- China’s central bank surprised the market with a blitz of policy easing measures to reduce RRR and mortgage rates and improve liquidity in the financial market

- Opportune timing to capture liquidity flow amid US Fed rate cut, weakening USD, and investors’ underweight in China equities

- Prefer large cap and index heavyweights and technology leaders at the forefront of liquidity flows

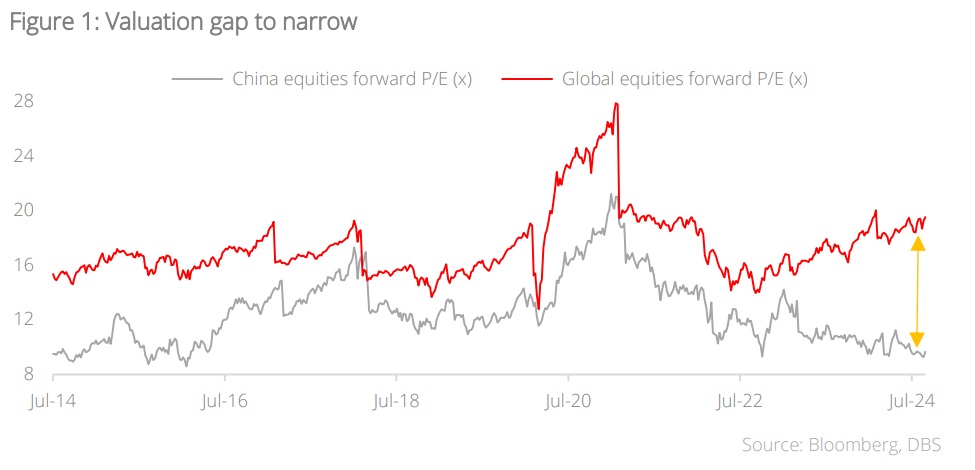

- Favourable risk-reward dynamic on wide valuation discount. China equities trade at 10x forward PER - half of global average

Related insights

- Alternatives 1Q25: Gold – Resilience with Alternatives20 Dec 2024

- CIO Insights 1Q25: Game Changers20 Dec 2024

- Bank of America19 Dec 2024

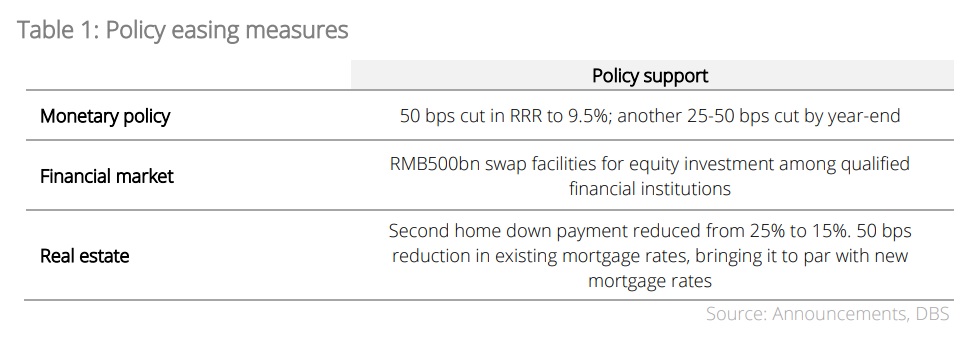

New policy blitz. China's central bank, the People's Bank of China (PBOC), has taken a proactive approach to bolstering the economy with a series of policy easing measures, surprising the market. These include reductions in Reserve Requirement Ratios (RRR) and adjustments to policy and mortgage rates (Table 1). These efforts aim to stimulate investment, enhance liquidity, and restore confidence in the financial markets. Addressing housing concerns will be essential to counter ongoing deflationary pressure.

The timing of these announcements could not be more opportune, capitalising on the tailwinds of supportive factors: liquidity inflow coinciding with the start of the US Fed’s rate cut cycle, a weakening US dollar, investors’ underweight positioning in China equities, and a general improvement in sentiment across Asia (excluding Japan) since the second quarter of this year.

In addition, the widening valuation gap has spurred investors to reassess their underweight position in China equities. At current level, the risk-reward dynamic appears favourable. At a forward PER of 10x (Figure 1), China equities are trading at a steep discount to the global average of 19x.

The jury is still out. While these policies take a hopeful aim at the sustained recovery of the stock market and broader GDP growth, the effectiveness and successful implementation of these measures remain to be seen. Nonetheless, these recent steps have undoubtedly boosted near-term sentiment and raised market expectations.

Unlike previous rounds of announcements, we believe this is less likely to be a false dawn. A robust ecosystem of favourable factors, both external and internal, supports this view. Effective implementation and sustained follow-through over the longer term could restore wealth effects and reinforce domestic consumption.

With global central banks lowering policy rates, China policy makers can breathe a sigh of relief. This backdrop presents the PBOC greater room for monetary easing, flexibility to inject liquidity into the system, stabilise the real estate market, and support a recovery in consumption. Moreover, lower global rates are supportive of risk assets in emerging markets which have underperformed since 2022.

Recommendations moving forward:

- Reassess investment positions: For clients who are underinvested, this presents an ideal opportunity to revisit their portfolios. We suggest adding to large-cap and index heavy-weights, technology leaders, and quality growth stocks which are the forefront of favourable liquidity flows.

- Income opportunities: On the income side, stay invested in large state banks for their reliable dividend yields which provide an attractive income stream for investors in an environment of falling rates. Historically, dividend payouts among China large state banks have remained stable over economic and interest rate cycles.

- Targeted exposure: For investors who already have exposures in China, we recommend investing in structured products to expand their exposure at targeted entry points.

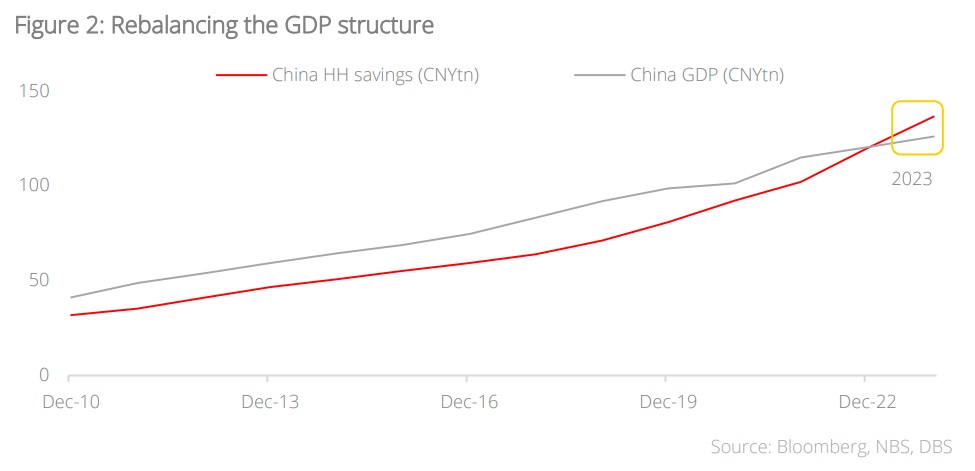

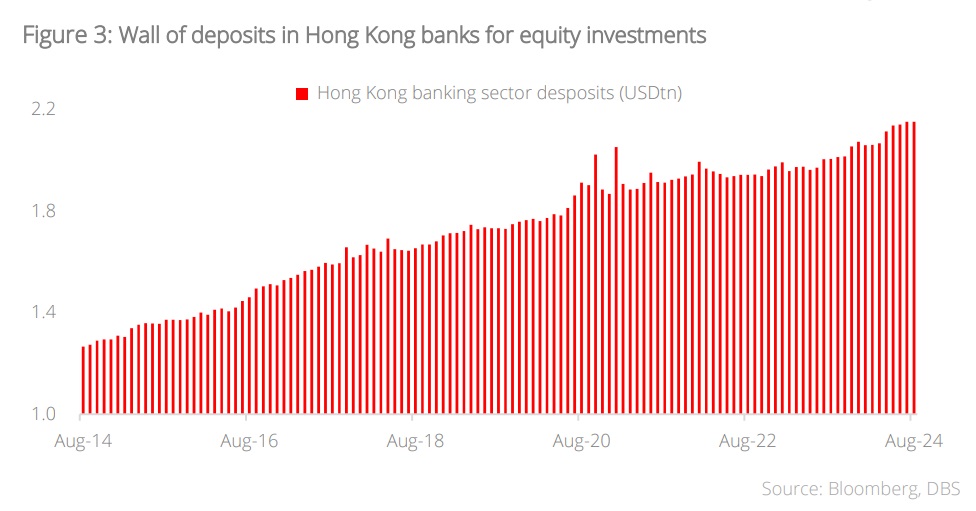

Supplementary tailwinds. Another potential tailwind supportive of improving performance over the longer term is the significant amount of cash on the sidelines. China’s total household deposits reached CNY126tn (USD18tn) at the end of 2023, surpassing total GDP value for the first time (Figure 2). Additionally, total bank deposits in the Hong Kong banking sector rose to a record USD2.2tn (Figure 3).

With the right policy initiatives and implementations, the former will be crucial to revitalising domestic consumption and reversing a precautionary savings mindset. Meanwhile, the latter will provide liquidity that can flow back into equities, seeking better returns in this declining rate environment.

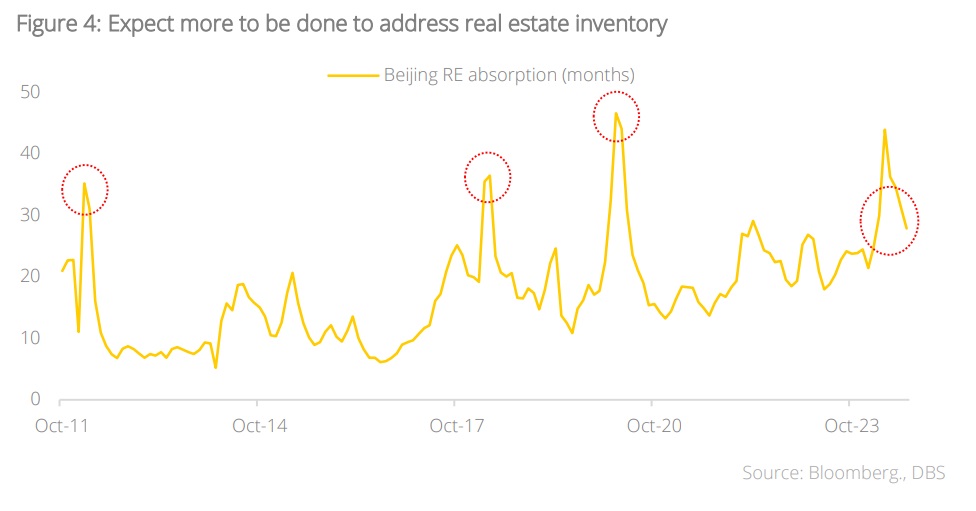

More time needed on real estate issues. Nonetheless, the years-long real estate slowdown and inventory issues—widely regarded as the single largest challenge faced by the country in recent decades—remain a headwind to the near-term outlook (Figure 4). Considering its substantial impact, a government-led resolution of the housing debacle will be crucial to stabilising growth targets.

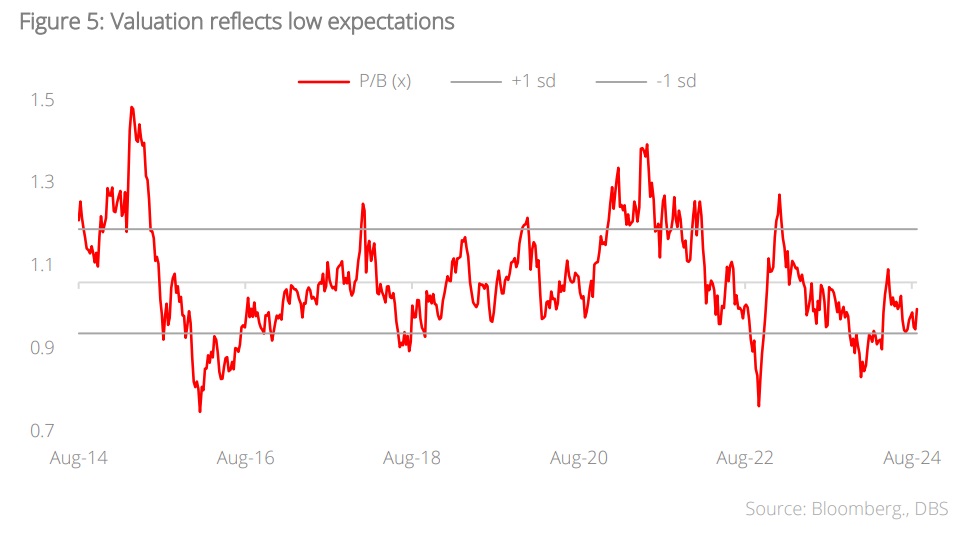

Valuations at floor. While we do not anticipate the market direction to immediately turn into a straight-line recovery, the combination of policy supports since 2023, current measures, and floor valuations (Figure 5) on low expectations will emerge as credible tailwinds to support the improving outlook.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.

Related insights

- Alternatives 1Q25: Gold – Resilience with Alternatives20 Dec 2024

- CIO Insights 1Q25: Game Changers20 Dec 2024

- Bank of America19 Dec 2024

Related insights

- Alternatives 1Q25: Gold – Resilience with Alternatives20 Dec 2024

- CIO Insights 1Q25: Game Changers20 Dec 2024

- Bank of America19 Dec 2024