- US: May inflation data that came in flat m/m should give Fed comfort on the inflation picture; We believe that two cuts are still on the table for 2024

- China: Greater Bay Area boasts a deep-rooted innovative culture, hosting China's top tech firms and over 75,000 high-tech enterprises in AI, 5G, and IOT, supported by significant R&D investments and a robust talent pool

- Thailand: Improving economy supported by domestic demand, foreign tourism, and goods exports; BOT kept rate steady at 2.5%

Related insights

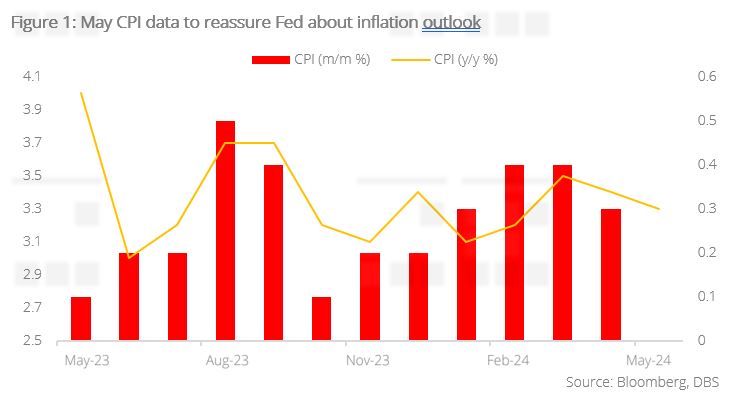

US: Fed tilts hawkish; we still anticipate two cuts in 2024. Back in their March meeting, the Federal Open Market Committee’s (FOMC) members were almost evenly split between two and three rate cuts, slightly tilting toward three. In their June meeting, they remained close to evenly split between one and two cuts, this time tilting marginally towards one. Revising up end 2024 core inflation forecast by 20 bps to 2.8%, they signalled slower-than-anticipated progress towards the 2% inflation target. However, May inflation data (CPI was flat m/m) released the same day as the FOMC meeting should give some comfort to the inflation picture. Fed Chair Powell, in his press conference, saw the latest data positively but stressed that more progress needed to be seen.

By the time the September policy meeting takes place, we believe there will be plenty of data available for FOMC members to see that inflation worries have abated largely; From manufacturers’ input price to insurance costs, rentals to medical services, as well pump price of gasoline, there is room for a stable or receding inflation outcome in the coming months. In this scenario, a September cut could be readily followed by one in December.

We concede that the two rate cuts scenario is not materially more likely than the one-cut scenario. In fact, at the tail end of the probability distribution looms a no-cut scenario, taking into account the possibility that soaring asset prices could spill over into consumer prices, along with a still-strong labour market.

When the rate cut comes, it will not be one reflecting great worries about jobs or financial stability, but rather one aimed at keeping real interest rates stable. It could therefore signal a shallow rate cut cycle through 2025, something the markets would have to reckon with eventually. For now, the key issue is the timing of the first cut in this cycle - we maintain our stance on September.

Download the PDF to read the full report which includes coverage on Credit, FX, Rates, and Thematics.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.