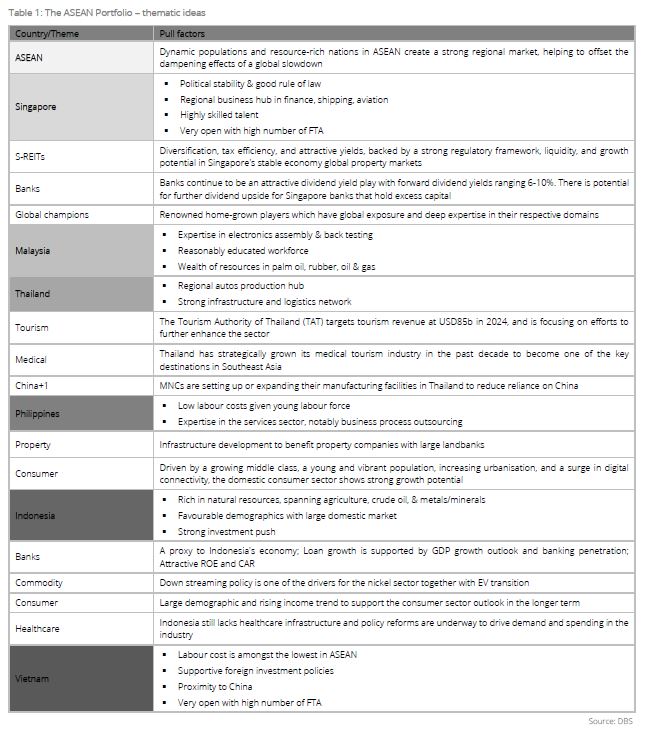

- Supported by five key pillars, ASEAN economies continue to demonstrate resilience despite global macroeconomic headwinds

- The region is poised to benefit from China+1, which presents opportunities for various sectors to move up the value chain

- Long-term drivers for the region are access to critical materials, proximity to suppliers, as well as concerted efforts to facilitate energy transition and a more liberal investment policy landscape

- We highlight key investment opportunities in each of ASEAN’s economy

Related insights

- China Equities: A Welcome Policy Move25 Sep 2024

- Equities Weekly | ASEAN Equities – Time to Shine25 Sep 2024

- Bank Rakyat Indonesia25 Sep 2024

Sustained momentum. As investors brace for global economic slowdown, ASEAN continues to demonstrate promising potential as a strategic economic bloc supported by five key pillars – favourable demographics, infrastructure development driving urbanisation and economic growth, an abundance of natural resources, a wealth of attractive tourist destinations, and a strategic location for supply chain diversification.

Against surrounding headwinds, ASEAN economies continued to sustain their growth momentum. GDP grew in all economies, with growth in Indonesia, Malaysia, the Philippines, and Singapore picking up pace during this period while Thailand and Vietnam recorded slower growth. Strong domestic demand backed by tight labour markets and stable prices, buoyed by robust tourism and a recovery in exports markets have helped to drive growth. By 2030, the bloc is set to become the fourth-largest economy in the world, overtaking Germany.

The region boasts strong export positions in sectors such as electronics, aerospace, semiconductors, machinery, and packaged foods. Other than the potential for expansion, China+1 offers ASEAN economies more opportunities to move up the value chain in their respective domains, pursuing higher value-added segments and harnessing Industry 4.0 to boost productivity, given the region’s relatively smaller role in higher-value industries such as biopharmaceuticals and chemicals.

One region, nine countries. Each ASEAN economy has its unique identity and growth story, from manufacturing-driven economies to commodity-rich producers, and to financial service providers. These factors collectively contribute to their attractiveness as investment destinations in the region. Long-term drivers for the region include access to critical materials, proximity to suppliers, and a focused policy on energy transition, in addition to a more liberal investment policy landscape facilitated by close collaboration across the member states.

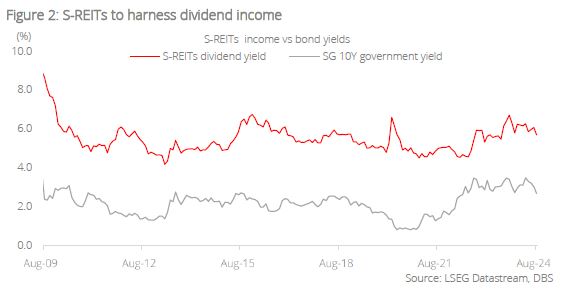

Singapore – a gateway to the region. With its favourable taxation policies and strategic geographical position, supported by a stable political environment and robust legal system, the city state offers investors unprecedented access to the Asian market, serving as a gateway to the region. Its wide network of trade agreements means businesses may access over 80 double taxation avoidance agreements, significant tax deductions, and numerous free trade agreements (FTA) with neighbouring Asian nations, the EU, the US, China, and India. S-REITs, banks, and Singapore's home-grown global champions stand out as attractive long-term investment opportunities.

Indonesia – commodity superpower. Agriculture continues to play an integral role in the economy, employing one-third of the country’s total workforce. As a resource-rich country, commodities account for around 60% of Indonesia’s exports. To reduce its vulnerability to global commodity price shocks, Indonesia is focusing on developing its downstream processing capabilities to improve its supply chain resilience. Driven by growing domestic consumption, Indonesia has demonstrated a continuous track record of high growth compared to other low-cost countries.

The nation has also maintained relative political stability through the years, led by a democratic government committed to economic development; the government continues to implement prudent macroeconomic policies and structural reforms to enhance the ease of business growth. Now a member of the G-20 economies, the nation offers foreign investors significant long-term growth potential, given its status as the largest economy in ASEAN, and the 16th largest in the world. Banks, consumerism as well as the commodity and energy sectors are active plays in Indonesia.

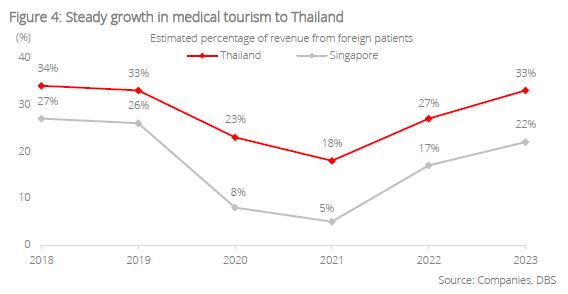

Thailand – a tourist favourite. Thailand boasts a prominent position as the world’s primary source of food and agricultural commodities, including rice and natural rubber. Its economy is highly diverse, comprising of mature sectors ranging from manufacturing, agriculture, and tourism to healthcare. Already a key auto manufacturing hub, Thailand is gunning for a larger market share in EV manufacturing; FDI interest has been directed largely to the electronics and autos sectors.

Data from Thailand’s Commerce Ministry show its top five export categories in 2023 are motor cars, parts and accessories, automatic data processing machinery, precious stones and jewellery, rubber products, and refined fuels. Thailand’s tourism sector also provides significant opportunities for investments in hospitality, retail, and related services. We favour Thailand’s tourism and the medical sector, as well as auto-related industries.

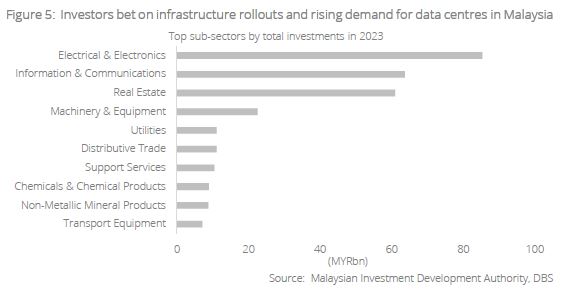

Malaysia – progressing up the value chain. A major exporter of agricultural and mining commodities, Malaysia has seen a shift in its export dynamics in recent years, marked by a decline in agricultural and mining exports which is offset by a surge in exports of manufactured goods. Malaysia is fast gaining increasing importance in global supply chains – particularly due to trade tensions between the US and China – such as a location for semiconductor producers looking to diversify their business risks.

Its well-established industrial sector presents opportunities in healthcare, electronics, the digital economy, and Islamic finance, among many other sectors. This shift reflects Malaysia’s progress towards higher value-added industries and highlights the broader changes in global demand and structural transformations within its economy. We believe investors would do well by gaining exposure to a broad market ETF with a portfolio comprising stocks of banks, utilities, and basic materials.

Philippines – a vast consumer market. The Philippines was among the world’s fastest-growing emerging markets in 2022, recording a GDP of 7.6%, the fastest pace since 1976. The nation is working to reduce its reliance on overseas remittances and has gradually developed its domestic industries to move up global value chains in select industries, presenting new investment opportunities. Its vast population of highly educated English-speaking pool of workers are still well sought after, especially in the medical and hospitality sectors across other countries.

The business process outsourcing (BPO) industry in the Philippines remains key for the country’s economy, contributing c.USD32.5bn in 2022, a 10% increase from 2021. The Philippines is second only to India in BPO, and this sector will likely remain a key part of its economy going forward, outpacing remittances. In our view, property and consumer stocks are the best plays for the Philippines.

CLMV – collective strength. Collectively known as CLMV, Cambodia, Laos, Myanmar, and Vietnam represent ASEAN’s frontier markets. By 2050, ASEAN is slated to become the fourth largest economy in the world, with the rise of CLMV driving additional investor interest to the region. Despite being at varied stages of development, which are uneven and still nascent, CLMV demonstrates significant growth potential, offering opportunities for foreign investors looking to tap into developing economies.

Vietnam’s accession to the World Trade Organization (WTO) in 2007 marked its ascension as a committed and robust trade partner for the global community. Since then, the country has entered into numerous FTA and Double Tax Avoidance Agreements, and is a key beneficiary of China+1 strategy. We believe Vietnam’s consumer market and industrialisation sectors present dynamic opportunities.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.

Related insights

- China Equities: A Welcome Policy Move25 Sep 2024

- Equities Weekly | ASEAN Equities – Time to Shine25 Sep 2024

- Bank Rakyat Indonesia25 Sep 2024

Related insights

- China Equities: A Welcome Policy Move25 Sep 2024

- Equities Weekly | ASEAN Equities – Time to Shine25 Sep 2024

- Bank Rakyat Indonesia25 Sep 2024