Related insights

- Global Credit 1Q25 – Making Bonds Great Again23 Dec 2024

- Alternatives 1Q25: Gold – Resilience with Alternatives20 Dec 2024

- CIO Insights 1Q25: Game Changers20 Dec 2024

Profit-taking sent the USD and US bond yields lower before the long Thanksgiving holiday starting today.US stock and bond markets will be closed on Thursday and Friday before returning on Monday.

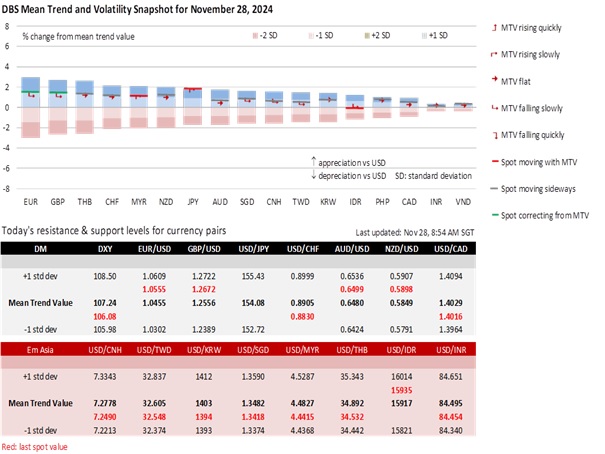

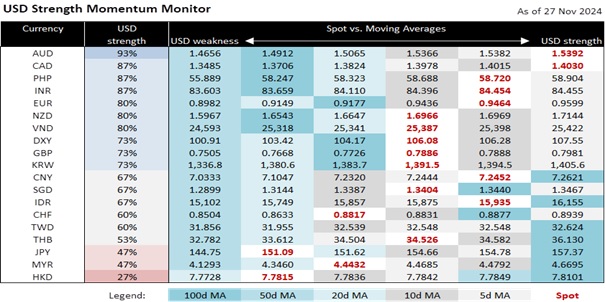

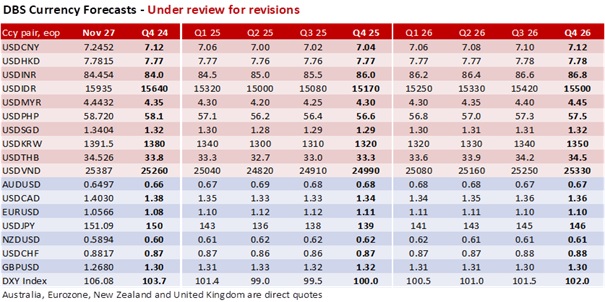

The DXY Index fell a second time in three days by 0.9% to 106, its lowest close since November 11. US inflation data met expectations; October’s PCE headline and core inflation were unchanged at 0.2% MoM and 0.3%, respectively, the same level as a month ago. The futures market increased the probability (66.5% vs. 52.3% a week ago) of the Fed lowering rates by 25 bps to 4.00-4.25% at its FOMC meeting on December 18.The US Treasury 2Y yield fell a third session by 2.9 bps to 4.23%, its lowest close since November 7. The 10Y yield ended November at 4.26%, near the month’s low of 4.22% seen on November 1. US fiscal sustainability worries ebbed after Trump nominated prominent hedge fund manager Steve Bessent as US Treasury Secretary.

With US bond yields near this month’s lows, most currencies in the DXY basket appreciated in the first three days of the week. The JPY outperformed with a 2.4% rally to 151 per USD, recovering all its losses after the November 5 US elections. JPY sellers retreated on fears of a hawkish tilt at the Bank of Japan meeting on December 19. BOJ Governor Kazuo Ueda said the committee would “seriously” assess the impact of the weak JPY on inflation and the economy while Prime Minister Shigeru Ishiba pushed for significant wage increases at the shunto negotiations next spring.

The European currencies regained their composure. EUR/USD appreciated 1.4% to 1.0566 after hitting the year’s low of 1.0418 last Friday. European Central Bank board member Isabel Schnabel narrowed the gap with the Fed by pushing back dovish rate cut bets in the Eurozone. EU CPI inflation returned to the 2% target in October after a brief dip to 1.7% YoY in September, with core inflation remaining high at 2.7%. Eurozone recession fears were not validated by GDP growth which improved to 0.4% QoQ sa in 3Q24 from 0.2% in 2Q24. GBP/USD recovered to 1.2680 after failing to break below 1.25 in the past three sessions. Bank of England officials did not signal another cut in December after its 25 bps cut to 4.75% on November 7.

We are guarded against the complacency that financial markets are exhibiting regarding Trump’s transactional approach to his aggressive trade policies. The CAD and MXN have been weaker by 0.4% and 0.8% since last Friday, a sign not to underestimate Trump’s tariff threats widening trade conflicts. Responding to Trump’s plans to impose 25% tariffs on all Canadian and Mexican goods entering America, Mexico has threatened to retaliate with its own tariffs, with Canada reportedly examining the same response. While markets have cheered Bessent’s nomination, Trump has filled key cabinet positions with China hawks. With Trump’s inauguration still six weeks away on January 20, 2025, Trump’s tariff threats are potentially a strategic move to evaluate the reactions of domestic and international stakeholders before actual policy formulation and implementation. We remain vigilant against more volatility, mindful that Trump is also unpredictable.

Quote of the Day

“I always tried to be correct, not politically correct.”

Lee Kuan Yew

November 28 in history

Lee Kuan Yew resigned in 1990, ending his term as Singapore’s longest-serving prime minister.

Topic

GENERAL DISCLOSURE/ DISCLAIMER (For Macroeconomics, Currencies, Interest Rates)

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

[#for Distribution in Singapore] This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 11th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.

Related insights

- Global Credit 1Q25 – Making Bonds Great Again23 Dec 2024

- Alternatives 1Q25: Gold – Resilience with Alternatives20 Dec 2024

- CIO Insights 1Q25: Game Changers20 Dec 2024

Related insights

- Global Credit 1Q25 – Making Bonds Great Again23 Dec 2024

- Alternatives 1Q25: Gold – Resilience with Alternatives20 Dec 2024

- CIO Insights 1Q25: Game Changers20 Dec 2024