- Equities: US equities hit record highs on the Fed's rate cut and strong data; Japanese and Chinese markets also gained, boosted by the Fed's decision despite weaker economic indicators

- Credit: The materialisation of Fed rate cuts is opportune for deploying cash to credit and securing against cash reinvestment risk

- FX: DXY to depreciate into 95-100 range through 2025 amid Fed’s rate cutting cycle; US Presidential elections on 5 Nov not expected to support the greenback

- Rates: Current backdrop benign for Asia local currency govvies; tailwinds for IndoGBs amid BI monetary easing and weak USD

- The Week Ahead: Keep a lookout for US Change in FOMC Rate Decision; Japan BOJ Target Rate

相關見解

- 日圓逆轉弱勢25 Sep 2024

- 每周外匯速遞 - 風險情緒高漲 英鎊澳元走強23 Sep 2024

- Multi-Asset Weekly: US Equities Dip Amid Volatile Market Conditions20 Sep 2024

US equities reached all-time highs amid Fed cut and strong economic data. US equities surged to record highs as markets reacted to the Fed’s decision to cut interest rates by 50 bps, marking the first rate cut since Mar 2020. The rate cut came amid mixed sentiment with some critics arguing that the Fed acted too aggressively, given the strong economic data. Retail sales came in better than expected (0.1% vs -0.2% consensus), while initial jobless claims fell to its lowest in three months, signalling consumer strength. The S&P 500 and Dow Jones gained 1.4% and 1.6% respectively with both closing at new all-time highs.

Over in Asia, Japanese equities rose; Nikkei 225 was up 3.1% as the combination of a weaker yen, Fed’s rate cut, and BOJ’s decision to hold rates steady supported equities. Chinese equities were also up over the week with the SHCOMP and Hang Seng up 1.2% and 5.1% respectively, driven largely by the Fed’s rate cut. However, domestic economic data remained weak with August industrial production falling below expectations and retail sales showing signs of slowing.

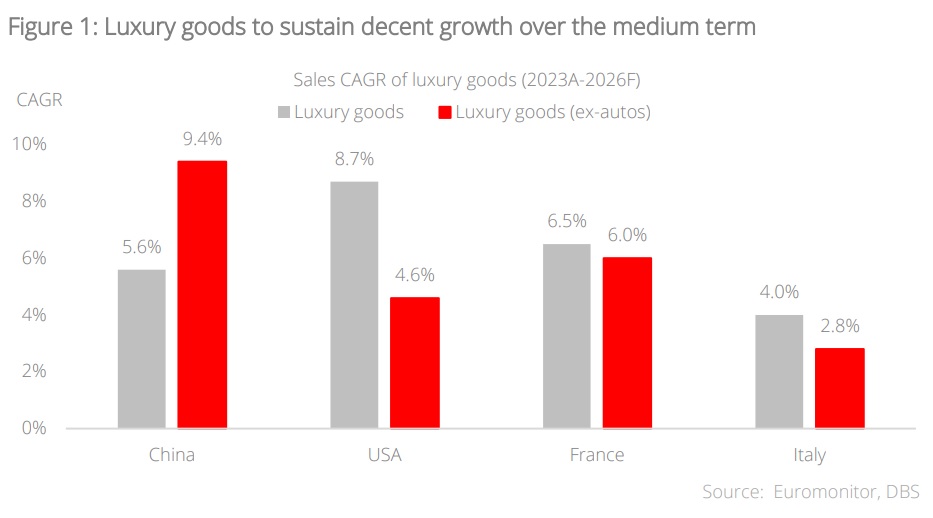

Topic in focus: Evolving luxuries. Following a strong rebound in 2021-22, the global luxury sector is grappling with challenges from slowing economic growth and dampened consumer spending. Last year saw a slowdown across Europe and the US, while China’s initially strong performance decelerated in the second half, leading to slowing sales and an uneven performance. McKinsey forecasts the sector to grow by 3–5% this year, down from 5–7% in 2023. A 2024 survey by PwC suggests that shoppers are shunning luxury items in favour of essentials; about 40% of respondents anticipate that they will be spending less or nothing at all on luxury goods over the next six months.

Still, we believe pockets of growth exist. Markets such as Japan are emerging as new growth areas; Savills’ Global Luxury Retail 2024 Outlook shows that while new store openings fell 12% in China, the wider Asia Pacific region reported an increase in new store activity. Tokyo and Singapore were key behind this increase, helped by a pick-up in tourism and a weak yen. During China’s eight-day Golden Week holiday in October last year, Hainan emerged as a top hotspot for tax-free shopping, highlighting opportunities in strong domestic travel. We maintain luxury as a long-term structural growth sector; in particular, widening income gaps will highlight less price-sensitive and more exclusive, experiential-driven demand. As the industry continues to be challenged by near-term headwinds, stay with quiet luxury brands that can adapt to changing preferences and are able to maintain a connection beyond material satisfaction, thereby becoming more resilient against economic downturns.

Download the PDF to read the full report which includes coverage on Credit, FX, Rates, and Thematics.

本資訊是由星展銀行集團公司(公司註冊號: 196800306E)(以下簡稱“星展銀行”)發佈僅供參考。其所依據的資訊或意見搜集自據信可靠之來源,但未經星展銀行、其關係企業、關聯公司及聯屬公司(統稱“星展集團”獨立核實,在法律允許的最大範圍內,星展集團針對本資訊的準確性、完整性、時效性或者正確性不作任何聲明或保證(含明示或暗示)。本資訊所含的意見和預期內容可能隨時更改,恕不另行通知。本資訊的發佈和散佈不構成也不意味著星展集團對資訊中出現的任何個人、實體、服務或產品表示任何形式的認可。以往的任何業績、推斷、預測或結果模擬並不必然代表任何投資或證券的未來或可能實現的業績。外匯交易蘊含風險。您應該瞭解外匯匯率的波動可能會給您帶來損失。必要或適當時,您應該徵求自己的獨立的財務、稅務或法律顧問的意見或進行此類獨立調查。

本資訊的發佈不是也不構成任何認購或達成任何交易之要約、推薦、邀請或招攬的一部分;在以下情況下,本資訊亦非邀請公眾認購或達成任何交易,也不允許向公眾提出認購或達成任何交易之要約,也不應被如此看待:例如在所在司法轄區或國家/地區,此類要約、推薦、邀請或招攬係未經授權;向目標物件進行此類要約、推薦、邀請或招攬係不合法;進行此類要約、推薦、邀請或招攬係違反法律法規;或在此類司法轄區或國家/地區星展集團需要滿足任何註冊規定。本資訊、資訊中描述或出現的服務或產品不專門用於或專門針對任何特定司法轄區的公眾。

本資訊是星展銀行的財產,受適用的相關智慧財產權法保護。本資訊不允許以任何方式(包括電子、印刷或者現在已知或以後開發的其他媒介)進行複製、傳輸、出售、散佈、出版、廣播、傳閱、修改、傳播或商業開發。

星展集團及其相關的董事、管理人員和/或員工可能對所提及證券擁有部位或其他利益,也可能進行交易,且可能向其中所提及的任何個人或實體提供或尋求提供經紀、投資銀行和其他銀行或金融服務。

在法律允許的最大範圍內,星展集團不對因任何依賴和/或使用本資訊(包括任何錯誤、遺漏或錯誤陳述、疏忽或其他問題)或進一步溝通產生的任何種類的任何損失或損害(包括直接、特殊、間接、後果性、附帶或利潤損失)承擔責任,即使星展集團已被告知存在損失可能性也是如此。

若散佈或使用本資訊違反任何司法轄區或國家/地區的法律或法規,則本資訊不得為任何人或實體在該司法轄區或國家/地區散佈或使用。本資訊由 (a) 星展銀行集團公司在新加坡;(b) 星展銀行(中國)有限公司在中國大陸;(c) 星展銀行(香港)有限責任公司在中國香港[DBS CY1] ;(d) 星展(台灣)商業銀行股份有限公司在台灣;(e) PT DBS Indonesia 在印尼;以及 (f) DBS Bank Ltd, Mumbai Branch 在印度散佈。

相關見解

- 日圓逆轉弱勢25 Sep 2024

- 每周外匯速遞 - 風險情緒高漲 英鎊澳元走強23 Sep 2024

- Multi-Asset Weekly: US Equities Dip Amid Volatile Market Conditions20 Sep 2024

相關見解

- 日圓逆轉弱勢25 Sep 2024

- 每周外匯速遞 - 風險情緒高漲 英鎊澳元走強23 Sep 2024

- Multi-Asset Weekly: US Equities Dip Amid Volatile Market Conditions20 Sep 2024