Related insights

A new golden age for vaccines? It has been nearly three years since Covid-19 turned the world on its head. And while the existential threat posed by the pandemic is no longer as acute as it once was, it continues to impact our lives in very real ways, chief among which is the need to be inoculated. This saw vaccines being developed in record speed in 2020 and transform hitherto unknown companies like BioNTech (BNTX US) and Moderna (MRNA US) into household names. As vaccination rates continue to climb globally, and Covid inches closer towards becoming endemic, the total pie for said vaccines will inevitably shrink.

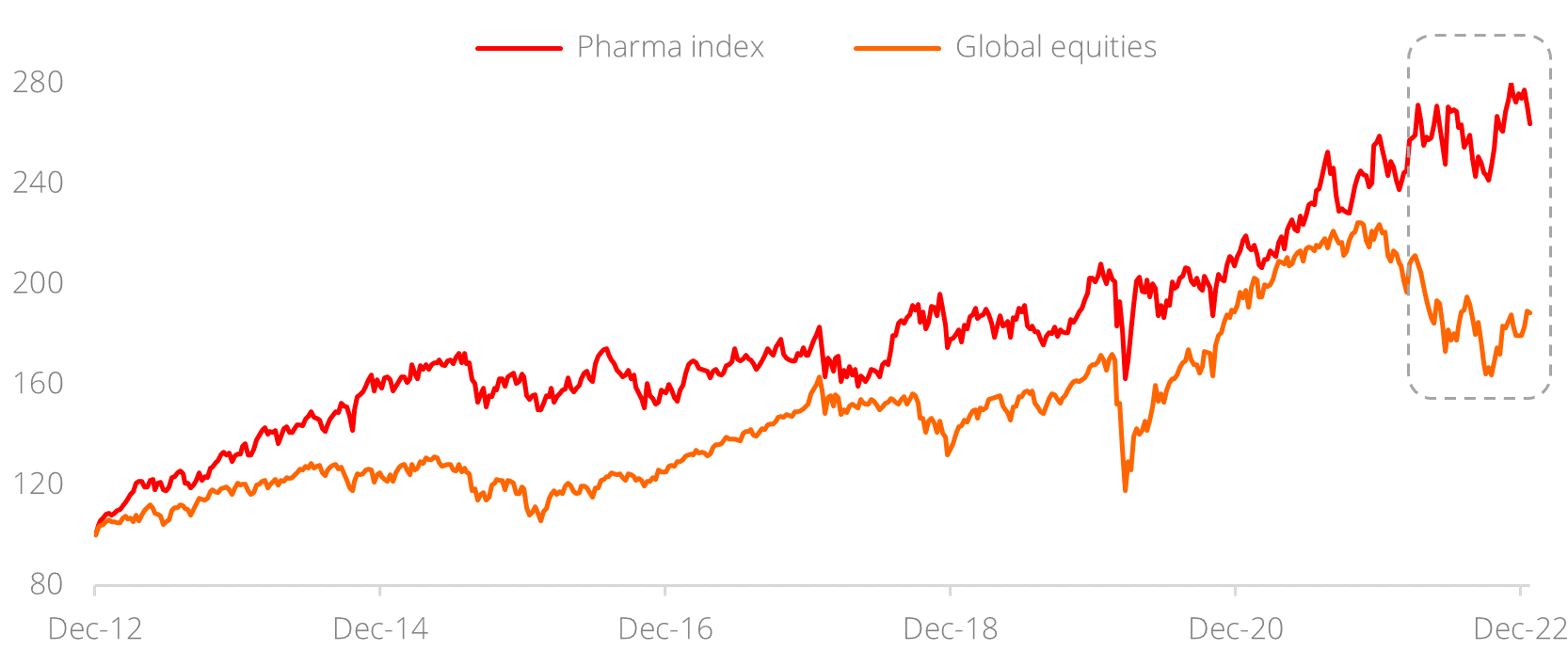

However, that does not mean pharmaceutical companies are seeing the end of the vaccine party. Quite the opposite, vaccine-related revenues are set to increase moving forward with the debut of commercial Covid-19 vaccines, which are expected to cost significantly higher per dose. Additionally, 2023 is likely see the advent of the first messenger-RNA (mRNA) vaccines for Influenza and respiratory syncytial virus (RSV), which will emerge as new revenue streams of existing vaccine makers. Market participants are betting on a big year for vaccine makers and pharmaceutical companies, as evidenced by the stellar performance of the healthcare sector (Figure 1).

Figure 1: Pharmaceutical sector has outperformed global equities in past decade Source: Bloomberg, DBS

Source: Bloomberg, DBS

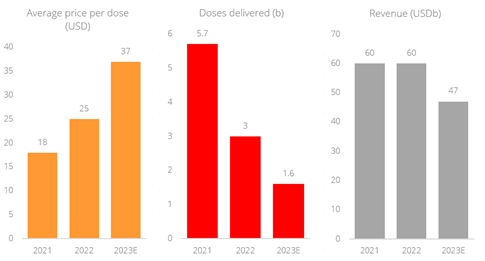

Covid-19 vaccines to go commercial in 2023. Since the onset of the pandemic, vaccine costs have been borne chiefly by governments. However, this is set to change as the market transitions from a public to a private one, welcoming commercial Covid-19 vaccines on board this year. Accordingly, vaccine prices are expected to increase significantly; Pfizer (PFE US) has already stated that it could price its commercial vaccines between USD110 and USD130 per dose, while Moderna expects a price between USD64 and USD100. In comparison, the US government has been paying much lower thus far, approximately USD30 per dose for Pfizer’s vaccine and about USD26 for Moderna’s. While commercial vaccines and their higher prices will not fully offset the reduction in revenue from slowing demand, they will help Covid-19 products remain indispensable to pharmaceutical companies. Pfizer chief executive Albert Bourla expects that their Covid-19 franchise will remain a multibillion dollar recurring revenue generator for the foreseeable future.

Figure 2: Covid-19 vaccine price per dose has increased over time Source: Airfinity forecasts

Source: Airfinity forecasts

mRNA vaccines for RSV and the Flu are gamechangers. Along with Covid-19, two other common viruses that cause respiratory illness are respiratory syncytial virus (RSV) and influenza. RSV in particular, has grown to become the second leading cause of hospitalisations in the US. However, a vaccine was nonexistent, until now. Thanks to breakthroughs in mRNA technology during the development of Covid-19 vaccines, pharmaceutical companies have managed to fast-track the research and development (R&D) process for their RSV vaccine among others. GSK’s (GSK LN) latest RSV vaccine trial results showed an overall efficacy of 82.6% for older adults and adults with comorbidities while Moderna’s version was 83.7% effective in preventing RSV (with two or more symptoms) among elderly patients over 60. Pfizer, which focused their vaccine on pregnant women and their ability to pass on the relevant antibodies to their offspring, also reported a favourable efficacy of c.82%. These and other RSV vaccines are in advanced stages of FDA approval and could potentially add to their respective developers’ revenue stream as early as this year. In addition to RSV, pharmaceutical companies are also developing mRNA-based vaccines for influenza as well. The ultimate goal for these companies will be to develop a combination of vaccines that could form a comprehensive solution against the triple threat of influenza, Covid, and RSV.

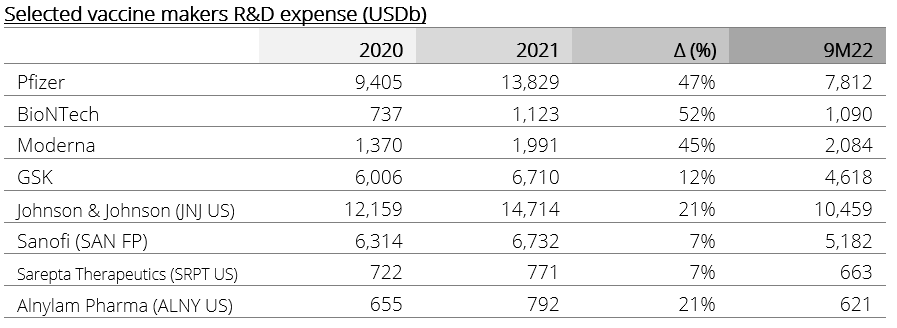

R&D spending to enhance product pipeline and patent arsenal. R&D spending has been the engine of growth for the healthcare sector for decades, and this has been especially true for the past three years. Over the course of the pandemic, vaccine makers sunk prolific amounts of capital into the development of Covid-19 vaccines and subsequent booster shots.

This heavy R&D spending benefitted not just Covid-19-related products but is also quickening the pace of other new product launches; in addition to the RSV and influenza vaccines, Pfizer has announced that it will be introducing 19 products, including five new vaccines in the next 18 months. Moreover, the growing levels of R&D contribute not just to the development of new products, but also to patents, which will in turn protect the long-term revenue of leading pharmaceutical firms.

Table 1: Big Pharma R&D has grown from strength to strength Source: Bloomberg, Company financials

Source: Bloomberg, Company financials

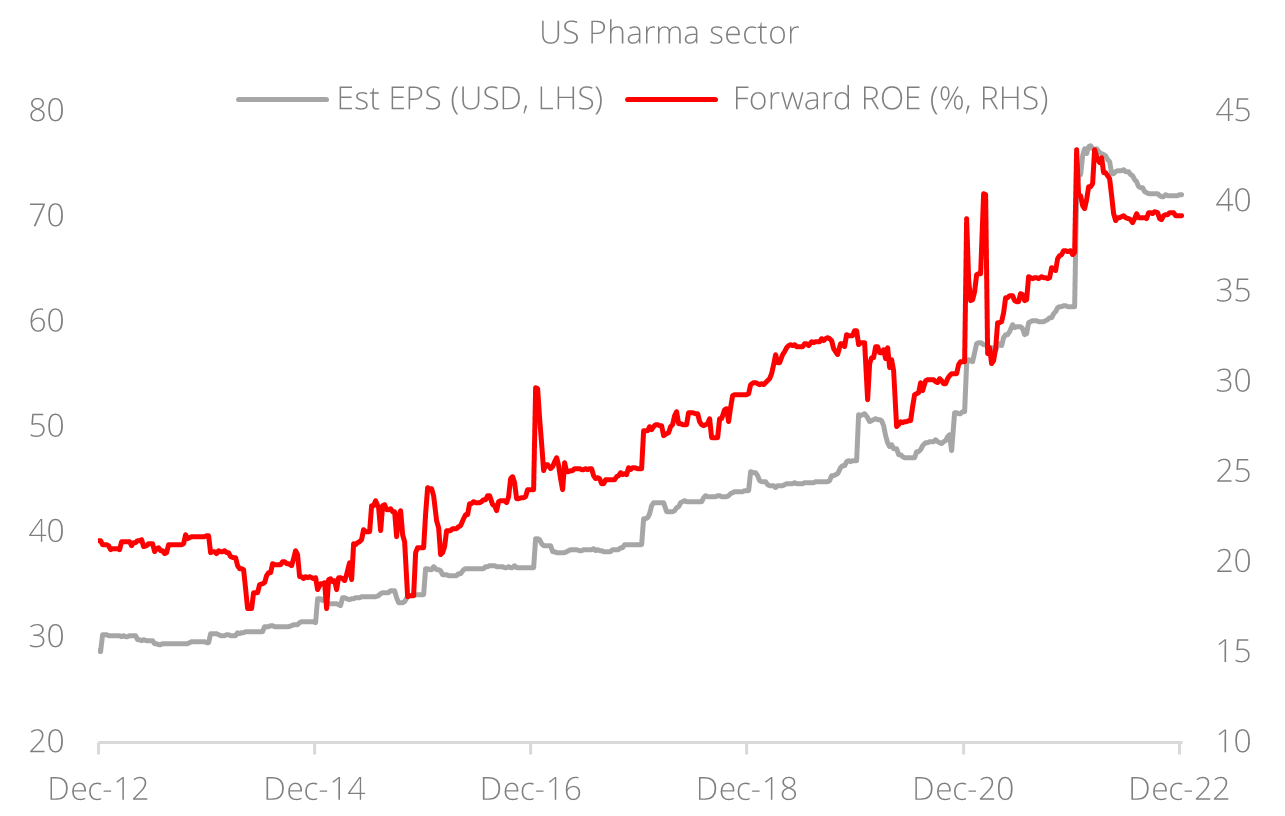

Continue to favour Big Pharma within the healthcare sector. Healthcare remains one of our top investment themes, and within the sector we continue to favour Big Pharma as they:

- Have a globally diversified revenue stream

- Possess the resources and expertise to conduct R&D and ensure patent protection, which will in turn contribute to commercial exclusivity and pricing power

- Have the balance sheet strength to acquire prominent industry peers to ensure a continuous pipeline

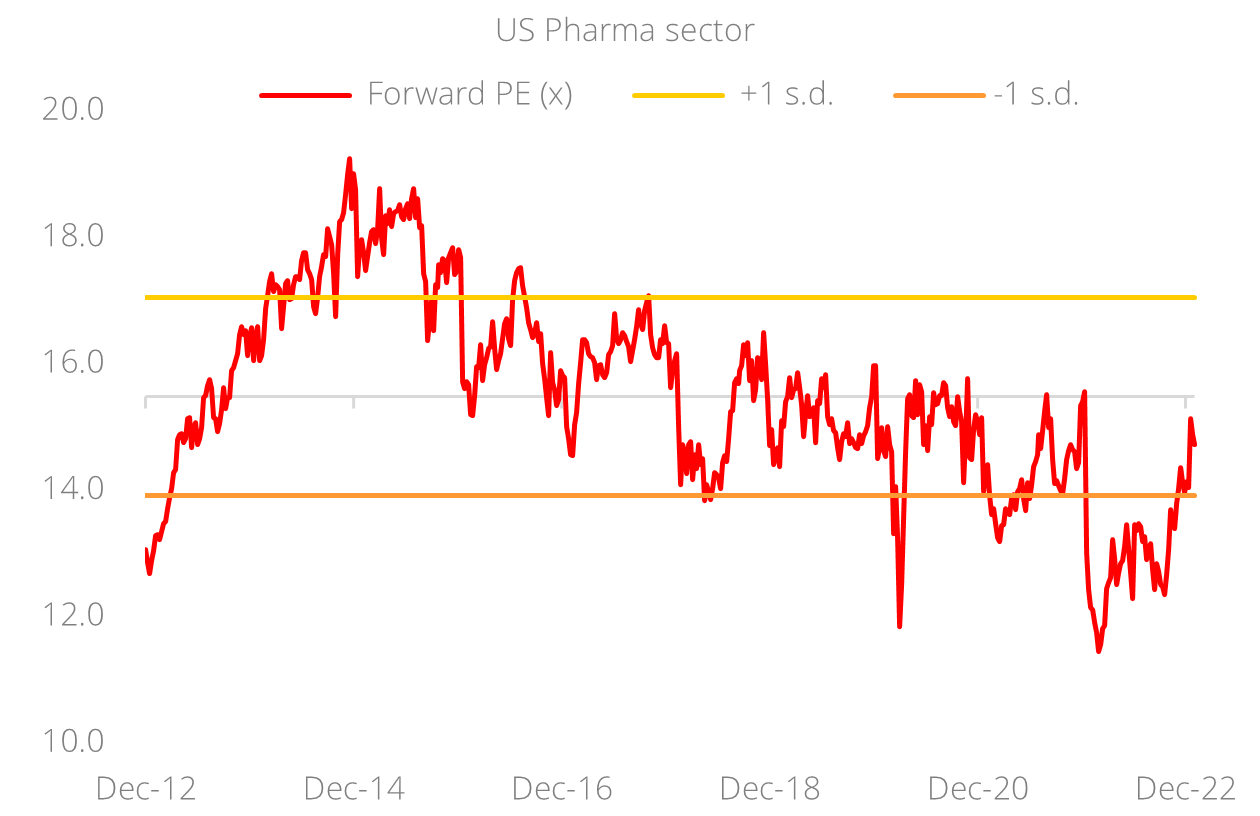

- Are trading at reasonable valuations

In conclusion, big pharma firms will continue to stay ahead of the curve in the markets they operate in due to their financial muscle. Their ability to spend heavily of R&D will help sustain market leadership, and their capacity to make acquisitions to fuel inorganic growth will reinforce the high barriers to entry for competitors. This will further perpetuate their industry-leading product portfolios and patents, and protect their market share at a global scale. With vaccine products on the uptrend and a strong pipeline in the making, healthcare sector leaders will have one more ace up their sleeve that will ensure the ‘defensive-growth’ characteristic that investors have come to know and love.

Figure 3: Sector has shown resilient earnings and ROE… Source: Bloomberg, Company financials

Source: Bloomberg, Company financials

Figure 4: … and is trading at reasonable valuations Source: Bloomberg, Company financials

Source: Bloomberg, Company financials

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.