- Treasury

- Interest Rates

- Cross-Currency Swaps

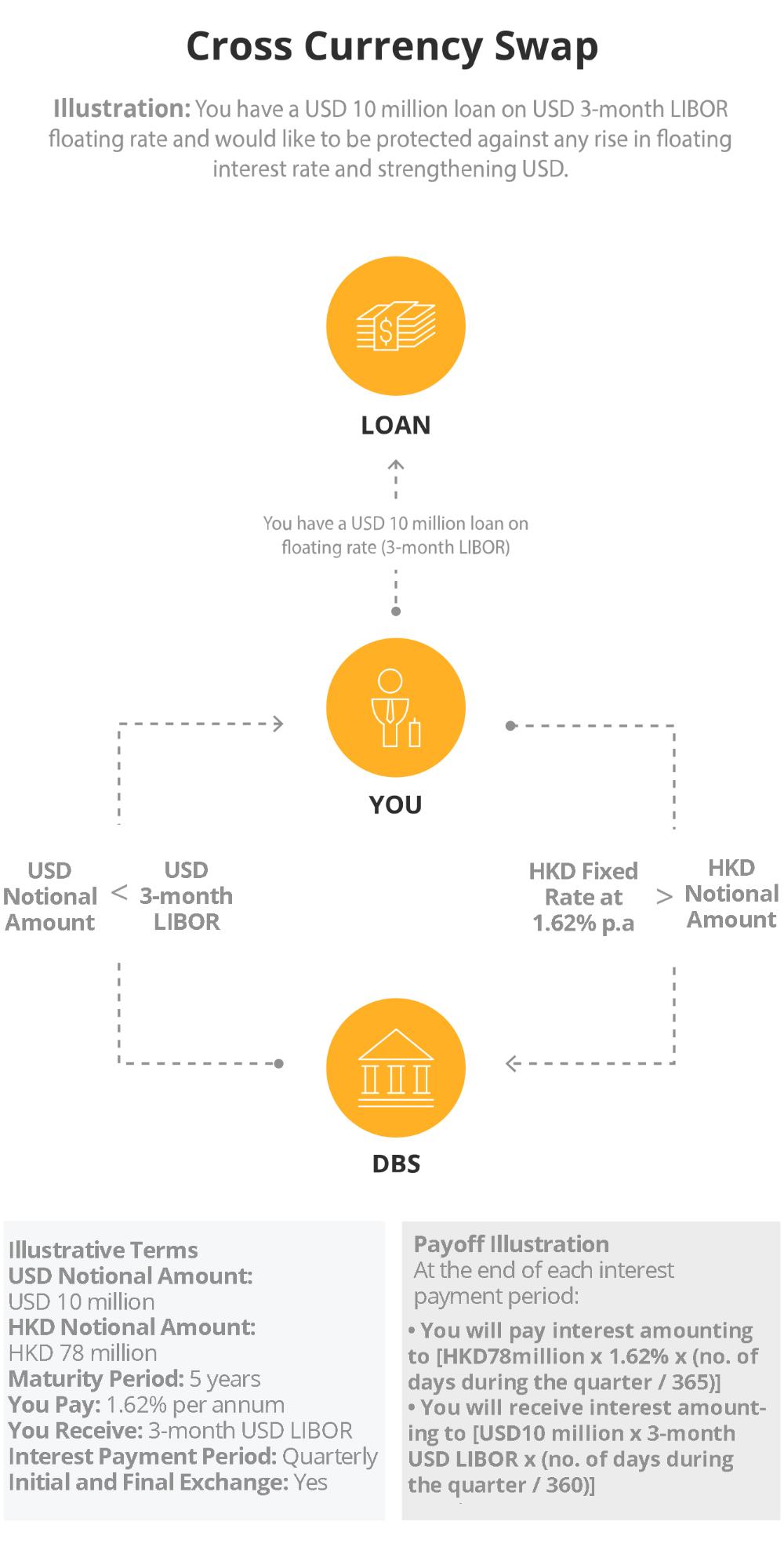

Cross-Currency Swaps

Hedge against currency and interest rate exposures

- Treasury

- Interest Rates

- Cross-Currency Swaps

Cross-Currency Swaps

Hedge against currency and interest rate exposures

Customisation

Cross-currency swaps can be customised to address your needs of both currency and interest rates risks

Competitive pricing

Enjoy the benefits of our market leader position and extensive network

Leverage our expertise

Identify and hedge against market volatility with our dedicated corporate advisory team

Certainty in volatility

Cross-currency swaps allow you to manage market volatility by fixing currency exchange rates and interest rates; business decisions can then be made with certainty

Take advantage of market dynamics

Cross-currency swaps allow you to take advantage of cross currency and interest rates dynamics. This may be especially useful for cross border transactions

You can choose to pay in a different currency on either a fixed or floating rate.

Please contact your relationship manager or Call DBS BusinessCare at 2290 8068 and we will arrange a product specialist to speak to you.

That's great to hear. Anything you'd like to add?

We're sorry to hear that. How can we do better?