Related insights

The USD’s weak momentum carries potential risks too.

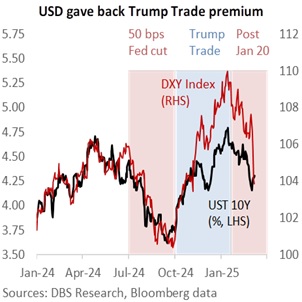

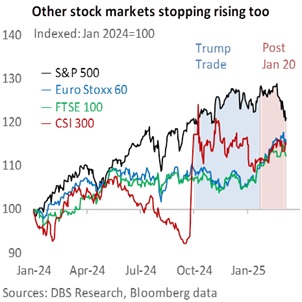

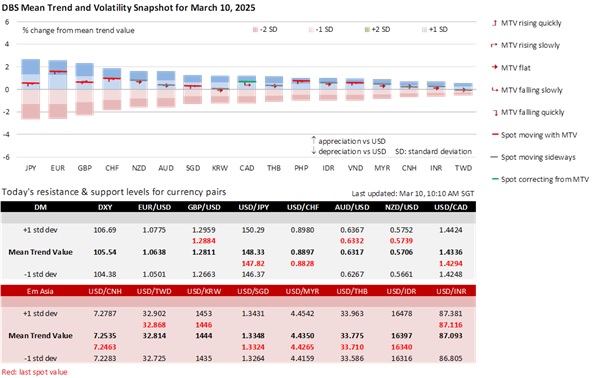

Following last week’s aggressive sell-off, we are staying vigilant regarding factors that can hurt or reverse its downward momentum. Last week, the DXY and the S&P 500 indices returned to levels observed around the November 2024 US elections. Investors perceived Trump’s trade and geopolitical actions as undermining the narrative of US exceptionalism. However, after the greenback’s aggressive sell-off last week, the 14-day RSI indicated that the DXY has entered oversold territory, while the EUR and GBP have reached overbought levels.

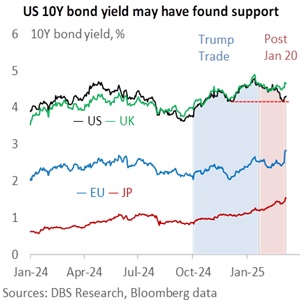

The DXY’s recoupling with the US 10Y bond yield may move it away from Trump’s erratic announcements towards a more fundamentally driven market.

Before this week’s Fed blackout period, Fed Chair Jerome Powell played down growth worries after last Friday’s lower-than-expected nonfarm payrolls, adding that the Fed was separating the signal from the noise. Powell emphasized the Fed was well-positioned to wait for greater clarity on the net effects of the White House’s four main policy thrusts – trade, immigration, fiscal policy, and regulation – before making any adjustments to interest rates. Here, markets will seek guidance in the Fed’s Summary of Economic Projections, given the forgone conclusion that the Fed Funds Rate will stay unchanged at 4.25-4.50%.

On tariffs, the Fed will pay attention to longer-term inflation expectations. Today, the New York Fed inflation expectations at the 1Y, 3Y, and 5Y horizons may extend their rises above 3% in February. This coupled with upside surprises in CPI inflation (out on March 12th), could lift the US Treasury 10Y yield and the DXY. If so, this could undermine the JPY and the CHF as alternative havens to the USD.

Despite Trump’s inconsistent approach to tariffs on US imports from Canada and Mexico, characterized by temporary delays and partial exemptions, he warned of possible reciprocal tariffs on Canadian lumber and dairy products this Friday. Neither Canada nor Mexico will be spared from the 25% tariff on steel and aluminium taking effect on March 12th. Trump promised a wave of reciprocal tariffs on April 2nd which will target EU goods with a 25% tariff.

Trump was unwavering in incrementally escalating tariffs on Chinese goods from 10% on February 4th to 20% on March 4th. Canada and China have retaliated with tariffs on US goods, with Mexico and the EU promising to do the same. Most countries, including the US, believe tit-for-tat tariffs would hurt the global economy, a factor that could reinstate the USD’s haven status.

Besides his trade policy escalating global trade tensions, Trump’s foreign policy affects international relationships.

The DXY’s decline last week was driven by the whopping 4.4% surge in the EUR, its largest component. Following the Trump-Zelensky clash in the Oval Office on February 28th, EU nations collectively reinforced their commitment to uphold security and sovereignty in Ukraine and Europe in response to greater external threats from America’s withdrawal of support. The EU 10Y bond yield surged 43 bps to 2.84% on the “ReArm Europe” plan to mobilize up to EUR800bn to enhance the EU’s defence infrastructure by relaxing the EU budgetary constraints. However, the EU’s consensus-based decision-making process can delay the implementation of the ambitious defence initiatives.

Moreover, the EU’s goal to deter future Russian aggression could be perceived by the Kremlin as provocations, resulting in a hardening stance that makes it challenging to achieve sustainable peace in Ukraine. Washington’s withdrawal of military aid and intelligence has emboldened Russia to intensify military operations against Ukraine to weaken Kyiv’s political will.

US and Ukrainian officials will meet in Saudi Arabia to resume dialogue on the Washington-led peace initiative with Russia. Ukrainian President Volodymyr Zelensky will meet Saudi Arabia’s Crown Price but not attend the talks led by US Secretary of State Marco Rubio. The Ukrainians will want to establish whether Washington will resume military support for Ukraine upon signing the minerals deal and whether the US is pushing for elections in Ukraine.

Overall, it is still premature to expect significant progress towards peace or a ceasefire between Ukraine and Russia. Finding a middle ground remains challenging, given Ukraine’s determination to defend its sovereignty and territorial integrity against Russia’s insecurity regarding Western encroachment.

Hence, the EUR’s upward momentum may wane or even correct if worries return over Ukraine’s precarious situation and potential US tariffs on EU goods or if US inflation and inflation expectations start surprising.

Quote of the Day

“The decline and fall of a civilization is barely noticed by most of its citizens.”

James Cook

March 10 in history

The Dot.com bubble peaked in 2000, with the Nasdaq Composite hitting 5048.62.

Topic

GENERAL DISCLOSURE/ DISCLAIMER (For Macroeconomics, Currencies, Interest Rates)

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

[#for Distribution in Singapore] This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 11th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.