- US: Inflation holds steady; FOMC minutes show support for gradual rate cuts amid a resilient US economy

- Hong Kong: Growth recovers to pre-pandemic levels but outlook remains gloomy, given China’s slowdown and corporate weakness

- Singapore: Resilient growth on the back of global tech and electronics upcycle; expect steady expansion in external-oriented sectors

- Taiwan: Export growth expected to decelerate but remain in expansionary mode in 2025; tariffs under Trump 2.0 to have significant impact

Related insights

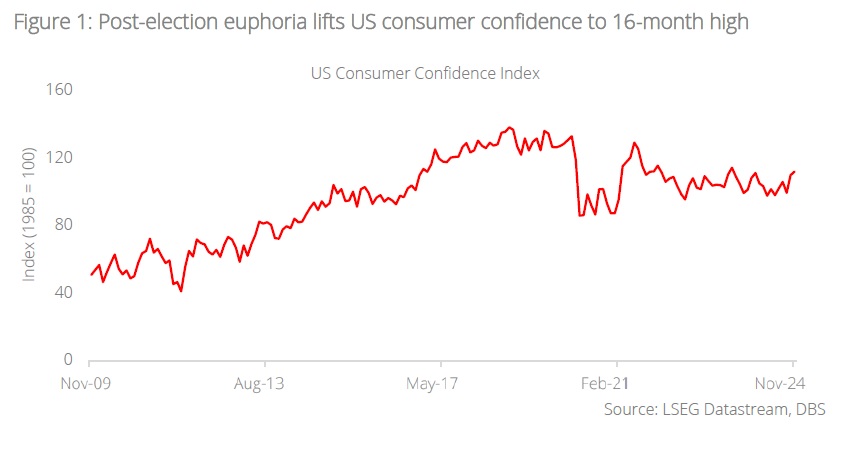

US: “Trump Trade” buoys consumer confidence. US inflation data met expectations; October’s PCE headline and core inflation were unchanged at 0.2% m/m and 0.3% respectively, at the same level as a month ago. The futures market increased the probability (66.5% vs 52.3% a week ago) of the Fed lowering rates by 25 bps to 4.00-4.25% at its Federal Open Market Committee (FOMC) meeting on 18 Dec. The FOMC minutes for the 6-7 Nov meeting showed broader support for a gradual pace of rate cuts because of greater uncertainty over the neutral rate amid a resilient US economy. Another reading below 200k for initial jobless claims should ease the Fed’s worries over the labour market weakness that drove the 50 bps cut in September.

The US Conference Board’s consumer confidence index improved a second month to 111.7 in November, its highest reading since Jul 2023, most likely driven by the “Trump Trade”. Besides becoming more optimistic about future job availability, consumers expected their financial situation to improve in six months. The perceived likelihood of a US recession over the next 12 months fell to a new low in November with a record 56.4% of the respondents expecting US equities to rise over the year ahead. The Board also asked a special question about 2025, in which consumers overwhelmingly cited higher prices as their top worry and lower prices as their top wish.

Ironically, Trump’s vow to impose harsh tariffs on America’s top three trading partners—25% on all goods from Mexico and Canada and an additional 10% on Chinese imports—have added to inflation concerns. Minneapolis Fed President Neel Kashkari was worried that a tit-for-tat tariff war would reignite inflation, while Mexican President Claudia Sheinbaum threatened to respond with retaliatory tariffs. In 2023, America imported USD475bn, USD418bn, and USD427bn of goods from Mexico, Canada, and China respectively—these three countries accounted for more than 40-45% of the US’ total imports. With 80% of Mexico’s exports and 75% of Canada’s exports heading to the US, the tariffs would also hurt the economies of America’s neighbours.

Download the PDF to read the full report which includes coverage on Credit, FX, Rates, and Thematics.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.