- US equities remain the only game intown within the developed markets space post Trump victory

- Beneficiaries of Trump 2.0 include US Financials, Energy, and Consumer Discretionary sectors

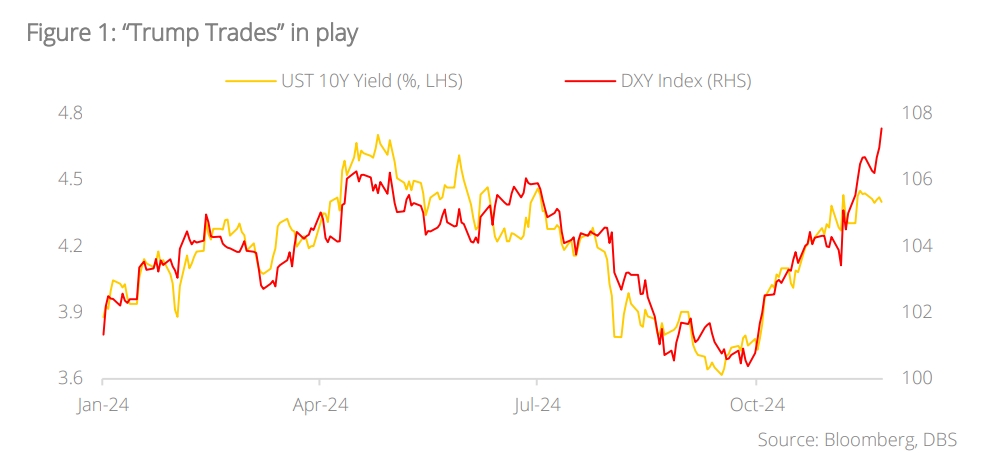

- Upcoming deregulation and expansionary policies from the Trump administration will increase bonds yields and dollar strength

Related insights

Winds of change. The shifting winds of geopolitics and monetary policies have triggered a drastic realignment within the US portfolio positioning. With a clear, decisive victory for Trump at the presidential election and an impending red trifecta at Capitol Hill, investors wasted no time in positioning for “Trump trades” – sectors or industries that could benefit from policy change that comes with the new administration. As we have highlighted in the asset allocation chapter, our base case assumptions for US policies are:

- Phase I – Tax Cuts: As the new administration moves swiftly to fulfil its campaignpromise on taxation cuts, it will result in tailwinds for domestic consumption andstrong corporate profitability. The downside of such fiscal largesse, however, is thestrain that will be inflicted on the US fiscal position, inevitably leading to higher bondyields and a stronger dollar.

- Phase II – Rising Trade Tensions: Trump has made tariff hikes a core feature of hiscampaign rhetoric; do expect this to be implemented in some shape or form as theRepublicans seek new avenues to fund their taxation cuts. The appointments of China hawks (Marco Rubio and Mike Waltz) to his cabinet will ensure a rocky road ofdiplomacy between the US and China in the coming years. Downside pressure onbond yields is to be expected should trade tensions between the superpowersescalate significantly – just as we have seen in Trump’s first presidency.

US exceptionalism – the only game in town. US equities remain the only game in town within the developed markets space, and investors’ portfolio positioning reflect that. Based on fund flow data from EPFR Global, USD6bn has entered US equity funds on a QTD basis (as of 6 Nov) as opposed to outflows for Europe and Japan. The robust flow momentum underscores investors’ confidence in the US economic and earnings outlook:

- Economic Momentum: The US economy continues to power ahead, underpinned bystrong momentum in AI-related capex and resilient domestic consumption. ISMServices remain expansionary at 56.0 in Oct 2024 (compared to 51.6 for Europe and49.7 for Japan) and this momentum is expected to persist in 2025 with consensusforecast expecting real GDP growth of 1.9% for the US (vs 1.2% for both the Eurozone and Japan).

- Corporate Earnings: Based on consensus forecast, US equities is expected to register earnings growth of 12.7% in 2025, driven by strong growth momentum in technologyas AI-related investments gather steam. In contrast, the earnings growth outlook forEurope and Japan are more muted at 6.4% and 0.2% respectively.

At this juncture, negative impact from a potential trade war has yet to be fully factored into analysts’ forecasts given the lack of clarity. However, should Trump’s tariff threats turn into reality, Europe is expected to suffer the brunt of the damage given a double whammy of tariff hikes on its US-bound exports and the influx of China goods that are being redirected from the US into the European market. Japan – an export-oriented country – will not go unscathed either with the US accounting for the lion’s share of its exports at c.22%.

Beneficiaries of Trump 2.0. To revitalise domestic manufacturing and create new job opportunities, Trump has spoken extensively on his plans for tax cuts and deregulation during the election. The geared beneficiaries of Trump’s expansionary policies are:

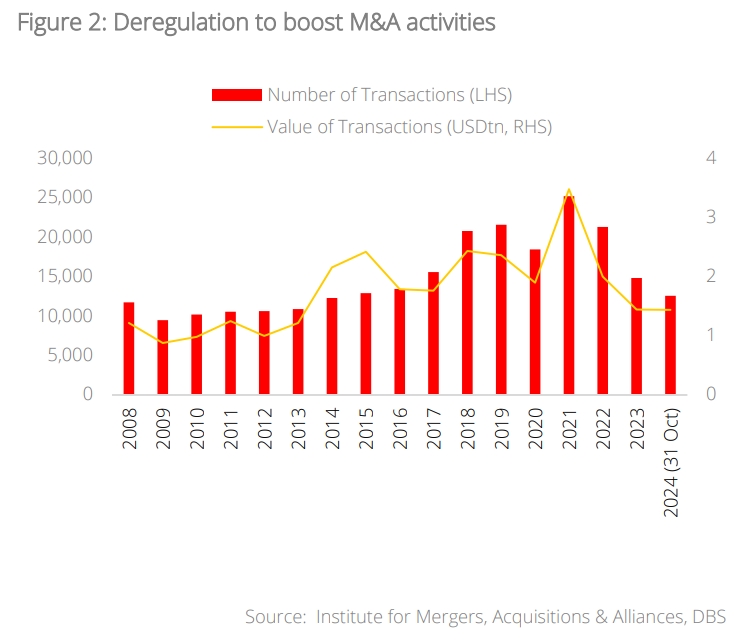

- US Financials – Deregulation propelling growth: Trump 2.0 is expected to emphasise a pro-business agenda and significantly reshape the regulatory landscape for US financials. Potential changes in regulations include the easing of capital requirements, which will allow banks to free up more resources for increased lending, hence generating higher profitability.

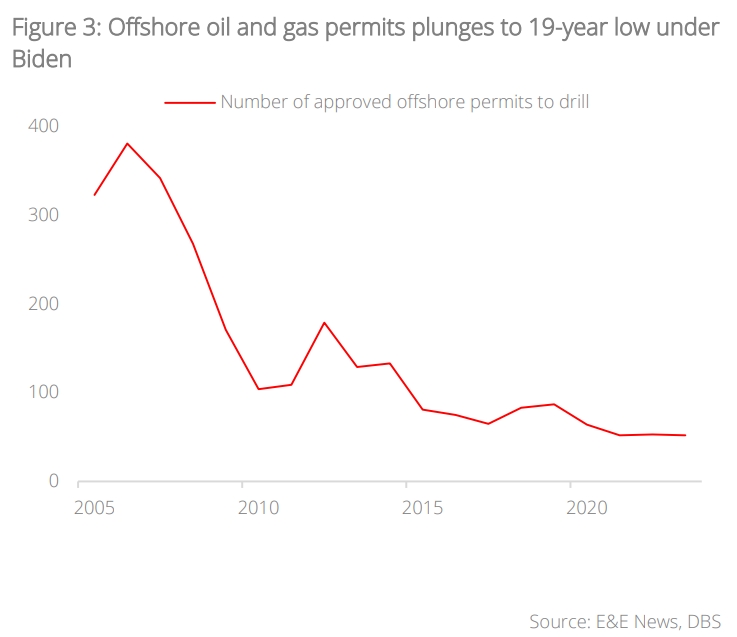

Another area that may undergo deregulation is the M&A space which has been dormant of late thanks to the tight regulatory environment. M&A transactions have plunged since 2021 and this slump may reverse as the incoming Trump administration prefers a less stringent anti-trust stance and shorter approval timeframes. - US Energy – “Drill, baby, drill”: Trump 2.0 is poised to provide significant tailwinds for the energy sector, particularly the fossil fuels companies, as driven by his pursuit of “energy dominance” for the United States. Trump’s “drill, baby, drill” mantra underscores his commitment to boost domestic oil and gas production, with the implications being:

- A potential rescission of environmental restrictions imposed by the Biden Administration, including the resumption of liquified natural gas (LNG) export authorisations to non-free trade agreement countries.

- A potential expedition of approvals for federal drilling permits and leases required for the production of oil and natural gases. The implementation of these initiatives will create a favourable operating environment for energy companies.

The recent nomination of Chris Wright, CEO of Liberty Energy (one of the largest hydraulic fracturing companies), as the new Secretary of Energy highlights Trump’s commitment to enhancing fossil fuel production. This appointment will reinvigorate the fossil fuel sector given Wright’s advocacy for fossil fuels.

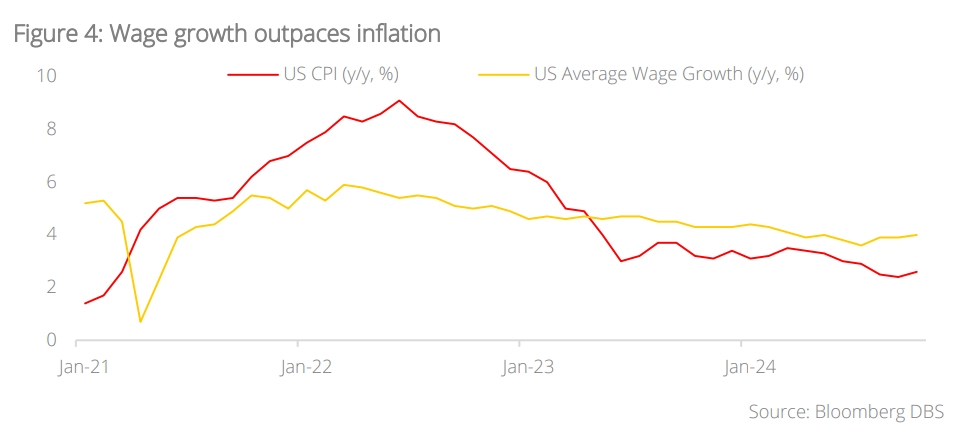

- US Consumer Discretionary – Beneficiary of tax cuts and changes to EV regulations: Consumer discretionary was one of the best performing sectors in 4Q24, underpinned by robust consumer spending and easing inflation. With rising disposable income and stronger consumer purchasing power, the demand for e-commerce, luxury goods, and autos were boosted across the board.

Within the consumer discretionary index, Tesla has emerged as one of the biggest beneficiaries of Trump’s re-election given the latter’s campaign promise on eliminating EV tax credits, which currently provide up to USD 7,500 in incentives for EV buyers. This policy change could potentially reduce US EV demand by c.27% and put pressure on less profitable EV players. Tesla, being the industry leader, is poised to benefit and this will have significant impact on the consumer discretionary space given Tesla’s weight within the index.

Trump’s pledge to expand the Tax Cuts and Jobs Act (TCJA) across all income levels will also boost US domestic consumption and drive the consumer discretionary space.

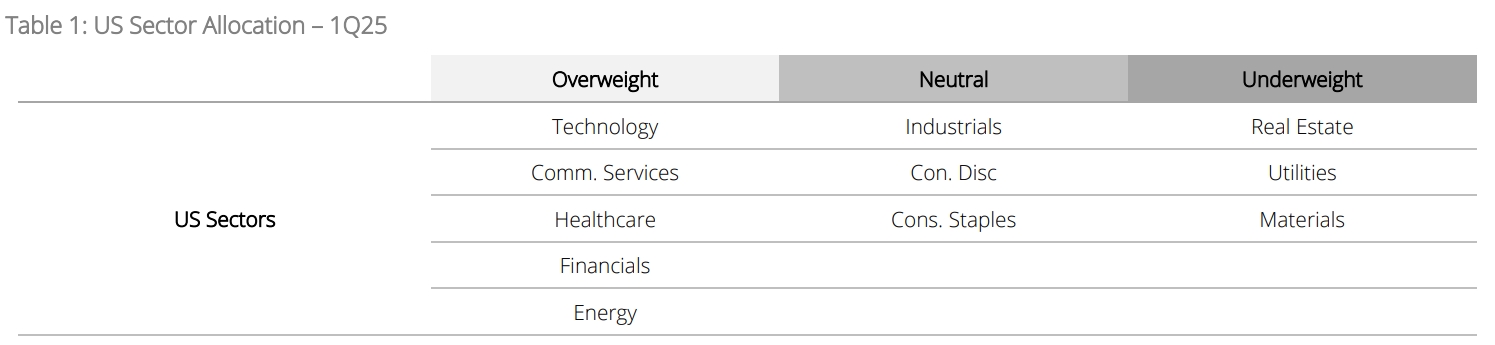

1Q25 US Sector Strategy – Positioning for Trump 2.0

Sectoral rotation to ride Trump 2.0. The incoming Trump Administration is expected to bring about deregulation and expansionary policies which translate to higher bonds yields and increased dollar strength. This warrants some tactical switches to our US sector allocation and the key changes for the quarter are:

- Upgrade financials to Overweight: Financials are poised to benefit from lower taxation and deregulation. The rebound in bond yield (as result of expansionary Trump policies) will also enhance the net interest margins for banks.

- Upgrade industrials to Neutral: Trump’s policies to boost US domestic manufacturing will underpin momentum for industrials. Industries that may benefit include transportation and capital goods.

- Upgrade consumer discretionary to Neutral: Trump’s tax cuts will generate wealth effects and boost consumer spending. This is positive for consumption plays in consumer discretionary.

- Downgrade real estate to Underweight: Higher bond yields are negative for real estate from a valuation and rental yield perspective. Besides, the commercial real estate space is in doldrums and will remain a lingering headwind.

- Downgrade utilities to Underweight: Utilities companies are usually positioned as a dividend play and high bond yields will diminish its attractiveness.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.