- Global sports apparel industry to sustain 5.9% CAGR in 2023-28

- Consumer behaviours shift towards value-conscious, personalised shopping experiences

- "Silver generation" emerges as new growth engine

- Incumbent-challenger rivalry demands more diversification, partnerships, and innovation

- Chinese sports apparel brands showing greater resilience, well-poised to benefit from government support

Related insights

- DEER: USD gains on tariff risks, SNB rate cut could weigh on CHF 10 Dec 2024

- Research Library10 Dec 2024

- India rates: New RBI Governor named as incumbent’s term ends 10 Dec 2024

Firm industry growth. The global sports apparel industry is set to enter 2025 with stabilising revenue expansion estimated in the mid-single digits. Non-luxury segments are expected to drive growth as rising inflation, lingering geopolitical tensions, and subdued consumer sentiment prompt shoppers to gravitate toward value-driven options. At the same time, shifting consumer behaviors, marked by a preference for personalised products, value-conscious choices, and unique shopping experiences continue to reshape the industry’s landscape.

While young consumers remain the key demand driver, the emerging influence of the silver generation (i.e. the over-50 demographic) has prompted brands to cater to their preferences. To capitalise on these evolving opportunities, industry players must prioritise innovative product differentiation, agile operational models, and cultural resonance. Such strategies will help mitigate inventory challenges and maintain competitiveness in a crowded marketplace.

The rise of challenger brands. Established players in the sports apparel industry are facing mounting competition from challenger brands like Lululemon, ON, and Hoka. While these relatively newer entrants have started to see gradual normalisation in growth after the initial rapid expansion, they have distinguished themselves through visible product innovation, a focus on specialised sports categories, and strategic marketing initiatives.

Incumbent brands like Nike and Adidas must adapt by diversifying their offerings and fostering more authentic partnerships with athletes and celebrities to maintain relevance. Striking the right balance between direct-to-consumer and wholesale channels will be critical to enhancing brand presence and customer engagement. Moreover, continued investment in innovation, targeted marketing, and consumer relationships will be essential for legacy brands to retain their competitive edge.

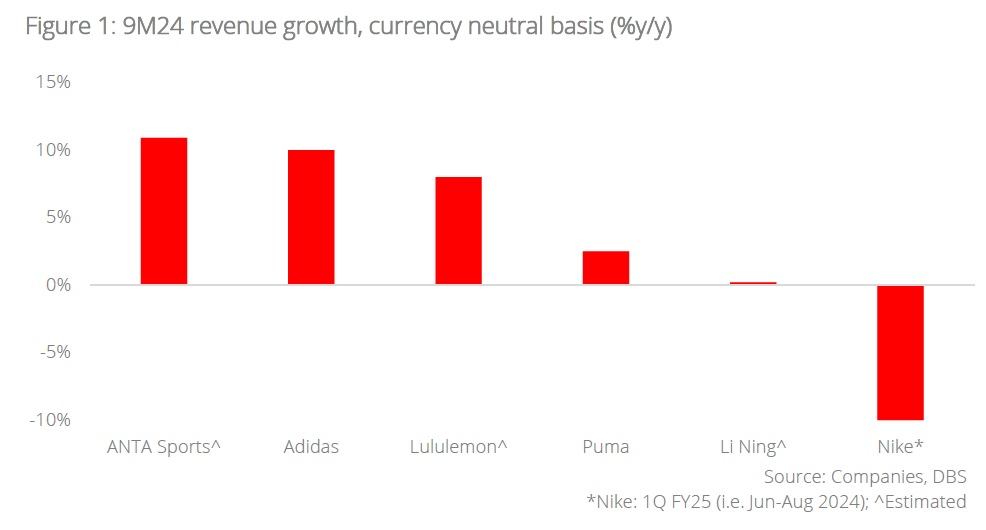

Bolstering resilience. While top players like Nike, Adidas, and Puma have experienced mixed results in recent year, Chinese sports apparel brands have shown agility in responding to shifting consumer demands. They are also poised to benefit from the government's latest stimulus plans, as well as its goal of expanding the Chinese sports industry to CNY5tn by 2025 (2022: CNYB3.3tn). To navigate the volatility, key players continue to reduce excess stock and steer towards healthier inventory levels. These efforts position them well for better growth prospects as market conditions stabilise.

Overall, with the global sports apparel industry expecting to sustain decent CAGR of 5.9% in 2023-28, brands that can improve their resilience and responsiveness to market changes are likely to emerge as industry outperformers.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.

Related insights

- DEER: USD gains on tariff risks, SNB rate cut could weigh on CHF 10 Dec 2024

- Research Library10 Dec 2024

- India rates: New RBI Governor named as incumbent’s term ends 10 Dec 2024

Related insights

- DEER: USD gains on tariff risks, SNB rate cut could weigh on CHF 10 Dec 2024

- Research Library10 Dec 2024

- India rates: New RBI Governor named as incumbent’s term ends 10 Dec 2024