- Equities: US markets gain on better economic data, Europe markets higher on faster rate cut expectations; slowing e-commerce sector impacts China markets

- Credit: Tightening credit spreads amid rising growth/inflation uncertainties signal investors to stay up in quality and consider hedging strategies

- FX: “Trump Trade” lifted DXY by 6.7% since 30 Sep; profit-taking on the cards ahead of Thanksgiving week

- Rates: 2Y/10Y segment of UST curve flattened post-elections; Fed to signal wait-and-see attitude after delivering one more cut in December

- The Week Ahead: Keep a lookout for US Initial Jobless Claims; Japan Industrial Production Number

Related insights

US markets resume rallies on better economic data; Europe flies higher on rate cut expectations. Markets resumed their rallies post-Donald Trump’s victory in the US elections as lower initial jobless claims and growth in housing demand boosted sentiment. The Dow, S&P 500, and NASDAQ gained 2.0%, 1.7%, and 1.7% respectively for the week. Investors shrugged off worries that interest rate cuts might come slower than anticipated amid the escalation of the Russia-Ukraine war. Nvidia reported good results, though investors’ expectations were higher. Hence, its share price initially fell before recovering. Disappointing economic data in Europe boosted expectations of faster rate cuts, leading to European stocks climbing higher with the STOXX 600 rising 1.1% and the FTSE jumping 2.5%. Chinese equities fell as underwhelming PDD Holdings earnings indicate slowing e-commerce sector earnings growth amid increasing pricing competition and weakening demand, with the Shanghai Composite Index down 1.9% and the Hang Seng Index dropping 1.0%.

Topic in focus: Cloudy outlook for Europe equities. As the year progresses to a close, the outlook for European equities remains downbeat. Economic growth in Europe (in particular, its largest economy, Germany) continues to be weighed down by weak private consumption and construction activity. The conclusion of the US elections further muddies the picture—Trump 2.0 comes with promises of a wider trade war which includes installing a blanket tariff of 10-20% on all imports and additional tariffs of 60-100% on goods brought in from China. These uncertainties will continue to suppress the earnings outlook for European companies, in particular, those heavily reliant on manufacturing.

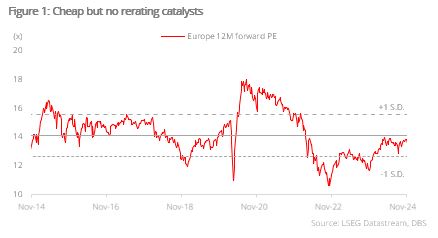

Lack of growth drivers. The STOXX 600 Index currently trades at a forward P/E ratio of 13.2x, hovering below its 10Y average of 14.1x. Given prevailing weak macroeconomic conditions and concerns regarding the sustainability of corporate earnings, we anticipate that valuations will remain muted in the short term with limited catalysts that could trigger a sustained upward rating from current levels. Until substantial improvements are seen in corporate earnings, we do not foresee an imminent rebound for Europe equities. While we maintain our underweight position on Europe, we remain optimistic on long-term structural themes such as quiet luxury, healthcare, technology, and healthcare.

Download the PDF to read the full report which includes coverage on Credit, FX, Rates, and Thematics.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.