- Equities: Global equity markets mixed amid AI disruption fears and expectations of US tariffs, ECB rate cut offers some relief to European markets

- Credit: Historical analyses suggest investment grade bonds perform well under high-rate pause environments, reinforcing our preference for A/BBB credit

- FX: Additional tariffs adds to the USD strength narrative

- The Week Ahead: Keep a lookout for US Change in Nonfarm Payrolls; Singapore Retail Sales

Related insights

Markets mostly lower amid AI competition and tariff threats. Global equity markets finished a volatile week mostly lower, with developed markets declining 0.5% while emerging markets were up 0.3%. A sharp sell-off in technology stocks fuelled the downturn, triggered by the launch of DeepSeek R1, a new open-source large language model from a Chinese developer. DeepSeek R1 reportedly matches the performance of leading Western AI models while requiring significantly less energy and processing power. This reveal sparked market panic as it challenges the prevailing assumption that each new generation of AI models would require exponentially greater processing power, thus bolstering the crucial role of hardware providers like Nvidia.

US equities was also hit by expectations of tariffs from the Trump administration on Mexico and Canada, the US’s top two trading partners. The S&P 500 was down 1% while NASDAQ was down 1.6%. Over in Europe, the European Central Bank (ECB) cut rates by a quarter percent to 2.75%, bolstering investor sentiment, STOXX 600 was up 1.8% for the week. Asia ex-Japan closed the week positive with the HSCEI and Hang Seng up 1.0% and 0.8% respectively.

Topic in focus: Navigating AI Disruption – DeepSeek’s impact and opportunities in US Big Tech. DeepSeek has emerged as a significant challenger to the dominance of OpenAI in the AI sector, offering similar performance with far lower computational costs. DeepSeek’s AI models reportedly required just USD5.6mn and 2.8mn GPU hours for training, a fraction of what competitors like Meta spend on similar models. While these achievements are groundbreaking, skepticism remains about the full scope of these costs, as other factors such as R&D and data acquisition are likely not accounted for. Moreover, DeepSeek faces unique challenges, including government vetting and censorship in China, as well as ongoing issues with service stability, which complicate its path to commercialisation. DeepSeek’s achievements only serve to further the AI narrative; increased spending, a growing addressable market, and innovation will continue to drive growth in the AI space.

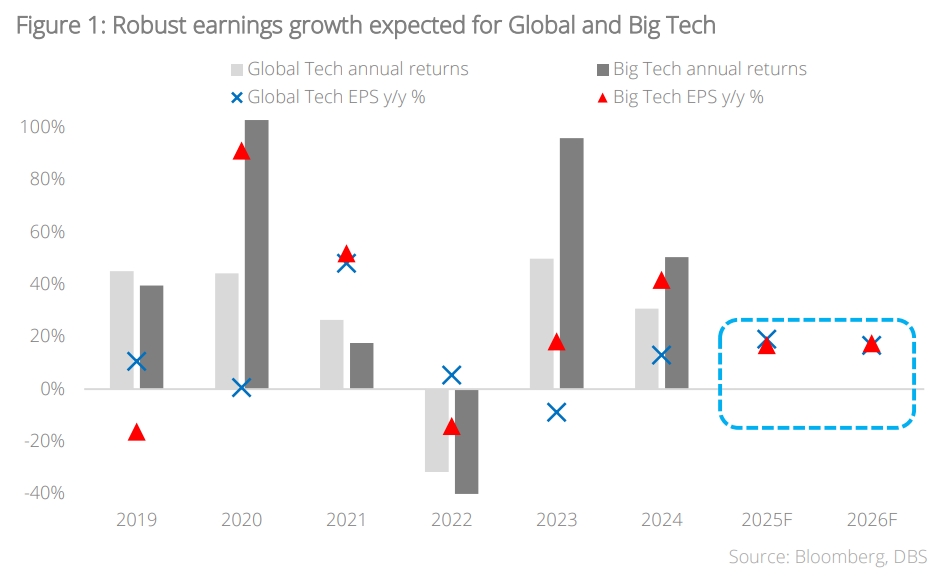

US Big Tech still hold a dominant position in AI, supported by their vast resources and advanced infrastructure. We recommend maintaining exposure to US Big Tech, which continues to lead the AI landscape with solid fundamentals and a clear growth trajectory. With strong earnings growth potential in the high teens for 2025 and 2026, these companies are well-positioned to benefit from continued AI demand and innovation. Given the dynamic nature of the AI sector, stay invested with the DBS I.D.E.A. strategy to ensure diversified exposure across secular growth themes.

Download the PDF to read the full report which includes coverage on Credit, FX, Rates, and Thematics.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.