Related insights

- Fixed Income Weekly: Duration Stews as Elections Unfold04 Jul 2024

- DEER: What drives the USD/JPY misalignment? 04 Jul 2024

- Research Library04 Jul 2024

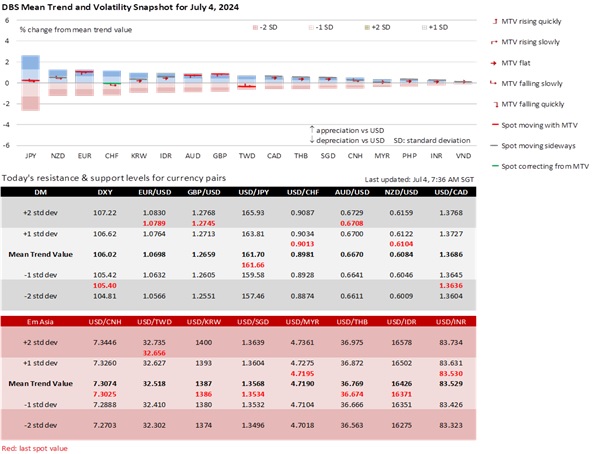

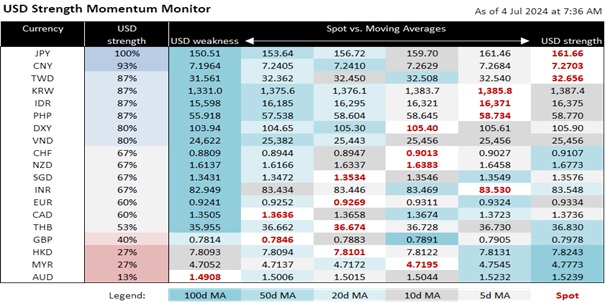

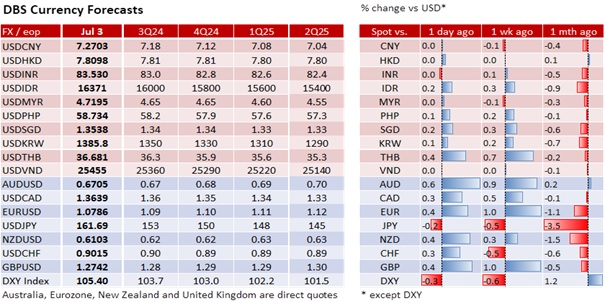

The services-driven expansion in the US is now slowing and starting to weigh on the USD. Overnight, the US ISM services index fell to 48.8 for June, marking its lowest read since May 2020. The services employment subindex also missed expectations at 46.1, marking a 5th consecutive month of contraction. Non-farm payrolls this Friday would be important to assess if job creation is starting to slow materially as well, given that job growth was previously led by services. DXY has eased back towards 105 but remains elevated, and there are risks of further slippage if NFP data disappoints. FOMC minutes for the June meeting indicate that Fed officials expect subdued growth over the remainder of the year. Lesser concerns over inflation going forward could raise speculation of rate cuts and pressure the USD.

USD/JPY has crept higher to mid-161 levels, with the move being orderly and not triggering any new rhetoric from Japanese officials. Still, we think the sharp extent of JPY weakness is a concern, and do not think that intervention is off the table. Officials are likely watching for signs of excessive one-way positioning before choosing to act. Speculative short positioning has risen in the last two weeks and may be getting close to the level seen in end-April, when MOF intervened. Thin liquidity conditions today with the US out on holiday is another reason to be cautious on intervention, and more so if USD/JPY bumps above 162. This week, the Q2 Tankan survey showed that Japanese large manufacturers are seeing an improving outlook, which should underpin confidence in further policy normalization by the BOJ.

USD/CNH is trading slightly above 7.30, supported by the PBOC’s further relaxation of the onshore CNY fixing as we expected. The USD/CNY fixing has moved above 7.13 yesterday for the first time since November. It is not accurate to say that the RMB has weakened broadly, given that most currencies have depreciated more against the USD than the RMB. We consider the fixing change as a minor adjustment amid USD strength, while also serving as an insurance against further trade tensions. While the official China manufacturing PMI is still in contraction, the Caixin manufacturing PMI came in at an encouraging 51.8 for June this week, signifying a private sector that is making progress in its recovery despite tariff threats.

Quote of the day

“Not everything that is faced can be changed, but nothing can be changed until it is faced.”

James Baldwin

4 July in history

In 1947, the "Indian Independence Bill" was presented before the British House of Commons, proposing the independence of the Provinces of British India into two sovereign countries: India and Pakistan.

Topic

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). This report is intended for “Accredited Investors” and “Institutional Investors” (defined under the Financial Advisers Act and Securities and Futures Act of Singapore, and their subsidiary legislation), as well as “Professional Investors” (defined under the Securities and Futures Ordinance of Hong Kong) only. It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 13th Floor One Island East, 18 Westlands Road, Quarry Bay, Hong Kong SAR

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.

Related insights

- Fixed Income Weekly: Duration Stews as Elections Unfold04 Jul 2024

- DEER: What drives the USD/JPY misalignment? 04 Jul 2024

- Research Library04 Jul 2024

Related insights

- Fixed Income Weekly: Duration Stews as Elections Unfold04 Jul 2024

- DEER: What drives the USD/JPY misalignment? 04 Jul 2024

- Research Library04 Jul 2024