- Commercial aircraft production continues to fall short due to persistent supply chain bottlenecks

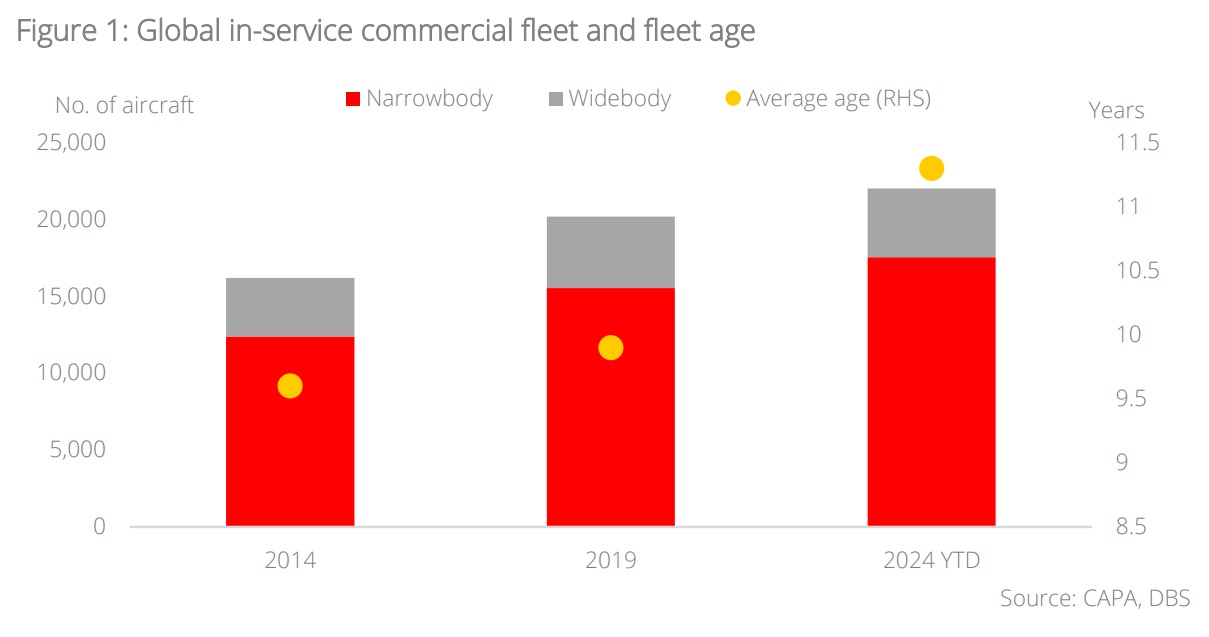

- In addition to rising aircraft utilisation, companies with greater aftermarket exposure are outperforming as airlines increasingly rely on older aircraft due to delivery delays

- Older aircraft have higher work content, while engine OEMs also benefit from increased demand for high-margin sales of spare parts/engines for previous-generation aircraft

- Lacklustre near-term earnings prospects for airframers, but the medium-term outlook remains positive due to strong order backlogs, with improved execution driving earnings growth

Related insights

- Alternatives 1Q25: Gold – Resilience with Alternatives20 Dec 2024

- CIO Insights 1Q25: Game Changers20 Dec 2024

- Bank of America19 Dec 2024

Airframers continue to face significant challenges, while engine OEMs and MRO operators are thriving. In recent years, both Airbus and Boeing have consistently fallen short of production targets, with Boeing further hindered by quality issues that prompted the FAA to enforce a production cap of 38 B737-MAX aircraft per month. While Boeing's manufacturing has improved since early 2024, recent strikes at its West Coast facilities threaten to disrupt production for the rest of the year. In contrast, engine OEMs and MRO operators, despite facing similar disruptions, have been more resilient. Both engine OEM aftermarket and MRO demand are benefiting from airlines extending the life of previous-generation aircraft, which have higher work content, while continued strong air travel demand boosts flight hours across all aircraft types.

Engine OEMs and MRO operators outperformed in 2Q24, while aircraft OEMs struggled amid production issues. RTX and GE Aerospace delivered robust results, surpassing market expectations due to strong aftermarket demand and a favourable revenue mix that improved margins. Both companies raised their FY24 adjusted EPS guidance, with RTX expecting a 7% increase and GE Aerospace anticipating a 38% rise, up from earlier forecasts of 5% and 33%, respectively. Similarly, ST Engineering achieved a stellar 32% y/y increase in MRO revenue and remains upbeat on its near-term prospects. In contrast, Airbus has reduced its 2024 delivery guidance by 4% to 770 aircraft and now expects to generate an adjusted EBIT of EUR5.5bn, down from EUR6.5-7.0bn previously. Meanwhile, Boeing underperformed in 2Q24 due to a significant drop in aircraft deliveries, charges related to a plea deal with the Department of Justice, and the adverse impact of some fixed-price development programs.

Despite high valuations, we remain positive on the industry, favouring companies with greater exposure to the aftermarket. Engine OEMs are expected to exhibit stronger earnings momentum over the next two years, driven by a robust aftermarket, ongoing delays in aircraft deliveries, and increased aircraft utilisation. Similarly, MRO operators are set for solid earnings growth as airlines not only prolong the service life of older aircraft but also work them harder to meet capacity demands. However, the near-term outlook for aircraft OEMs is murky, with risks skewed to the downside due to persistent production bottlenecks, particularly for Boeing which is still dealing with a strike. That said, both major airframers are fully booked into the next decade and are expected to return to growth once execution improves. We believe the current high industry multiples are justified by strong defensive moats, and the sector being in the early stages of a growth cycle. However, we are more cautious on aircraft OEMs in the near term.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.

Related insights

- Alternatives 1Q25: Gold – Resilience with Alternatives20 Dec 2024

- CIO Insights 1Q25: Game Changers20 Dec 2024

- Bank of America19 Dec 2024

Related insights

- Alternatives 1Q25: Gold – Resilience with Alternatives20 Dec 2024

- CIO Insights 1Q25: Game Changers20 Dec 2024

- Bank of America19 Dec 2024