- Market volatility and weak inflation numbers have made September Fed policy rate cut a certainty

- Fed policy rates poised to head south from here; based on Fed Funds Futures, 8-9 rate cuts are expected by end-2025

- Larger proportion of debt for US small caps maturing in the short term, enabling them to refinance at lower rates (and enhancing profitability)

- Fund flows data suggests strong rebound in investors’ sentiments towards small-caps as the interest rate environment evolves

- At 17.7x, small-caps’ forward P/E is well below its 20-year average and this represents a 22.9% discount to the S&P 500

Related insights

- Cloudy Outlook Ahead30 Aug 2024

- FX Tactical Ideas: Long AUD-NZD at Bottom of Ascending Channel30 Aug 2024

- CDL Hospitality Trusts30 Aug 2024

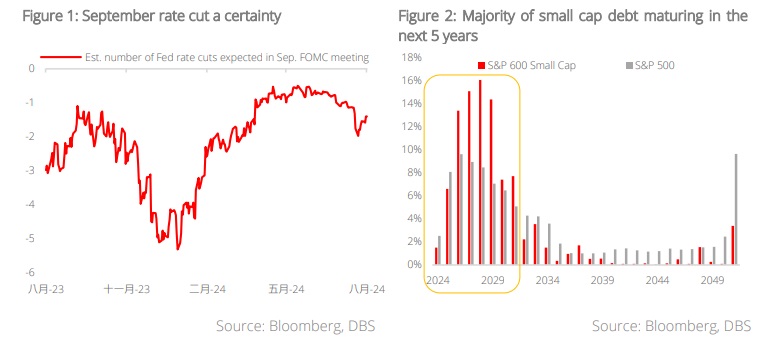

September Fed rate cut a certainty amid soft inflation outlook. Since the release of June’s CPI data, the odds of a September Fed rate cut have surged to near certainty and the subsequent July numbers reaffirmed this view. Going by the Fed Funds Futures, traders are pricing-in a 100% probability of one rate cut in September and a 40% chance of a second cut during the meeting. Whether the Fed will go all out to cut 50 bps remains to be seen as the central bank would want to avoid being perceived as “panicking”. In any case, policy rates are poised to head south from here with 8-9 cuts expected by end-2025.

Fed policy easing positive for US small caps as rally broadens. Despite weaker-than expected jobs data, an economic soft landing for the US remains our base-case assumption and this is constructive for risk assets. As the US equity rally broadens, we expect small caps to benefit from a falling rates environment. Medium-term momentum for the small-caps space include:

- Rate cuts and lower borrowing cost to buoy small-caps earnings: Small-cap

companies tend to be more rates-sensitive given their debt structure. Indeed, small cap companies have a larger proportion of debt maturing within the next five years as compared to larger companies (c.67% for S&P 600 Small Cap vs. c.45% for S&P 500). As the Fed embarks on monetary easing, small-cap companies will be able to refinance at lower rates and reduce their borrowing cost. The latter is expected to contribute substantially to their bottom-line, with earnings growth for S&P 600 Small

Cap expected at c.20.3% in FY2025 (vs. c.14.0% for S&P 500). - Fund flows suggest renewed interest in US small-caps as rate cuts loom: In the three months leading up to June's CPI data release, small-cap equity funds registered consecutive weekly outflows. But since the release of June’s data (which fuelled

expectations of a September cut), small-cap equity funds saw a notable turnaround, attracting combined inflows of USD11bn in four weeks (ending 7 August). We expect this momentum to persist as investors reposition their portfolios in response to the

changing interest rates environment. - Attractive “broadening rally” play amid steep valuation discount: At 17.7x, the S&P 600 Small Cap index’s forward P/E is currently well below its 20-year average. Above all, the index is also trading at a 22.9% discount to the S&P 500 and this represents a compelling opportunity for investors looking to participate in the broadening rally.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.

Related insights

- Cloudy Outlook Ahead30 Aug 2024

- FX Tactical Ideas: Long AUD-NZD at Bottom of Ascending Channel30 Aug 2024

- CDL Hospitality Trusts30 Aug 2024

Related insights

- Cloudy Outlook Ahead30 Aug 2024

- FX Tactical Ideas: Long AUD-NZD at Bottom of Ascending Channel30 Aug 2024

- CDL Hospitality Trusts30 Aug 2024