- China: Strong stimulus, from rate cuts to public outlays, are expected to support economy growth of 5.0% in both 2024 and 2025

- Japan: Preliminary estimates saw the economy grow by 0.9% q/q sa, marking the second quarter of positive growth

- Hong Kong: Export growth remained strong at 10.7% y/y from 1Q-3Q, driven primarily by the electronics sector

- India: Supply-side pressures, driven by unseasonal rains and import tax hikes, are expected to push near-term inflation above RBI's projections for a second consecutive quarter

相關見解

- 中國經濟前景與澳元17 Dec 2024

- 每周外匯速遞 - 聚焦聯儲局議息會議16 Dec 2024

- Economics Weekly: Rate Cut Outlook on Track13 Dec 2024

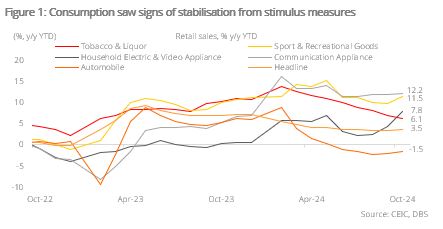

China: Signs of stabilisation on decisive stimulus. Resilient external trade stayed as a bright spot in October. Exports growth increased from 2.4% y/y in September to 12.7%, resulting in a 5.1% y/y growth YTD. Major products such as high-tech products, electronics, and automobiles recorded a YTD improvement during the month. Aligned with the uptick of exports shipments, both SME exporter-focused Caixin and official manufacturing PMI also rebounded back to expansion territories in October.

Chinese exporters face several risks, in particular, elevated trade tension as the new US administration will likely raise further tariffs against China. However, the actual impact may be less severe as the tariffs are being implemented in phases and the tariffs that are implemented on other countries will dilute the effect on China. Burgeoning demand from emerging markets and domestic stimulus could partly offset the loss of trade income from the US. Furthermore, there might be front loading of export orders as seen during Trump’s first term. keeping export from China to the US resilient.

Retail sales growth accelerated from 3.3% y/y in the first nine months to 3.5% YTD in October as consumption sentiment saw signs of stabilising due to the stimulus measures. Spending on leisure, cosmetics, and household electronics surged by 26.7% , 40.1%, and 39.2% y/y respectively. However, a negative wealth effect from asset markets continues to dampen consumption sentiment with sales of big-ticket items, luxuries, and construction materials declining further. Hopefully, the CNY300bn consumption upgrade subsidy, equivalent to 0.6% of retail sales, will cushion the downtrend.

Persistently weak aggregate demand indicates the need for further loosening of monetary policy. This is evidenced by the 6.1% y/y contraction in M1 in October. Meanwhile, M2 growth rebounded from an all-time low of 6.2% y/y in June to 7.5%. The gap between short-term M1 and time deposit M2 growth widened to 13.6 %pts, hovering around its highest level since May 2012. This implies households and corporations are reluctant to hold liquid cash for consumption and investment. However, it is worth noting, both M1 and M2 growth show early signs of bottoming out as a result of ongoing stimulus.

Strong stimulus measures, from rate cuts to public outlays, have been the hallmark of China’s policy stance since September. This ought to help the economy maintain 5.0% growth in 2024 and 2025, though China's economy will continue facing risks from property market to strained local government finance due to persistently weak aggregate demand and a very likely escalation of trade and tech war. We see room for a 10 bps 1Y LPR cut in this quarter and another 50 bps cut in 2025.

Download the PDF to read the full report which includes coverage on Credit, FX, Rates, and Thematics.

本資訊是由星展銀行集團公司(公司註冊號: 196800306E)(以下簡稱“星展銀行”)發佈僅供參考。其所依據的資訊或意見搜集自據信可靠之來源,但未經星展銀行、其關係企業、關聯公司及聯屬公司(統稱“星展集團”獨立核實,在法律允許的最大範圍內,星展集團針對本資訊的準確性、完整性、時效性或者正確性不作任何聲明或保證(含明示或暗示)。本資訊所含的意見和預期內容可能隨時更改,恕不另行通知。本資訊的發佈和散佈不構成也不意味著星展集團對資訊中出現的任何個人、實體、服務或產品表示任何形式的認可。以往的任何業績、推斷、預測或結果模擬並不必然代表任何投資或證券的未來或可能實現的業績。外匯交易蘊含風險。您應該瞭解外匯匯率的波動可能會給您帶來損失。必要或適當時,您應該徵求自己的獨立的財務、稅務或法律顧問的意見或進行此類獨立調查。

本資訊的發佈不是也不構成任何認購或達成任何交易之要約、推薦、邀請或招攬的一部分;在以下情況下,本資訊亦非邀請公眾認購或達成任何交易,也不允許向公眾提出認購或達成任何交易之要約,也不應被如此看待:例如在所在司法轄區或國家/地區,此類要約、推薦、邀請或招攬係未經授權;向目標物件進行此類要約、推薦、邀請或招攬係不合法;進行此類要約、推薦、邀請或招攬係違反法律法規;或在此類司法轄區或國家/地區星展集團需要滿足任何註冊規定。本資訊、資訊中描述或出現的服務或產品不專門用於或專門針對任何特定司法轄區的公眾。

本資訊是星展銀行的財產,受適用的相關智慧財產權法保護。本資訊不允許以任何方式(包括電子、印刷或者現在已知或以後開發的其他媒介)進行複製、傳輸、出售、散佈、出版、廣播、傳閱、修改、傳播或商業開發。

星展集團及其相關的董事、管理人員和/或員工可能對所提及證券擁有部位或其他利益,也可能進行交易,且可能向其中所提及的任何個人或實體提供或尋求提供經紀、投資銀行和其他銀行或金融服務。

在法律允許的最大範圍內,星展集團不對因任何依賴和/或使用本資訊(包括任何錯誤、遺漏或錯誤陳述、疏忽或其他問題)或進一步溝通產生的任何種類的任何損失或損害(包括直接、特殊、間接、後果性、附帶或利潤損失)承擔責任,即使星展集團已被告知存在損失可能性也是如此。

若散佈或使用本資訊違反任何司法轄區或國家/地區的法律或法規,則本資訊不得為任何人或實體在該司法轄區或國家/地區散佈或使用。本資訊由 (a) 星展銀行集團公司在新加坡;(b) 星展銀行(中國)有限公司在中國大陸;(c) 星展銀行(香港)有限責任公司在中國香港[DBS CY1] ;(d) 星展(台灣)商業銀行股份有限公司在台灣;(e) PT DBS Indonesia 在印尼;以及 (f) DBS Bank Ltd, Mumbai Branch 在印度散佈。

相關見解

- 中國經濟前景與澳元17 Dec 2024

- 每周外匯速遞 - 聚焦聯儲局議息會議16 Dec 2024

- Economics Weekly: Rate Cut Outlook on Track13 Dec 2024

相關見解

- 中國經濟前景與澳元17 Dec 2024

- 每周外匯速遞 - 聚焦聯儲局議息會議16 Dec 2024

- Economics Weekly: Rate Cut Outlook on Track13 Dec 2024