- Equities: Better-than-expected earnings boosted US markets; Europe markets higher on hopes of faster ECB rate cut; China markets lower as investors await further policy implementation details

- Credit: Historical data suggests IG credit offers robust returns, regardless of the pace of rate cuts; investors should consider moving cash into credit to capitalise on these gains and mitigate cash reinvestment risk

- FX: DXY rebound likely capped at c.103.30; cautious on dovish bias for EUR/USD ahead of ECB meeting; downside bias for USD/JPY if it consolidates in 145-150 range

- Rates: Fed unlikely to pause in November even if data is strong; Fed could pause easing cycle earlier than planned if data stays resilient

- The Week Ahead: Keep a lookout for US Change in Initial Jobless Claims; Japan Industrial Production Number

Related insights

- ECB Eases Amid Disinflation25 Oct 2024

- Mapletree Industrial Trust25 Oct 2024

- Singapore Equity Picks25 Oct 2024

Equity markets were mixed. US stock markets rose, boosted by better-than-expected earnings posted by big banks. Higher-than-expected inflation data and weekly jobless claims tempered market sentiment. The Dow Jones, S&P 500, and NASDAQ gained 1.2%, 1.1%, and 1.1% respectively for the week. In Europe, the STOXX 600 gained 0.7% as investors expect the European Central Bank (ECB) to cut interest rates faster. The FTSE dropped 0.3% for the week. Japanese yen weakness helped Japan’s exports, and the Nikkei 225 gained 2.5%. After surging sharply in late September, China and Hong Kong markets retreated as investors await further policy implementation details that were lacking in the recent press conference. The SHCOMP and the Hang Seng Index dropped 3.6% and 6.5% respectively for the week.

Topic in Focus: Fed signals cautious approach amid economic resilience. Following stronger-than-expected jobs data last Friday, markets scaled back expectations for a 50 bps rate cut at the next Federal Open Market Committee (FOMC) meeting, favouring a more modest 25 bps reduction. The September FOMC minutes, released this week, reveal that some officials prefer a gradual approach to rate cuts, reflecting the economy's unexpected resilience despite what the Fed describes as a “restrictive” policy stance.

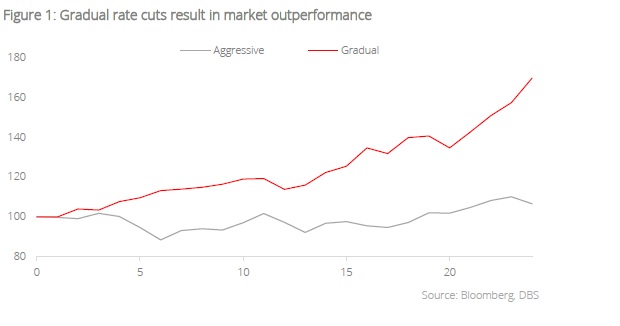

This gradual easing is a positive for markets, based on historical patterns. Since 1986, there have been four instances where the Fed cut rates in response to economic stress, only for a recession to follow. In these cases, the S&P 500 declined by 3% and 17% over the next 12 and 24 months from the initial cut. In contrast, the Fed’s pre-emptive rate cut in 1995, aimed at avoiding a downturn, led to a strong market rally instead, with the S&P 500 gaining 14% and 70% in 12 and 24 months after the first cut.

Current macro conditions closely resemble those of 1995 with strong GDP growth, growing consumer spending, low unemployment, along with structural drivers like the proliferation of AI, further enhancing productivity, and growth potential. This measured approach has the potential to sustain economic strength while supporting market stability, mirroring the favourable outperformance from 1995.

Download the PDF to read the full report which includes coverage on Credit, FX, Rates, and Thematics.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.

Related insights

- ECB Eases Amid Disinflation25 Oct 2024

- Mapletree Industrial Trust25 Oct 2024

- Singapore Equity Picks25 Oct 2024

Related insights

- ECB Eases Amid Disinflation25 Oct 2024

- Mapletree Industrial Trust25 Oct 2024

- Singapore Equity Picks25 Oct 2024