- Equities: Worries over higher-for-longer rates negatively impacted global stock markets

- Credit: Strong US households imply that the mortgage market is healthy despite widening spreads. MBS a unique opportunity for government-backed yields

- FX: Stay vigilant of downside risks in the USD in June; EUR/USD to break above 1.08-1.09 range if ECB delivers hawkish interest rate cut at 6 June meeting

- Rates: Steepening for US 2Y/10Y curve is still at play; Expect ongoing steepening of CGB curve alongside commencement of CNY1tn ultra-long special sovereign bond issuance

- The Week Ahead: Keep a lookout for US Change in Nonfarm Payrolls; China Trade Balance

Related insights

Hawkish Fed rhetoric affected global equity markets. The Dow Jones, S&P 500, and the NASDAQ dropped 1.0%, 0.5%, and 1.1%, respectively for the week. Technology stocks did not perform well, while US 10Y Treasuries hit a recent high. Even though inflation data was in line with market expectations, hawkish comments from US Minneapolis Federal Reserve (Fed) President Neel Kashkari cast a pall over markets. Higher-than-expected inflation in Europe also dragged markets lower. The Stoxx 600 and the FTSE both retreated 0.5% for the week. The Nikkei 225 dropped 0.4% amid news that Japan’s industrial output fell in April. The HSI fell 2.8%, but Hong Kong markets might have retraced due to profit taking after the sharp increase in the beginning of the month. The SHCOMP dipped 0.1% as China’s PMI fell to 49.5 in May.

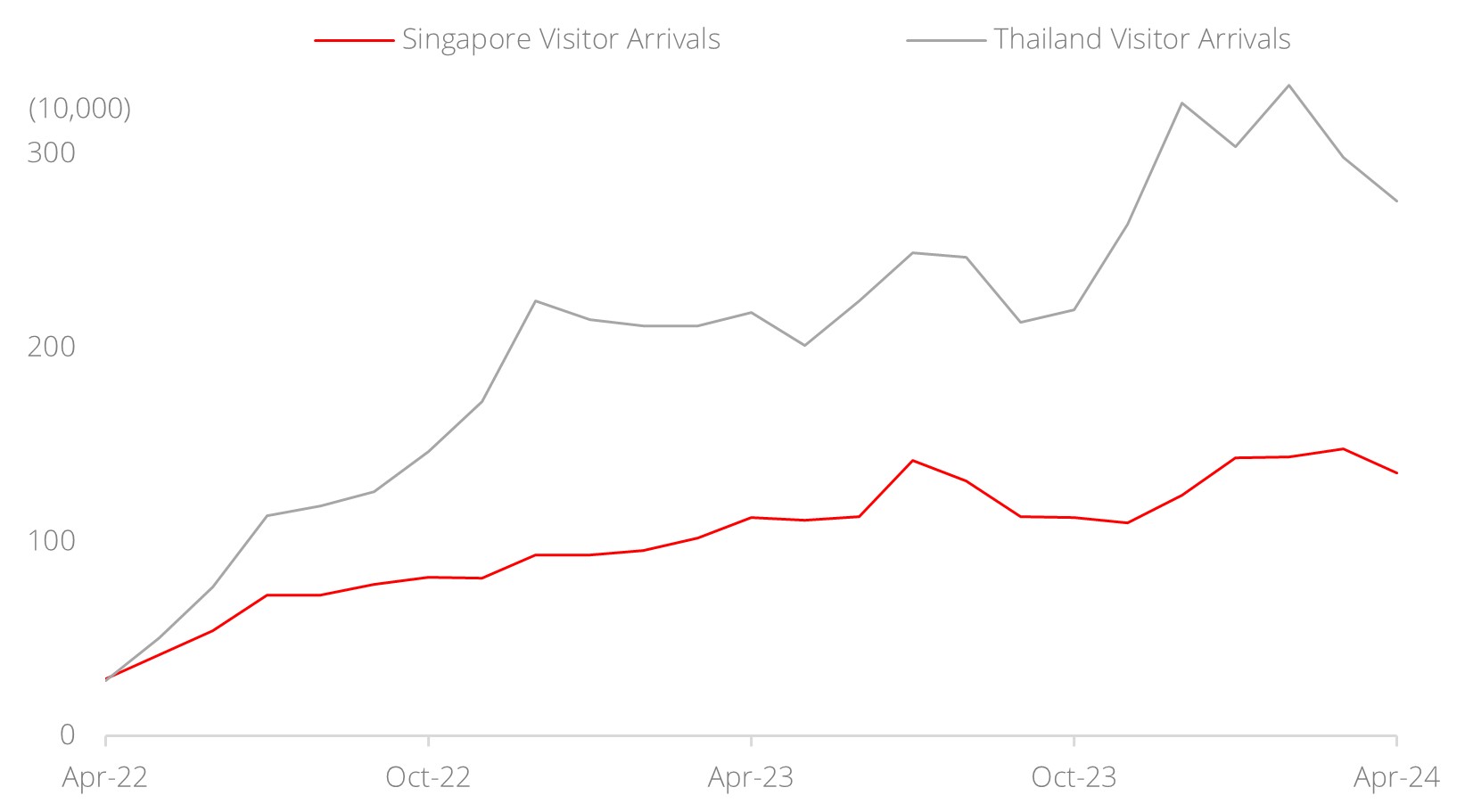

Topic in focus: ASEAN – A growth engine for the global economy. ASEAN's economic recovery is expected to continue in 2024, underpinned by resilient domestic demand and the easing of supply chain disruptions. While monitoring China's growth is prudent given its links with the region, ASEAN's growth outlook remains positive, supported by trade-oriented economies, recovery in the electronics cycle, and tailwinds from travel and tourism. The robust 4.7% GDP growth forecast and bottoming exports provide fundamental support. Urbanisation, demographics, and integration tailwinds also bode well for businesses expanding in ASEAN, cementing its status as a major global growth engine. Longer-term, we see opportunities in supply chain reconfiguration beneficiaries and critical infrastructure providers, particularly for commodities and steel.

Key investment themes include consumer and telecom sectors in Indonesia; Thailand's tourism and industrial names that will benefit from the visa waiver and resurgence in FDI applications; and Singapore banks, as well as retail and hospitality REITs benefitting from events. Bright spots also include Malaysia's construction industry and Vietnam’s potential re-rating due to rapid growth, low urbanisation, and possible index inclusion.

Figure 1: Tourism trends in ASEAN are on the rise

Download the PDF to read the full report which includes coverage on Credit, FX, Rates, and Thematics.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.