- With heightened macro uncertainty and weakened consumer and corporate sentiment, US domestic travel demand has softened. Meanwhile, budget cuts have prompted a decline in government travel. International travel demand may also be at risk, given the increasingly uncertain economic backdrop

- Although global cargo demand rose modestly in Feb 2025, growth is decelerating. Tariffs, the upcoming end of US De Minimis exemptions, and the normalisation of shipping routes threaten to reduce air freight volumes from 2H25

- Mounting demand concerns and cargo headwinds increasingly cloud the prospects for airlines. However, we believe certain carriers are positioned to fare better

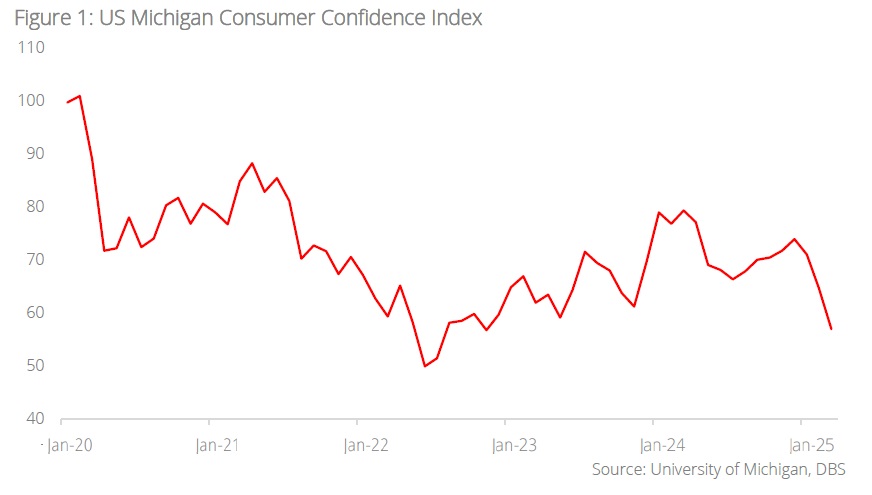

Tariff headwinds denting consumer and corporate confidence. Heightened macro uncertainty and subdued sentiment appear to be weighing on US domestic travel demand and corporate bookings, alongside a reduction in government travel due to budget cuts. This has prompted various US airlines such as Delta, American, and Southwest to lower their 1Q25 guidance. While the premium and international segments remain more resilient for now – likely supported by less price-sensitive and loyalty-driven travellers, potential downside risks are emerging amid a weakening economic backdrop, with several airlines also flagging early signs of softness on US–Canada and transatlantic routes. More airlines may revise their guidance downward in the coming months, along with the street trimming earnings estimates, which could impact share prices.

Trade disruptions and potential easing of shipping disruptions could also temper air cargo momentum. Global air cargo demand, as measured in cargo-tonne-kilometers (CTKs), rose by 3.0% y/y (seasonally adjusted) in Feb 2025, though the pace of growth is slowing. Looking ahead, we anticipate air cargo headwinds stemming from tariffs and the imminent elimination of De Minimis tax exemptions in the US. This poses a risk to China–US e-commerce flows, and the boost from customers front-running tariffs are likely to subside over the coming quarters. With the Middle East situation stabilising, air freight (which had benefitted from a shift from sea to air due to shipping disruptions), traffic may gradually return to maritime transport as conditions normalise. As a result, global air cargo volumes could contract from 2H25, partly mitigated by the resilient demand for Chinese e-commerce goods on price advantage and possible diversion of trade flows as vendors relocate to tax-exempt countries like Malaysia, Thailand, and Vietnam.

We temper our optimism on the sector as a whole, though select airlines are better-positioned. A more cautious stance on the airline sector may be warranted, as growing demand concerns and cargo headwinds increasingly cloud the outlook. Nonetheless, United is poised to outperform US peers thanks to a larger international market share, expanding loyalty programmes, and limited cargo exposure. IAG stands out with its higher-end customer focus, relatively low cargo exposure, and compelling valuation. Over in APAC, Qantas is supported by an increasingly favourable yield environment and a robust cost reduction plan. Although Cathay has higher cargo exposure, we expect passenger revenue growth, reduced fuel cost, and efficiency gains to bolster profitability, with valuations remaining attractive.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.