- We expect a sustained improvement in China’s macroeconomic data and consumer confidence which should underpin a longer-term re-rating of the stock market post the announcement of the stimulus package

- Liquidity injection measures to bolster stock market; these coupled with policies promoting the stock market as a wealth-building avenue should continue to energise the stock market. China financials, as a big caps proxy to the economy, should benefit the most

- We favour financial institutions which are aligned with the policy-driven structural shift in the stock market. Non-bank financials, such as insurance companies, should benefit more as wealth flows from property investment toward long-term accumulation vehicles such as mutual funds, insurance products, and wealth management solutions

- Policy impact on banks is neutral despite NIM compression as loan and fee income should grow faster

China stimulus package better than expected. China regulators have announced an extraordinary robust set of stimulus measures, including reserve requirement ratio (RRR) cuts, support for property markets, and low-cost facilities to boost the stock market. The People’s Bank of China (PBOC) delivered a series of policy rate cuts, and the Politburo’s call for “forceful” rate reductions signals further easing ahead. The PBOC has also revised down outstanding mortgage rates by c.50 bps to support the property sector and consumer sentiment. Although China’s banks will face a 5-6 bps decline in net interest margins (NIM) due to the repricing of existing mortgages, this impact is mitigated by lower funding costs, increased loan volume, and growth in capital market-related fee income. As a result, we expect a neutral overall impact on banks' NIM and earnings.

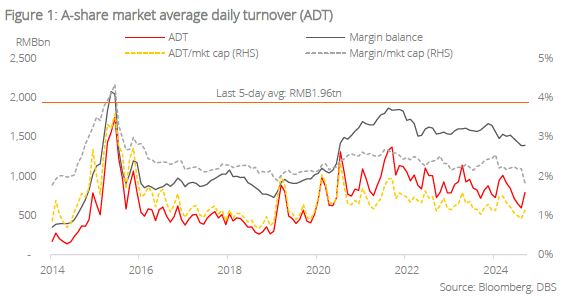

A-share market energised. The PBOC has also introduced several measures to support the stock market, including a swap facility that enables securities firms, funds, and insurers to access PBOC liquidity for equity purchases, and a re-lending facility that allows listed companies to buy back shares and increase their holdings. The initial phase of these initiatives amounts to RMB800bn. These measures are expected to inject additional funds into the stock market, signalling the central government's strong commitment to bolstering the economy and improving market sentiment in the short term. Both brokers and insurers stand to benefit from the recent market rally, as increased trading volumes and fund inflows into mutual funds boost brokers' fee income, while rising stock values generate gains for both brokers and insurers.

Despite the recent market rally when the policy measures were first announced, valuations are still appealing. The anticipated fiscal stimulus could drive short-term price appreciation, while the policy measures’ long-term effects — reflected in sustained improvements in macroeconomic data and consumer confidence — should underpin a longer-term re-rating of the stock market, especially financial stocks.

Insurance companies to benefit from policy-driven shift. We favour financial institutions which are aligned with the policy-driven structural shift in the stock market, especially following the Chinese government’s move from restricting speculative investment to promoting the stock market as a wealth-building avenue. As returns from property investment are expected to decline, we foresee a significant flow of wealth toward long-term accumulation vehicles such as mutual funds, insurance products, and wealth management solutions. Insurers with strong distribution networks and high sensitivity to stock market gains are well-positioned for business growth and improved earnings prospects. The overall impact of recent policies on banks is neutral.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.