- Global: Weak US economic data underscore moderating consumer sentiment ahead of next week’s FOMC; ECB cuts rates for the first time in five years

- China: Property sector woes remain an overhang on China’s economy, but steady policy rate cuts and liquidity injection measures are helping gradually

- India: Expect policy continuity with the incumbent NDA coalition’s victory in the general elections; 1Q24 real GDP growth rose 7.8% y/y, exceeding expectations

- Taiwan: 1Q GDP growth accelerated to 6.6% y/y, supported by surge in net exports and steady growth in private consumption

Related insights

Global: The Federal Reserve’s narrative to be patient on interest rate cuts has become more bark than bite without the backing of US data. Job Openings and Labor Turnover Survey (JOLTS) job openings fell to 8,059k in April, weaker than the 8,350k consensus, while March’s figure was revised down to 8,355k from 8,488k. The US’ manufacturing sector weakened further in May, with the ISM Manufacturing Index falling from 49.2 in April to 48.7 in May.

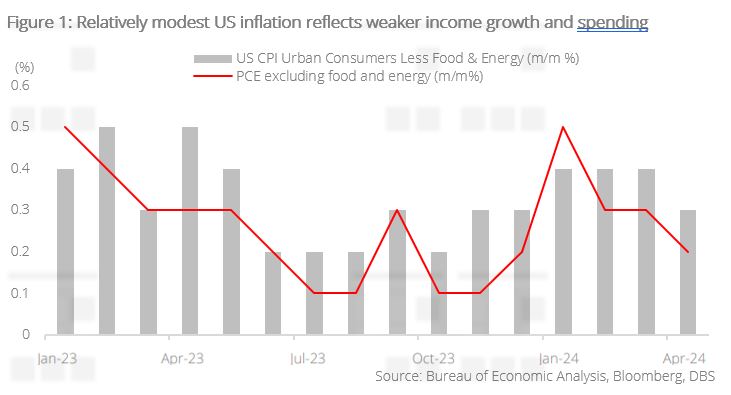

PCE and core PCE inflation, the preferred inflation measures of the Fed, stalled at 2.7% y/y and 2.8% in April respectively. On a sequential basis, core PCE moderated from 0.3% m/m to 0.2%. The relatively modest inflation was underpinned by slower personal income growth. This points to a more balanced labour market condition. Against this backdrop, personal spending growth eased from 0.8% to 0.2%.

Last week’s downward revision of 1Q GDP figure (from 1.6% q/q saar to 1.3%) further attests to moderating consumer sentiment. With the US economy moving from exceptional growth towards a soft landing, the Fed will expect inflation to cool in 2H24. At next week’s Federal Open Market Committee (FOMC) meeting on 12 June, Fed Chair Jerome Powell may warn again that the US is on an unsustainable fiscal path arising from its mounting debt.

The European Central Bank (ECB) announced its first interest rate cut since 2019, cutting its deposit rate from a record-high 4% to 3.75%. The ECB cited progress in tackling inflation even as it acknowledged that inflation is likely to stay above target well into next year – core inflation increased to 2.9% in May vs. the consensus for it to stay unchanged at April’s 2.7%. We expect policy to remain restrictive for the rest of the year to get inflation to the 2% target. Meanwhile, other global central banks have aligned with the Fed’s cautious stance to get inflation back to target, by delaying and reducing the number of interest rate cuts this year.

Download the PDF to read the full report which includes coverage on Credit, FX, Rates, and Thematics.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.