- Selloff triggered by French political woes as investors spooked by the prospect of a far-right government; excessive fiscal deficit push bondholders away from French debt

- Widespread contagion to the broader European market is unlikely given recovering fundamentals, better-than-expected 1Q24 GDP growth

- Europe equities have stayed resilient despite growth concerns; supportive central bank policies and better-than-expected corporate earnings set the stage for sustained economic recovery

- However, a significant decline in bond yields or a substantial improvement in corporate earnings are needed for longer-term gains in Europe equities

- Maintain underweight position; focus on sector-specific opportunities and stick with quality companies in the luxury, tech, and healthcare space

Related insights

Unchartered waters. Volatility in Europe markets erupted in the wake of French President Emmanual Macron’s abrupt call for a snap parliamentary election, triggering fears of worsening political instability and an already ballooning fiscal deficit. The prospect of a far-right government, known for its protectionist policy stance and ambitious spending plans rattled investors, sending French stocks and bonds into a sharp selloff last week. Banks, widely seen as proxies for the economy given their sensitivity to economic cycles and sovereign spreads, suffered the most, while the broader CAC 40 Index suffered a loss of c.5% on a month-to-date basis.

Contagion risks unlikely. The retreat in French markets also triggered a selloff in the broader European region, leading to the Stoxx Europe 600 Index registering its largest weekly loss in months. Fears arising from unexpected political risks may have roiled markets, but we believe the sharp selloff was a knee-jerk reaction to a fleeting headwind, rather than a fundamental downgrade of the region’s outlook. Europe equities have shown resilience this year despite stagflation concerns, gaining 7.3% YTD while advanced GDP growth in 1Q24 surpassed forecasts. Commitment by the ECB to begin cutting rates around mid-year, ahead of the Fed, also attests to a positive growth environment for corporate earnings recovery.

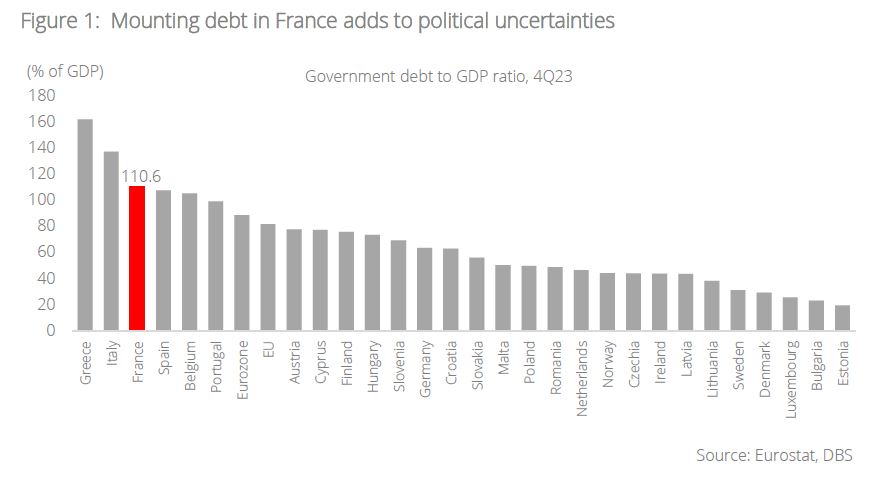

France has some of the weakest macro fundamentals of the major European economies, complicating political agenda and increasing uncertainties. The point of stress for France lies in its excessive budget deficit of 5.5% (which is well above the EU limit of 3%), and its burgeoning public debt which has surged to more than 110% of its GDP. This is in stark contrast to the region’s largest economy – Germany – which is forecast to run a budget deficit of 1.75% this year, along with a national debt-to-GDP ratio of 63.6%. Despite pressure from the ECB, France continues to lag most other Eurozone economies in reducing its deficit, driving investors to steer clear of French debt.

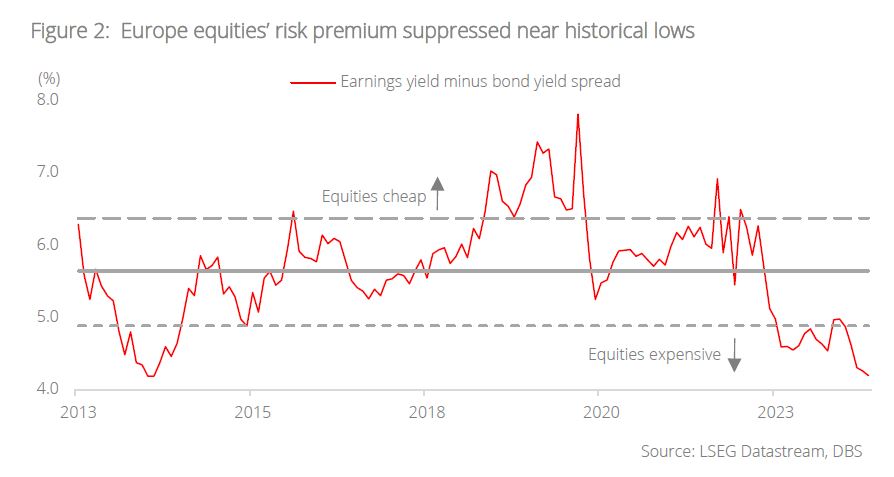

Silver linings. Investor concern over France’s political woes should continue to subside, as attention reverts to economic data and central bank policies. In the near-term, weak sentiment will further compress equity valuations, which have already been suppressed near historic lows. Until we see a significant decline in bond yields or a substantial improvement in corporate earnings, the sustainability of gains in Europe equities remains in doubt. We maintain our underweight position on Europe equities, and highlight fundamentally driven sector-specific opportunities.

Given this period of heightened volatility, stay with European companies that exhibit strong fundamentals and growth prospects in the luxury, tech, and healthcare space:

Luxury: The luxury industry is anticipated to see a mid- to high-single digit CAGR over the next five years, with significant contributions from increasing affluence in Asia. Recent earnings highlight the success of dominant European brands in capturing the ‘quiet luxury’ movement – for instance, Hermès achieved notable double-digit growth in organic retail sales.

Tech: Europe is home to the world’s leading supplier of extreme ultraviolet light (EUV) lithography, a vital technology in enabling mass production of the world’s most advanced microchips. As companies and governments race to safeguard their supply chains and leverage on AI technologies, demand for such expertise will bring strong earnings potential.

Healthcare: Aside from its defensive nature which offers a hedge against macroeconomic downturns, extensive R&D in recent years by some of the world’s largest pharmaceutical companies, many of which originate from Europe, has produced a myriad of commercial-stage drugs which generate steady cashflow, followed by a pipeline of drug discoveries that offer compelling structural growth opportunities. As of 2Q24, Europe healthcare outperformed both the broader STOXX 600 Index and the US healthcare sector.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.