- Equities: Trump's sweeping tariffs caused US and Europe markets to decline; Asia also posted negative performances

- Credit: TIPS may persist in its current streak of positive returns and outperformance over treasuries amid anticipation of further rate cuts and risks of stagflation

- FX: Equity movements may be a gauge for FX

- Rates: Early signs that extreme levels have been reached; positive negotiation breakthroughs ahead of the 9 Apr reciprocal tariff implementation could help stabilise sentiment

- The Week Ahead: Keep a lookout for US Change in Initial Jobless Claims; China CPI

Trump’s sweeping tariff policy caused market declines. The Liberation Day tariffs (universal 10%, effective on 5 Apr, and reciprocal, effective on 9 Apr) turned out to be more severe than what the market was pricing, triggering a sharp decline. As a result, the NASDAQ and S&P 500 indices lost 10.0% and 9.1% respectively. Similarly, the Euro STOXX 600 fell by 8.4% amid negative sentiments regarding Trump’s 20% tariffs on the EU. This week, keep a close watch on the US CPI report, a crucial indicator amid rising recession fears.

Asia ex-Japan equities also fell due to the Trump administration’s decision to hike tariffs on China by 34% and China’s reciprocal tariffs of 34% on all US imports starting 10 Apr. Japan’s Nikkei index plunged 9.0% due to Trump’s larger-than-expected reciprocal tariff of 24% to be applied on imports from Japan.

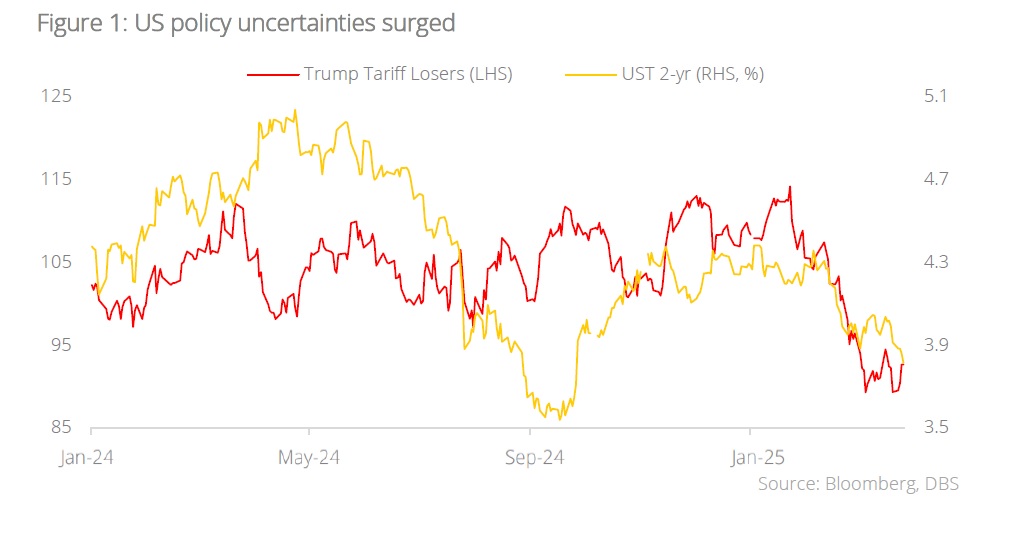

Topic in focus: Navigating Trump’s beautiful trade war. Confusion and chaos gripped financial markets following Trump’s “Liberation Day” tariff blitz, marking his administration’s most aggressive disruption of the global order to date. The imposition of a 10% universal tariff on all imports, alongside reciprocal tariffs as high as 60% for countries with the worst US trade deficits, triggered fears of an escalating trade war. China was hit with a 34% tariff, and the EU with 20%. With global recession risks already emerging, the scale of this trade salvo far exceeded what markets had anticipated.

While some viewed Trump’s tariffs as a negotiation tactic, the universal tariff suggests an ideological shift aimed at resetting global trade structures instead. As the EU signals potential retaliation, financial markets must brace for prolonged turmoil and our recommendations for equities are:

- Favour markets with fiscal stimulus capacity: Countries like China and Europe are better positioned to buffer the impact through stimulus. China’s low central government debt (25% of GDP) gives it ample room to boost domestic demand, while Europe’s new EUR500bn infrastructure fund signals a shift toward growth-driven fiscal policies.

- Favour companies reshoring to the US: High-margin sectors like semiconductors, pharmaceuticals, and aerospace are moving production back to the US, supported by government incentives such as the Inflation Reduction Act (IRA) and are better positioned to withstand supply chain disruptions.

Download the PDF to read the full report which includes coverage on Credit, FX, Rates, and Thematics.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.