- Global: Global GDP growth outlook remains positive despite headwinds from elevated interest rates and geopolitical tensions

- Japan: Steady wage growth to drive gradual recovery in private consumption, offsetting some of the negative impacts from slower export growth

- Singapore: Resilient economy supported by global tech and electronics upcycle, and global reduction of interest rates

- Taiwan: Demand for AI-enabled mobile phones, PCs, and other consumer electronics could increase in 2025, supporting export growth

Related insights

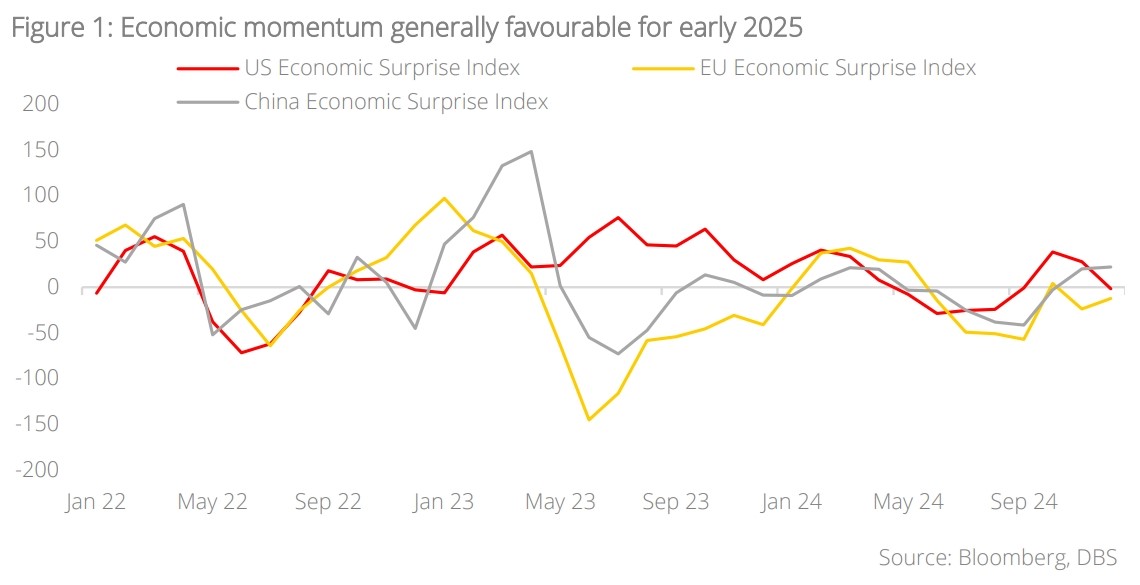

Global: Broadly stable outlook ahead. Despite a general source of unease due to the prevalence of relatively high interest rates and heightened geopolitical risks, the global economy remains on a broadly comfortable expansionary path. Global growth is slated to be around 3.25% in 2024, not much different from the outcome in 2023 or the forecast for 2025. Yet, within that picture lies considerable heterogeneity. Many economies were struggling with high inflation just a couple of years ago, while some have been experiencing a downshift in growth dynamism.

This week, Fed officials have reinforced its latest narrative for a careful approach to future rate cuts. They pointed to PCE core inflation remaining high (2.8% y/y in December) amid a resilient US economy, a stabilising labour market, and stalling disinflation. The Federal Open Market Committee (FOMC) minutes also drew attention to a possible delay in returning inflation to the 2% target because of President-elect Donald Trump’s proposed policies on tariffs, tax cuts, and immigration. Hence, pay attention to today’s University of Michigan Consumer Sentiment Survey, which recently reported a rise in one-year inflation to 2.8% in December after six months of declines, alongside the highest level of consumer confidence since April.

The US election result and its implications for Europe will be a key focus area in 2025. There is ample uncertainty surrounding upcoming tariffs under the Trump 2.0 presidency, the extent of US support for Ukraine in the ongoing conflict, and an anticipated bout of deregulation in the US. On the trade front, linkages run deep. A clear overhang can be found in President Trump’s threat of a blanket 10% tariff, which would affect the EU since its largest export market is the US – not to mention the fact that many EU member countries are running deficits. Meanwhile, there is the second derivative impact of slower growth in China and other trading partners.

Download the PDF to read the full report which includes coverage on Credit, FX, Rates, and Thematics.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.