- US: Latest price data show slowing disinflation; further trade tariffs and immigration policies add to inflation concerns

- Singapore: Poised to outperform on the back of strong export demand and expansion of key sectors; electronics to remain key growth driver

- India: Growth slows while inflation picks up pace; we revise our FY25 GDP growth to 6.3% y/y from 6.7% earlier

- Taiwan: Further US-China trade tensions likely to encourage Taiwanese companies to invest in ASEAN,

Related insights

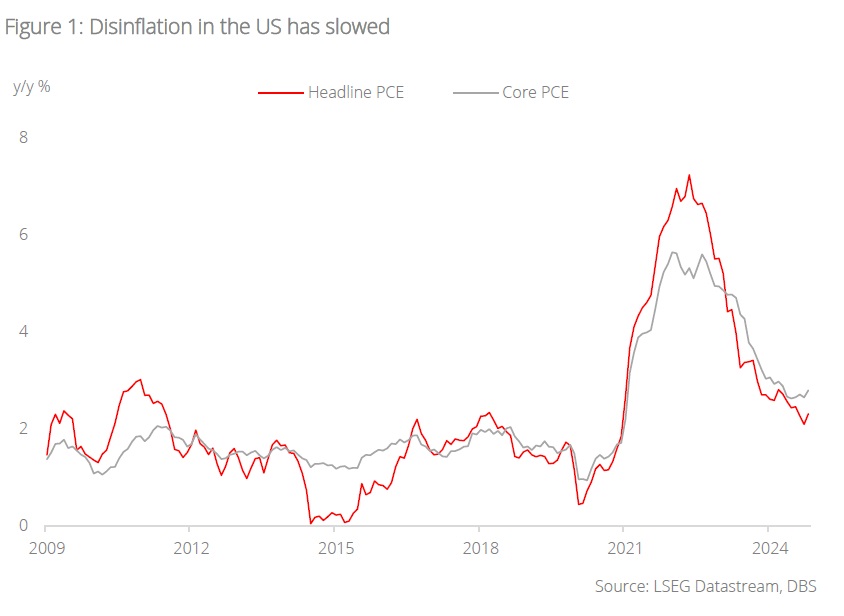

US: Stalling disinflation. Latest price data from the US show stalling pace of disinflation. From early-2023 to mid-2024, core PCE inflation eased steadily from around 5% to below 3%. Since then, it has hovered at 2.75%. More broadly, surveys of business owners in manufacturing and services sectors with national and regional footprints point to costs bottoming out and a marginal increase in plans to raise prices. These findings will be a source of discomfort for Fed officials as they gather during 17-18 December.

Fed Chair Jerome Powell reckoned the Fed could afford to be a little more cautious in lowering rates towards neutral. His confidence in the US economy was consistent with the Fed’s Beige Book which reported that economic activity rose slightly in most areas. While it wants more clarity on US President-elect Donald Trump’s actual tariff and immigration policies, the Fed noted that businesses were concerned about the impact of tariffs on inflation after Trump assumes office in January. US ISM Services fell to 52.1 in November, taking a breather after increasing for four months in a row to 56 in October from 48.8 in June.

Overall, the market is hesitant in adopting a strong stance on Fed cuts beyond the one currently projected for the Federal Open Market Committee meeting on 18 Dec. Tonight, consensus expects US nonfarm payrolls to rebound to 215k in November; markets had brushed off October’s decline to 12k as a distortion due to the hurricanes and strikes. The unemployment rate is expected to stay unchanged at 4.1% for a third month. The Fed enters a blackout period next week, during which CPI inflation is expected to remain unchanged for a fifth time at 0.2% m/m in November, and excluding food and energy prices, a fourth month at 0.3% m/m.

Download the PDF to read the full report which includes coverage on Credit, FX, Rates, and Thematics.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.