Related insights

- Strong 2Q GDP Highlights Economic Resilience26 Jul 2024

- Research Library26 Jul 2024

- Singapore: MAS’s dovish hold26 Jul 2024

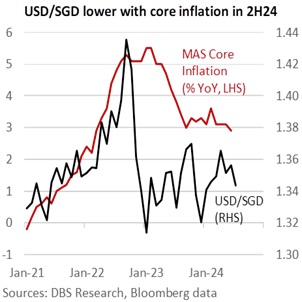

The Monetary Authority of Singapore delivered a dovish tilt in its decision to maintain the three parameters – slope, mid-point, and width – of its SGD NEER policy band. The central bank revised this year’s forecast for CPI All-Items to 2-3% from 2.5-3.5% previously. The condition for easing policy in the future appears to reside in its assumption for core inflation to decline discernibly in 4Q24 and towards 2% in 2025. The statement highlighted that the seasonally adjusted core inflation quarter-on-quarter has declined to an annualised 2.1% in 2Q24, amid moderate imported inflation and easing domestic cost pressures, with expectations for it to be lower in 2H24 vs. 1H24. Given its sanguine economic outlook and lower inflation projections, the SGD NEER has and should continue to hold in the upper half of the policy band. Per our model, this should keep USD/SGD below 1.35 or the level implied by the mid-point of the SGD NEER policy band. Looking ahead, we see the door opening for USD/SGD to trade in a lower 1.32-1.34 range later in the year on the drop in Singapore’s core inflation and a weaker DXY from the two Fed cuts that we expect in the remainder of 2024.

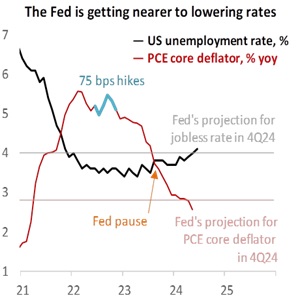

USD/JPY fell to a two-month low of 152 during the European session before a stronger-than-expected US GDP report lifted it to 154. However, markets were unconvinced that the unwinding of JPY carry trades has run its course. Although US advance GDP growth doubled to an annualized 2.8% QoQ saar in 2Q24, the S&P 500 and Nasdaq Composite indices fell a third session by 0.5% and 0.9%, respectively. Investors could not shake off the increased uncertainties surrounding the November US Presidential elections. Following President Joe Biden’s exit, the presidential campaign has become less one-sided, with Democrat candidate Kamala Harris and Republican candidate Donald Trump offering divergent domestic and foreign policy directions. Looking for today’s US PCE inflation to mirror the softer CPI inflation a fortnight ago, the futures market increased the probability of a September Fed cut to 108% from 104.5% a day earlier.

This month’s aggressive unwinding of JPY carry trades, especially against the commodity-led currencies, was triggered by a combination of events. First, the USD’s resilient outlook was hurt by a slower US CPI inflation and a higher unemployment rate fuelling bets for a Fed cut in September. US presidential candidate Donald Trump also decried the JPY’s massive weakness. Second, markets suspected the Bank of Japan intervened in the currency markets amid expectations for more policy normalization announcements at next week’s BOJ meeting. Third, China’s economic recovery prospects became uncertain again, hurting commodity prices. The People’s Bank of China surprised with interest rate cuts on Monday and Thursday following the slowdown in real GDP growth to 4.7% YoY in 2Q24 from 5.2-5.3% in the previous two quarters. Against this backdrop, it did not help that Bank of Canada surprised with a rate cut yesterday, with the Reserve Bank of New Zealand delivering a dovish tilt at its last meeting on July 10.

Quote of the day

”If I want to knock a story off the front page, I just change my hairstyle.”

Hillary Clinton

26 July in history

In 2016, Hillary Clinton became the first female nominee for US President at the Democratic National Convention.

Topic

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). This report is intended for “Accredited Investors” and “Institutional Investors” (defined under the Financial Advisers Act and Securities and Futures Act of Singapore, and their subsidiary legislation), as well as “Professional Investors” (defined under the Securities and Futures Ordinance of Hong Kong) only. It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 13th Floor One Island East, 18 Westlands Road, Quarry Bay, Hong Kong SAR

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.

Related insights

- Strong 2Q GDP Highlights Economic Resilience26 Jul 2024

- Research Library26 Jul 2024

- Singapore: MAS’s dovish hold26 Jul 2024

Related insights

- Strong 2Q GDP Highlights Economic Resilience26 Jul 2024

- Research Library26 Jul 2024

- Singapore: MAS’s dovish hold26 Jul 2024