- Equities: Asia markets buoyed by PBOC announcement of property sector stimulus; US equities continue rise on strong earnings and potential September rate cuts

- Credit: Continued growth support from private sector surplus savings. Disinflationary environment, stable economy, and policy certainty create favourable set up for investors

- FX: GBP/USD facing resistance at 1.27-1.28 and on 22 May, profit-taking could set in on two significant events; EUR/USD faces resistance after its month-long rally from 1.06 to 1.09

- Rates: UST 2Y yield to be stuck between 4.70 to 4.90% in the near term; In Asia, we have upgraded 2Y JGB forecast

- The Week Ahead: Keep a lookout for US Change in Initial Jobless Claims; Singapore CPI

Related insights

- SGD Rates: SORA-SOFR basis downside if carry unwinds? 18 Jul 2024

- DBS Stock Pulse: (1) Singapore Equity Picks – Remove SingTel and Frencken (2) Global Stocks - 4 key developments to monitor as the US 2Q24 earnings season unfolds (3) Global Technology – Navigating the fallout from further curbs on chip stocks18 Jul 2024

- Research Library17 Jul 2024

Property sector support drove rise in Asia equities. China and Hong Kong equity markets were mostly up last week thanks to announcements from China’s central bank to boost its ailing property market – a reduction of minimum mortgage downpayment requirements and removal of mortgage rate floors. The HSCEI and Hang Seng were up 3.2% and 3.1% respectively. Japan equities were also up last week (Nikkei-225 +1.5%; Topix +0.6%) after Bank of Japan (BOJ) Governor Ueda announced that the central bank has no immediate plans to sell its ETF holdings.

US equities continue to be boosted by a strong earnings season as well as a revival in rate cut hopes following signs of a potentially cooling labour market. The Nasdaq, S&P 500, and Dow Jones were up 2.1%, 1.5%, and 1.2% respectively last week. This week, all eyes will be on earnings release of AI stalwart Nvidia for guidance on the sector’s forward earnings visibility.

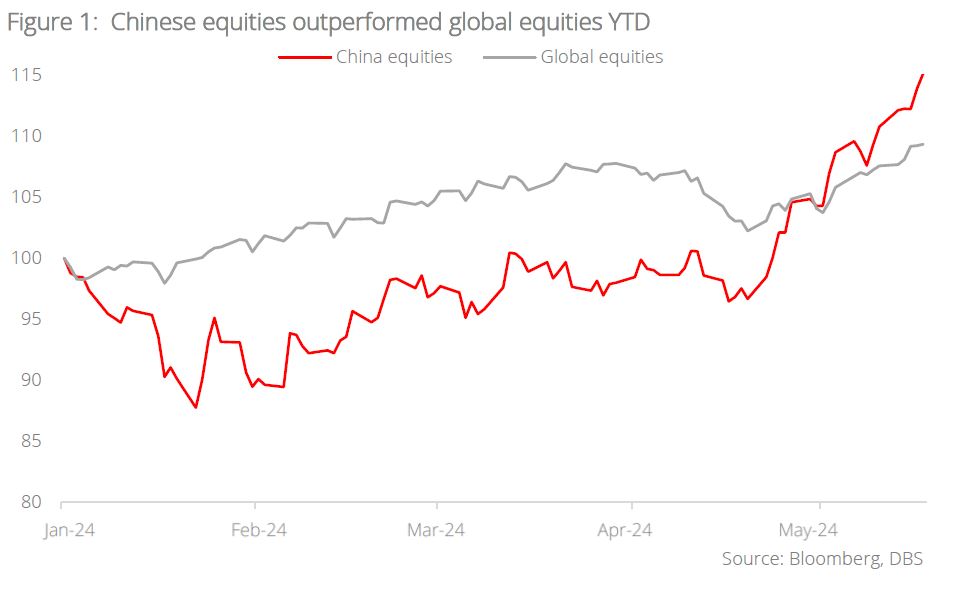

Topic in focus: Chinese equities – Stellar performance in 2024. Chinese equities had a tumultuous year in 2023, marked by challenges in the property sector and declining exports. This resulted in a return of -11% and underperformed global equities by 11.8 %pts. However, 2024 brought a remarkable turnaround for Chinese equities, which have since posted impressive double-digit gains of 15.5% on a YTD basis, outperforming global equities by 5.2 %pts. Macroeconomic data further indicated a recovery in the economy, with better-than-expected first-quarter GDP, three consecutive months of rising CPI, and official manufacturing PMI remaining in expansionary territory in the recent two months. Additionally, China has also begun the sale of RMB1tn of ultra-long special sovereign bonds, which will be used to stimulate key sectors in its economy.

From a sectoral perspective, we maintain a preference for Chinese platform companies, including online travel companies. Online travel revenue is forecasted to grow robustly by c.18% in 2024, even after experiencing a strong rebound of 110% in 2023. Over the long term, this growth will be propelled by structural changes in travel behaviour, such as the expansion of short-haul travels (e.g., concerts and examinations) and the younger generation's preference for individual trips. These factors are expected to sustain and drive the growth of online travel platform companies.

Download the PDF to read the full report which includes coverage on Credit, FX, Rates, and Thematics.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.

Related insights

- SGD Rates: SORA-SOFR basis downside if carry unwinds? 18 Jul 2024

- DBS Stock Pulse: (1) Singapore Equity Picks – Remove SingTel and Frencken (2) Global Stocks - 4 key developments to monitor as the US 2Q24 earnings season unfolds (3) Global Technology – Navigating the fallout from further curbs on chip stocks18 Jul 2024

- Research Library17 Jul 2024

Related insights

- SGD Rates: SORA-SOFR basis downside if carry unwinds? 18 Jul 2024

- DBS Stock Pulse: (1) Singapore Equity Picks – Remove SingTel and Frencken (2) Global Stocks - 4 key developments to monitor as the US 2Q24 earnings season unfolds (3) Global Technology – Navigating the fallout from further curbs on chip stocks18 Jul 2024

- Research Library17 Jul 2024