For existing DBS business customers with DBS IDEAL access:

Step 1: Log in to DBS IDEAL using your company’s Organization ID, User ID, and PIN.

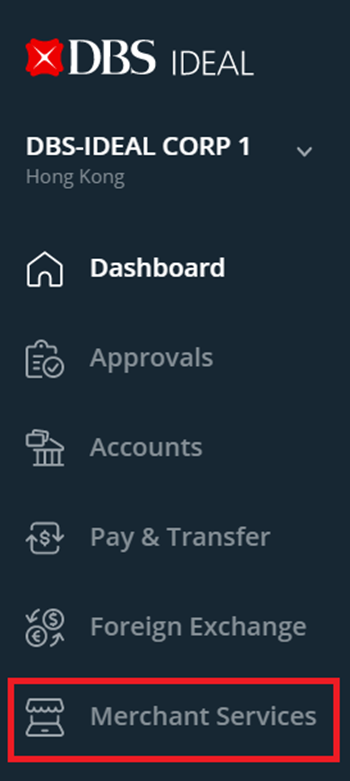

Step 2: Click on ‘Merchant Services’ to enter DBS MAX Merchant Services Portal.

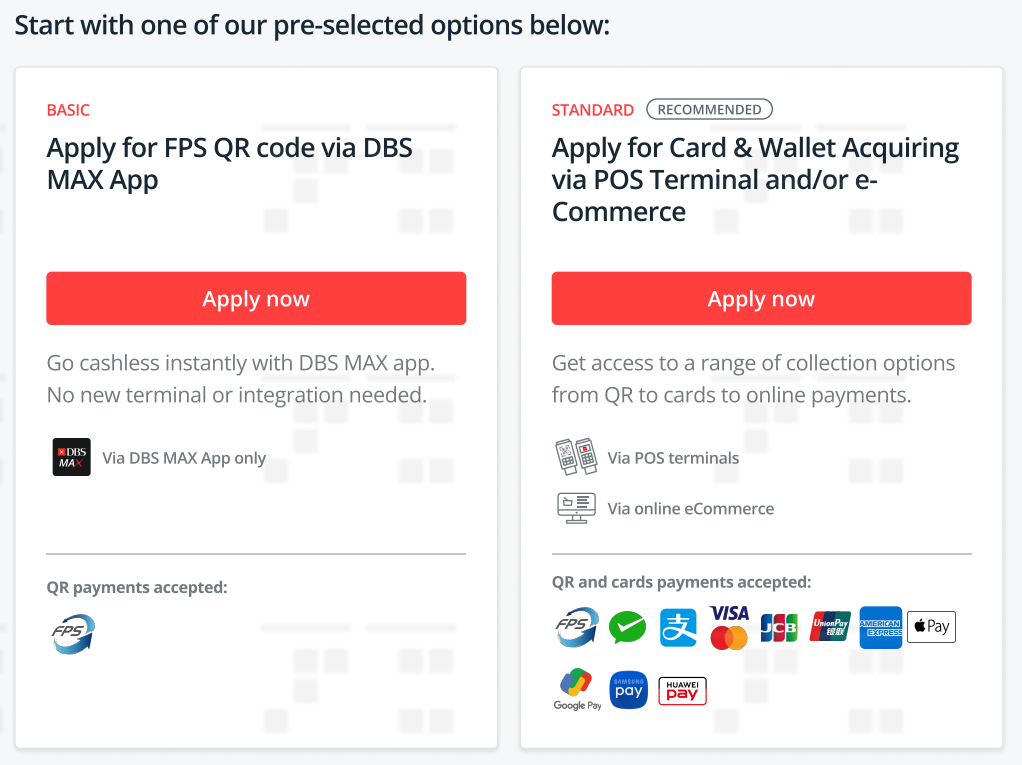

Step 3: Apply for FPS and/or international credit / debit card and wallet schemes* for collections.

Contact us now to get started with DBS MAX Merchant Solutions!

Note: You will need to be a DBS IDEAL authoriser to be able to register for DBS MAX Merchant Solutions. DBS MAX Portal is currently available on Google Chrome and Internet Explorer desktop browsers only.

New to DBS?

Open your account via ‘DBS Online Account Opening for Business’ and sign up for DBS IDEAL. Want to learn more about DBS MAX Merchant Solutions? Contact us to find out more!

* DBS Bank (Hong Kong) Limited (“The Bank”) is the provider for payment collections via Faster Payment System (“FPS”) while the other payment collection methods under DBS MAX Merchant Solutions are provided by third-party service providers. The Bank is not liable for the services/products provided by the third-party service providers. Click here for the full disclaimer of the service.

That's great to hear. Anything you'd like to add?

We're sorry to hear that. How can we do better?