sustainable domestic-driven growth, focusing on rebuilding confidence and boosting consumers’ propensity to spend, and rolled out more substantive stimulus measures since end of 2024

Choppiness ahead. The implementation of further rounds of trade tariffs will lead to heightened volatility across Asia markets and weigh on sentiment. Investors can expect a bumpier US-China relationship and market gyrations that will significantly impact trade dynamics and investment patterns.

The market anticipates that such trade levies could be used as leverage for broader US-China trade negotiations amid the recent decision to delay full tariffs on China, suggesting that the new administration might adopt a less aggressive approach than previously proposed. At the same time, the tariffs are not limited to China; and other trade surplus bodies like Canada, Mexico, Taiwan, South Korea, Vietnam, ASEAN, Germany, and Japan may face similar risks.

Looking beyond the noise, China and Asia ex-Japan’s (AxJ) investment outlook remains supported by the following fundamental factors:

1. Gradual consensus earnings upgrades

2. Improving support for liquidity due to share buybacks

3. Less cautious fund flows as China equities are massively under-owned

4. Regional firms are diversifying their bases for both input sources and end markets

5. Historically high levels of domestic household savings in China (USD20tn) and the North Asia region (combined banking deposits in Hong Kong, Taiwan, and South Korea at USD5.5tn). Any reallocation into capital markets from bank deposits will have profound effects on regional capital markets

6. Markets have been conditioned to the possibility of tariffs and an ongoing trade stalemate

7. Declining US and global rates are positive for EM equities

Currently, it will be premature to try to predict the policies that will be implemented under Trump 2.0, or the China’s responses. Using history as a guide, China could react to any negative US policies with counteracting policies of their own, including monetary easing, or further currency control to keep the RMB weak.

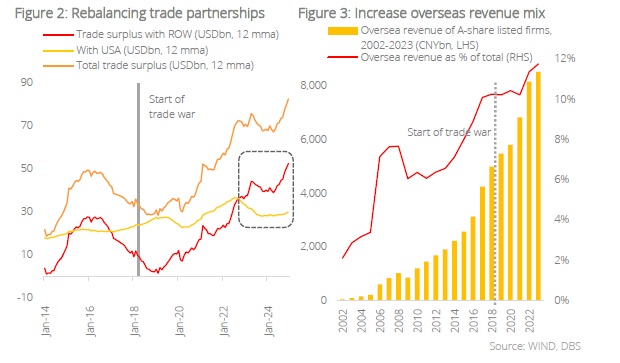

China has been in a trade war since 2018 but is in a better position this time. The country has made significant progress in mitigating tariff impacts as its manufacturing sector has become increasingly competitive through the modernisation of its industrial system and the diversification of trade partners. China has done so since 2019, expanding its trade balance and increasing overseas revenue, which is now 12% of corporate income. This includes enhanced outbound direct investments (ODI) and active participation in China+1.

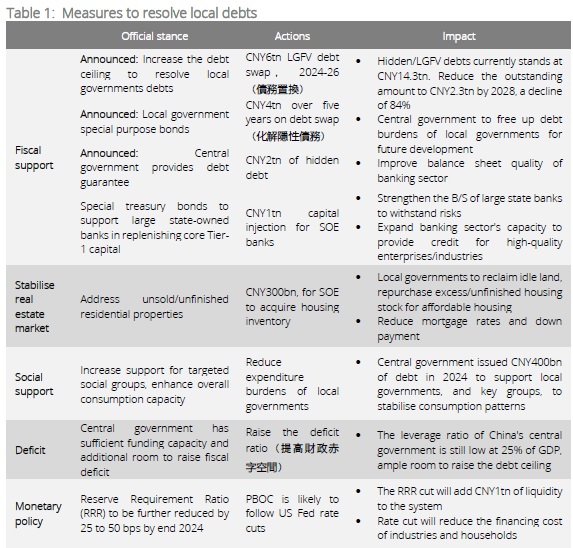

The CNY12tn move. China’s massive CNY12tn debt swap program demonstrates the government’s commitment to address the long existing LGFV debt situation. This move is viewed as pivotal in strengthening the financial position of local governments to ease their financial burdens and enable timely payments to employees and service providers, which will improve livelihoods and stimulate consumption.

Boosting consumption is key. Any uncertainty from an external source, including policy headwinds from Trump 2.0, will prompt the Chinese government to roll out more expedited support. These measures will include increased government spending, expanded fiscal deficits, and targeted initiatives to stimulate consumption and domestic-driven growth. These include trade-in programs, salary increases among government employees, pension hikes, and infrastructure investments. With more precise and measurable targets being announced, there will be a more tangible and sustainable recovery.

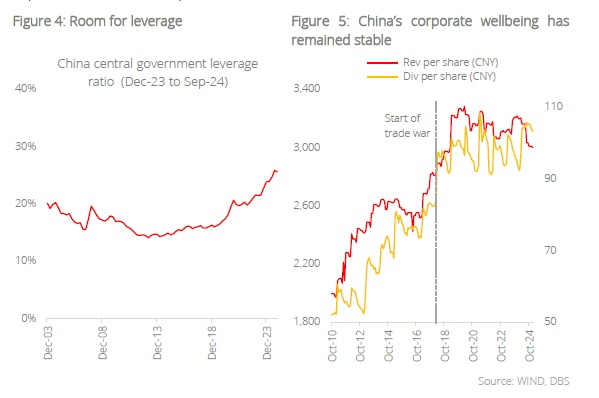

Comfortable level of central government leverage. At a ratio of 25% to its 2023 GDP, the central government’s leverage is significantly lower than average of 75% among G20 members. This will provide sufficient room to increase the funding quota to resolve the debt burdens of local governments, settle outstanding salaries, and provide working capital to jumpstart local activities. In response to current developments, we expect the Chinese authorities to enhance policy clarity and commitments, while improving the effectiveness of implementations, unlike in previous rounds.

Similarly, ongoing efforts to raise self-sufficiency, sustainability of corporate income, and earnings will be crucial to sustaining the investment attractiveness of select themes and industries.

For example, China entities listed in the Hong Kong exchange delivered an impressive return of 26% (31% in total return) in 2024, its first annual positive returns over past five years, and largest annual returns since 2009. This is a marked reversal of years of underperformance as optimism gained momentum after the government announced a series of measures to revive growth.

The evidently wide valuation gap since 2022 reflects investors’ preexisting cautious view on the ongoing trade spat over the foreseeable horizon. This low-expectation backdrop presents an opportunity for re-rating, as fundamentals continue to improve from policy supports and on-going market reform.

To counterbalance the hawkish US policy framework, we foresee China positioning for a longer-standing structural shift with the following actions:

1. Expand domestic ecosystem and supply chains

2. Further explore new supply sources and global end markets

3. More Chinese firms will seek listings in domestic or regional exchanges

4. Expedite outbound FDI and cross border M&A among neighbouring markets

5. Meaningfully increase the leverage capacity of central government to resolve local government debt burden

6. Make available financial supports for listed companies to implement share buyback

7. A step-up in more sustained stimulus measures

8. A deflationary environment is not entirely bad for China

We anticipate greater policy clarity going forward to counterbalance any external headwinds and prioritise domestic growth momentum. We maintain convictions on large cap industry leaders, software & technology developers, platform entities, beneficiaries of domestic consumptions, and dividend yield names.

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.