- Restaurant operators target revival of store traffic through attractive value deals to attract inflation-weary consumers

- Margin contraction imminent as companies prioritise reclaiming or defending market shares

- Key catalysts include acceleration of store openings – especially in international markets – to deliver better-than-expected growth, and rebasing effect from the US’s operations

- China markets reflect intense competition, particularly in the coffee and fast-food categories where profitability appears most apparent

Related insights

- Research Library17 Jul 2024

- Equities Weekly: Europe Equities – Market Resilience Despite Political Gridlock17 Jul 2024

- Moderna Inc 17 Jul 2024

Lacklustre results amid base effects from price hikes. Global fast food chain operators have reported disappointing results so far in 2024 and this is primarily due to base effects from successive price hikes amid rising inflationary pressures from labour and ingredient costs. Consequently, this has resulted in consumers cutting back on fast-food spending.

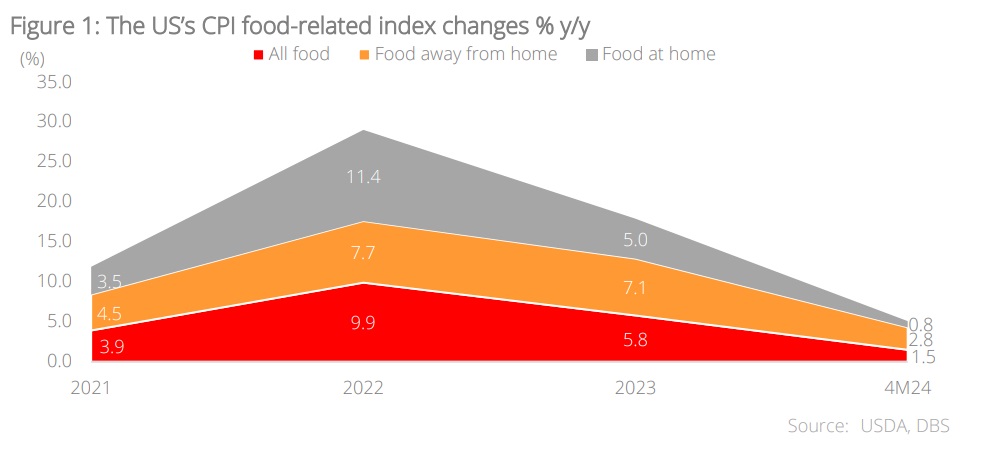

According to United States Department of Agriculture (USDA), the 4M24 US CPI on food-away-from-home (restaurant purchases) grew at 2.8% y/y, outpacing overall food CPI growth of 1.5% y/y. Overall, food price growth in the US is expected to decelerate in 2024, with food-at-home prices growth predicted to moderate to 1.2% y/y (2023: +5.8% y/y), and food-away-from-home to 4.2% y/y (2023: +7.1% y/y).

Rekindling interest amongst inflation-weary consumers. In a strategic move to revitalise in-store traffic, fast food players have launched value meals in an attempt to entice cost-conscious customers. For instance, Burger King’s USD5 meals include a choice of one sandwich from three options, along with nuggets, fries, and a drink, while Wendy’s is offering a USD3 value breakfast meal which includes small-sized seasoned potatoes and a choice between two English muffins with protein. Additionally, Wendy’s also provides USD5/USD6 value meals for lunch/dinner sets. McDonald’s has similarly launched USD5 value meal that includes four items – such as a burger, chicken nuggets, fries, and a drink – for a limited time.

As companies prioritise on reclaiming or defending market shares in 2024, margin contraction is likely. Other key initiatives include store expansion, cost-saving strategies through digitalisation, and international growth plans to offset moderating growth in their key markets.

China’s cut-throat competition unlikely to ease up. China’s restaurant industry, previously a strong growth driver for US players such as Yum! and Starbucks, has evolved into a complex market. While China’s restaurant spending per capita possesses tremendous growth potential, price competition in this space is nonetheless extremely intense. Indeed, negative same-store sales (SSS) growth can be observed across Yum China (9987 HK) (-3% y/y) and Starbucks (SBUX US) (-11% y/y in China) in the latest quarter. Luckin Coffee (LKNCY US) also reported a 20.8% decline in SSS and this highlights the same challenges facing the industry across the board.

In response to the challenging macro-economic environment, players focus on expanding their presence in lower tier cities through franchising. Following a strong year of operating leverage in 2023 after China’s reopening, margin contraction is on the cards in view of marketing and promotion initiatives.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.

Related insights

- Research Library17 Jul 2024

- Equities Weekly: Europe Equities – Market Resilience Despite Political Gridlock17 Jul 2024

- Moderna Inc 17 Jul 2024

Related insights

- Research Library17 Jul 2024

- Equities Weekly: Europe Equities – Market Resilience Despite Political Gridlock17 Jul 2024

- Moderna Inc 17 Jul 2024