- Significant sectorial rotation in play as Fed embarks on monetary easing

- Utilities, consumer staples and healthcare will see strong momentum in an environment of growth moderation and falling bond yields

- Tech sell-down on the S&P 500 presents opportunities for investors to jump onto the AI bandwagon

- Broadening US rally and lower yields will also underpin momentum in US small caps

- Investors rotate from tech-related sectors to defensive plays and domestic cyclicals

Related insights

- ECB Eases Amid Disinflation25 Oct 2024

- Mapletree Industrial Trust25 Oct 2024

- Singapore Equity Picks25 Oct 2024

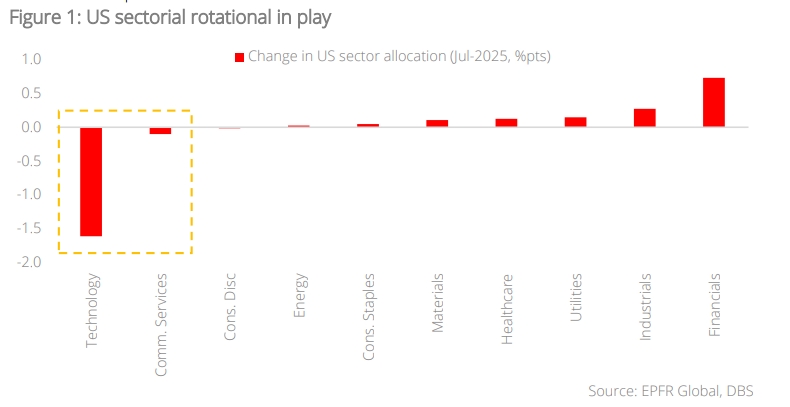

Significant sectoral rotation in preparation for Fed’s pivot. At the Jackson Hole conference, Fed Chair Powell announced that it was time to adjust monetary policy given the sharp moderation in US headline inflation. This change in the Fed’s policy stance triggered huge shifts in portfolio positioning during 3Q24 as data from EPFR Global shows investors rotating from tech-related sectors to defensive plays and domestic cyclicals. The same tactical shifts are reflected in sectoral performance with tech-related segments (technology, communications services, and consumer discretionary) registering average declines of 3.9% QTD (as of 4 Sep), compared to average gains of 9.9% for defensive plays (consumer staples, utilities, and healthcare). From the latest positioning and performance data, it is evident that investors are positioning tactically for 1) economic moderation and Fed monetary easing, and 2) potential disappointment in Tech earnings and AI monetisation potential.

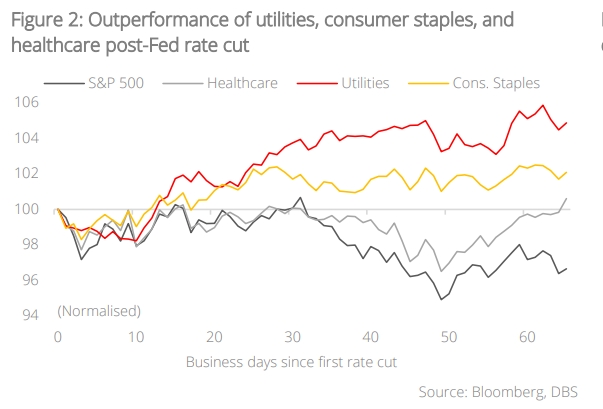

Beneficiaries of rate cuts in past economic cycles. Historically, Fed rate cuts tend to precede recessions. In the current market cycle, an economic soft landing for the US remains our base-case scenario. That said, we are also cognisant that macro momentum is showing signs of moderation. In such an environment, we seek to gain exposure to sectors that benefit from rate cuts and yet stay resilient when momentum slows. Based on our analysis of past cycles, these sectors include:

1. Utilities: The demand for utilities is inelastic given its provision of basic necessities like electricity, water, and gas. Additionally, utilities offers attractive dividend yield; as interest rates decline, yield-focused investors will progressively shift allocation from bonds to income equities and utilities stocks will be geared beneficiaries.

2. Consumer Staples: Consumer staples demand is essentially inelastic as consumers will need to purchase them regardless of the economic environment. Moreover, the lower interest rate environment also reduces the interest expense of consumers and enhances their spending power. Companies providing “value” goods selling at lower price points will be geared beneficiaries as consumers trade down.

3. Healthcare: Similar to utilities and consumer staples, the demand for healthcare is broadly inelastic regardless of macro conditions and this is particularly so in an ageing society. Furthermore, pharmaceutical and biotechnology companies require significant capital for R&D to drive innovation and new product creation. Moderating interest rates reduce the cost of borrowing for R&D expenditures.

Our analysis of the recent four rate-cut cycles shows that utilities, consumer staples, and healthcare have, on average, outperformed the broader US market by 9.0 %pts, 4.3 %pts and 4.2 %pts respectively three months after the initial Fed rate cut.

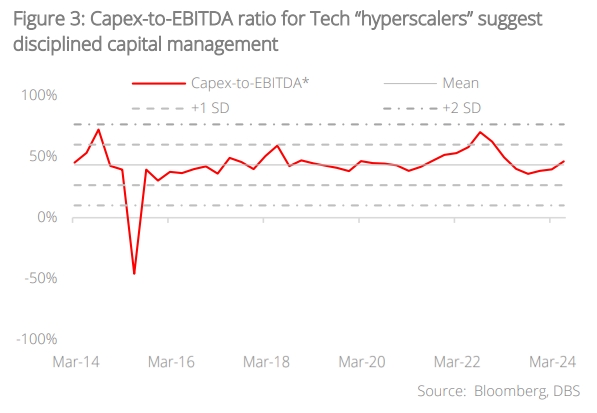

US Technology sell-down presents opportunities. Apart from valuation headwinds, the recent weakness in Technology shares stemmed from rising concerns on AI-related capex as investors question the monetisation potential of these investments. We believe that such concerns are unfounded for two reasons:

- Capex funded by free cashflow: Unlike the dot-com era, the AI revolution today is funded by free cash flow as opposed to debt. “Hyperscalers” such as Alphabet, Amazon, Meta, and Microsoft are flush with cash from their businesses and the free cash flow of these companies is projected to grow 142% from USD142.8bn in 2020 to USD345bn by 2026.

- Disciplined capital management: Tech “hyperscalers” have maintained their capex-to-EBITDA ratio at around the 10-year average of c.43%. This suggests prudence and a disciplined approach to capital management. Such self-sustaining financial models ensure that these companies are not over-leveraged, which in turn ensures that the AI trend is more resilient to economic fluctuations.

The recent Tech sell-down on the S&P 500 presents opportunities for investors to jump onto the AI bandwagon and we maintain that the AI revolution is still in its infancy, holding immense growth potential.

Every dog has its day - time to relook US small caps. As the US equity rally broadens, we expect small caps to benefit from a falling rates environment. Medium-term catalysts for the small-caps space include:

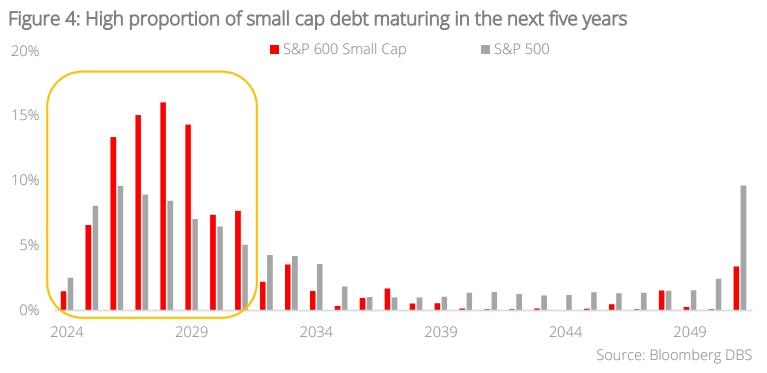

- Earnings boost amid lower borrowing cost: US small caps tend to be more rates -sensitive as 67% of them have debt maturing within the next five years as compared to c.45% for larger companies. This allows more small-cap companies to refinance at lower rates and reduce their borrowing cost.

- Steep valuation discount: At 17.7x, the S&P 600 Small Cap index’s forward P/E is well below its 20-year average. Additionally, it is also trading at a 22.9% discount to the S&P 500. This represents a compelling opportunity for investors looking to participate in the broadening US equity rally.

Fund flows data from EPFR Global suggests that investor sentiments towards US small caps are on the rebound. During the first half of the year, this space registered net outflows of USD1.5bn. But on a QTD basis in 3Q, US small caps saw net inflows of USD11.4bn. We expect this momentum to persist as investors reposition their portfolios to ride on the evolving interest rate environment.

4Q24 US Sector Strategy – Rotation to defensive plays

Paring back underweight positioning on defensive sectors as macro momentum slows.The broadening US rally, coupled with sectoral shifts to position for the start of the Fed easing cycle, has seen defensives massively outperforming growth in 3Q24. Our overweight calls lost 2.2% (as of 5 Sep) as a result of weakness in technology, communications services and energy. Healthcare was the only exception as it managed to gain 6.0%. For the upcoming quarter, we are making the following switches to our US sector allocation to adjust to the new macro environment.

- Upgrading utilities, consumer staples and real estate from Underweight to Neutral: For the upcoming quarter, we are turning neutral on these sectors as lower bond yields will underpin their momentum. As growth momentum moderates, sentiments towards defensive sectors like utilities and consumer staples will improve as investors favour the stability in demand for these segments. In the case of real estate, REITs will benefit from renewed enthusiasm on income equities as bond yields fall.

- Downgrading materials and consumer discretionary from Neutral to Underweight: While a soft-landing scenario for the US economy remains our base case, there are incremental signs that macro momentum is moderating. Therefore, we are reducing growth exposure in our sector allocation with downgrades for cyclical plays like materials and consumer discretionary.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.

Related insights

- ECB Eases Amid Disinflation25 Oct 2024

- Mapletree Industrial Trust25 Oct 2024

- Singapore Equity Picks25 Oct 2024

Related insights

- ECB Eases Amid Disinflation25 Oct 2024

- Mapletree Industrial Trust25 Oct 2024

- Singapore Equity Picks25 Oct 2024