- Pricing continues to be a key revenue driver with international markets outperforming the US

- Despite easing inflation, US consumers remain hesitant, driving private-label growth and prompting companies to rethink their pricing strategies

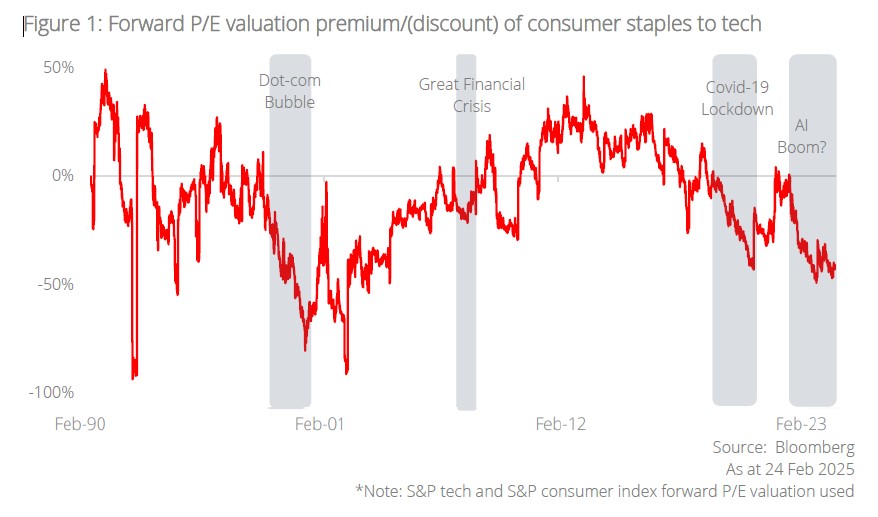

- The widening valuation gap between consumer staples and tech sector suggests potential upsides through mean reversion

- Favour companies with strong executions; avoid those with volatile cocoa costs and weak operational

Related insights

- Asia ex-Japan Equities10 Mar 2025

- Procter & Gamble10 Mar 2025

- The USD’s weak momentum carries potential risks too10 Mar 2025

Mixed performance in 2024; growth continues to be driven by pricing and international markets. Excluding Coca-Cola, major listed packaged food and non-alcoholic beverage (PFNAB) companies experienced a decline in volume/mix in 2024, citing weaker demand, economic uncertainty, and a shift towards cost-conscious purchasing given heightened inflation and high interest rates. However, most companies managed to sustain net organic revenue growth as price increases offset weaker volumes. International markets outperformed the US, where companies successfully passed on higher prices. Looking ahead to 2025, the outlook remains mixed. Some companies project mid-single-digit revenue growth, while others, like Kraft Heinz, anticipate low-single-digit growth or continued declines.

Providing a value proposition remains critical amid consumer caution. Despite easing inflation and a strong equities market, US consumers remained cautious on consumption in 4Q24. The University of Michigan’s Consumer Sentiment index declined to 67.8 in Feb 2025, down from 71.1 in January, marking the lowest in seven months. Additionally, trade-down behaviour persists across income groups as highlighted in a McKinsey report, leading to continued gains by private-labels and prompting brands to adjust pricing strategies. For example, PepsiCo has shifted from value packs to an absolute price-point strategy, entering the sub-USD2 category for the first time to cater to value-conscious consumers.

The widening valuation gap between the consumer staples and tech sector presents an attractive time to diversify into consumer staples. Historically, major market events—such as Covid-19 (2019–2021), the global financial crisis (2009–2010), and the dot-com bubble (1999–2000)—have coincided with a widening valuation gap between consumer staples and the tech sector. Currently, consumer staples trades at a c.40% discount to tech, well above the historical median of 11% discount. We believe this gap may narrow through mean reversion, presenting an attractive upside for consumer staples. Among packaged food and beverage companies, we believe investors could overweight those demonstrating strong executions and underweight those facing volatile cocoa input costs and weaker executions.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.

Related insights

- Asia ex-Japan Equities10 Mar 2025

- Procter & Gamble10 Mar 2025

- The USD’s weak momentum carries potential risks too10 Mar 2025

Related insights

- Asia ex-Japan Equities10 Mar 2025

- Procter & Gamble10 Mar 2025

- The USD’s weak momentum carries potential risks too10 Mar 2025