- US: FOMC minutes indicate worries over stubborn inflation; slowing Chinese economy and CRE risks remain key downside risks to economic activity

- Japan: Core inflation slowed to 2.2% in April after rising 2.6% in March, marking a second straight month of decline; weak yen continues to erode purchasing power

- Singapore: On track for 2%+ growth this year as global downside risks linger; manufacturing poised for a fragile recovery in 2024 after weak 1Q

- Thailand: 1Q24 upside growth surprise and a better cyclical outlook lower rate cut odds; tourism and private consumption to support growth with the digital wallet policy posing upside risks

Related insights

- SGD Rates: SORA-SOFR basis downside if carry unwinds? 18 Jul 2024

- DBS Stock Pulse: (1) Singapore Equity Picks – Remove SingTel and Frencken (2) Global Stocks - 4 key developments to monitor as the US 2Q24 earnings season unfolds (3) Global Technology – Navigating the fallout from further curbs on chip stocks18 Jul 2024

- Research Library17 Jul 2024

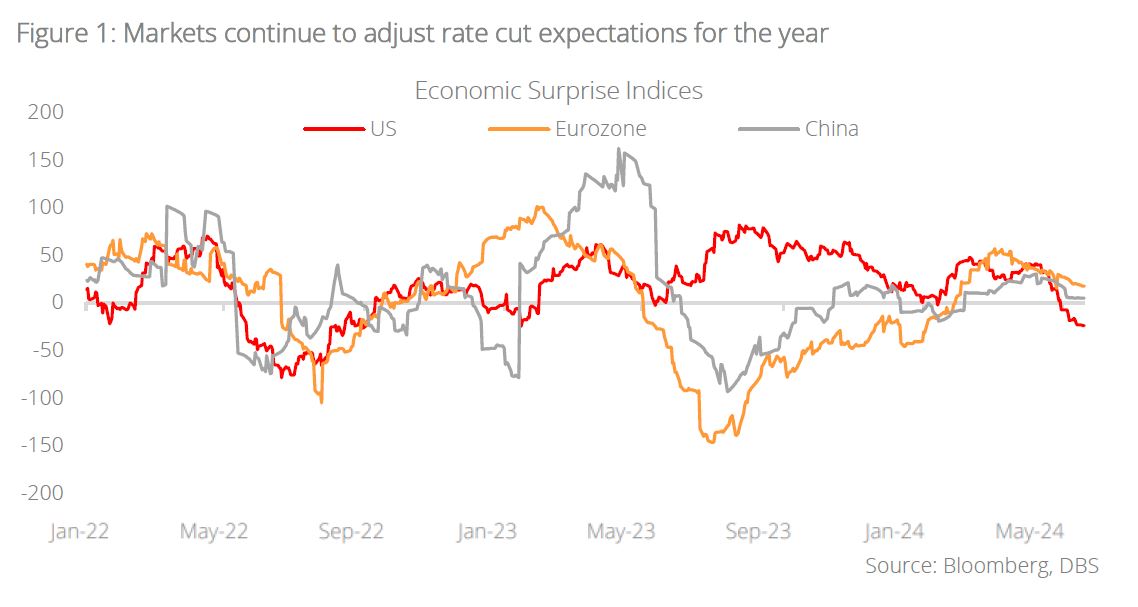

US: FOMC minutes signal worries over lack of progress on inflation. While inflation has eased over the past year, recent months saw the return of the ‘higher-for-longer’ narrative as a slew of readings indicated inflation was more stubborn than officials had expected for the year. Minutes of the Federal Open Market Committee (FOMC) meeting (held on 30 Apr - 1 May) released this week emphasised that rates could be kept high for some time as inflation remains sticky. Some officials questioned whether rates are sufficiently restrictive, and a few indicated a willingness to tighten policy further. This adds an additional degree of uncertainty and the market pushed 2Y to 5Y yields up in the process.

FOMC participants also noted downside risks to economic activity, including a slowing Chinese economy and the deterioration in the commercial real estate (CRE) market, sharply tightening financial conditions. FOMC discussions were based on the stronger labour market and inflation data in 1Q24 and excluded the disappointing nonfarm payrolls or CPI inflation in April.

Global growth momentum has sapped a tad. While the US economy is still looking strong overall, there are marginal signs of weakness, ranging from ISM Manufacturing orders to retail sales. The data from China are mixed, with cooling exports and retail sales on one hand and improving labour market on the other hand. Europe has seen soft factory orders and construction, but services remain strong. Not quite recession watch, but we believe weaknesses are surfacing.

Download the PDF to read the full report which includes coverage on Credit, FX, Rates, and Thematics.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.

Related insights

- SGD Rates: SORA-SOFR basis downside if carry unwinds? 18 Jul 2024

- DBS Stock Pulse: (1) Singapore Equity Picks – Remove SingTel and Frencken (2) Global Stocks - 4 key developments to monitor as the US 2Q24 earnings season unfolds (3) Global Technology – Navigating the fallout from further curbs on chip stocks18 Jul 2024

- Research Library17 Jul 2024

Related insights

- SGD Rates: SORA-SOFR basis downside if carry unwinds? 18 Jul 2024

- DBS Stock Pulse: (1) Singapore Equity Picks – Remove SingTel and Frencken (2) Global Stocks - 4 key developments to monitor as the US 2Q24 earnings season unfolds (3) Global Technology – Navigating the fallout from further curbs on chip stocks18 Jul 2024

- Research Library17 Jul 2024