- DeepSeek has taken the world by storm, challenging OpenAI’s long-held AI dominance

- It is reported that DeepSeek’s AI models are able to achieve similar performance at a fraction of the cost and computational power required by its US counterparts

- While groundbreaking, DeepSeek’s achievements only serve to further the AI narrative; increased spending, a growing addressable market, and innovation will continue to drive growth in the AI space

- US Big Tech continues to be in pole position as DeepSeek grapples with reliability issues, which will act as challenges to full commercialisation

- Stay invested in AI through the DBS I.D.E.A. strategy to ensure diversified exposure across secular growth themes

Related insights

A bolt from the blue. Just as OpenAI took the world by storm with ChatGPT in November 2022, DeepSeek-V3, a large language model launched by the Chinese start-up DeepSeek, crafted its own “Sputnik moment” this year, handily climbing to the top of the Apple App Store’s download rankings in both the US and China since its launch on 20 January. But more than just rapidly growing its user base, what stood out was the platform’s ability to achieve similar performance levels to its US rival platforms at a fraction of the cost and computing power. It was reported that DeepSeek-V3 required just 2.8mn GPU hours and c.USD5.6mn to train, significantly less than Meta’s last major AI model, which took c.USD60-70m to train. If true, the implications for the AI landscape would be massive as it challenges the current mode of AI development, which prioritises scale, both in investment and computational power. The open-source format of DeepSeek also calls into question the proprietary nature of OpenAI’s models, and whether that is the ideal way forward from a cost, efficiency, and commercialisation perspective. In summary, the advent of DeepSeek is emerging as a challenge to what has otherwise been unbridled US AI supremacy.

Is this really the new promised land? While DeepSeek has undoubtedly shaken up the AI landscape, it is important to approach this development with some healthy skepticism. DeepSeek’s accomplishments are indeed groundbreaking, but the claim that they were achieved without the use of advanced GPUs and chipsets and at a cost of just USD5mn appears improbable. In all likelihood, the oft-quoted USD6mn figure covers only the infrastructure cost of development − USD2/GPU hour rental price for 2.8mn GPU hours. It does not take into account all the other costs associated with prior R&D needed to develop the capabilities and algorithms needed to run a fully functioning large-language model, not to mention the cost of the data needed to feed the models as well. DeepSeek also faces additional challenges that are unique to the Chinese market. Firstly, it must undergo the Chinese government’s vetting process, and be subject to certain censorship requirements. This will inevitably limit its potential customer base due to its smaller parameter set. The service was also reported to have experienced instability, preventing consistent performance, which means full commercialisation will still take some time to iron out. All in all, the track record of DeepSeek is not at the same level as its Western counterparts and the roadmap and timeline on commercialising/monetising its products is still unclear.

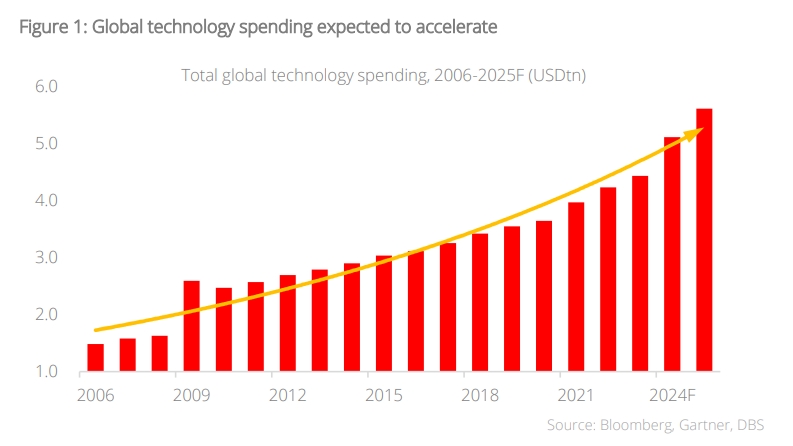

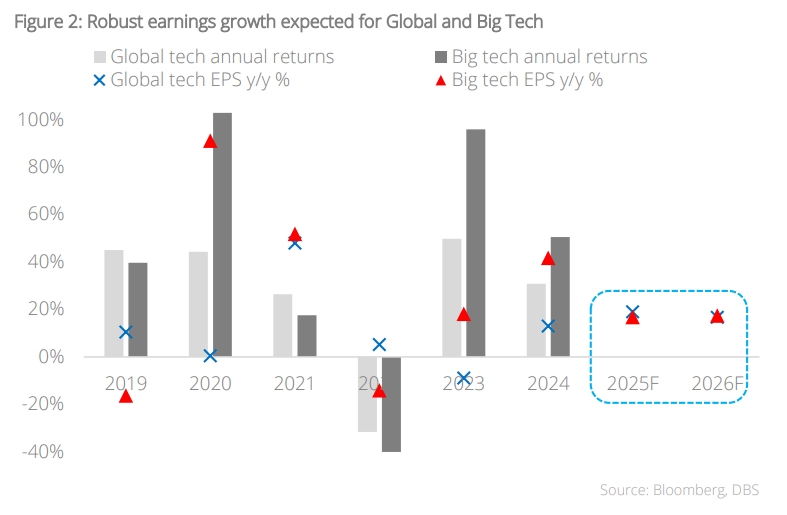

US Big Tech still in the driver’s seat. On that same note, we have to acknowledge that while DeepSeek does pose a challenge to US Big Tech, the latter remains firmly in pole position. Alternative strategies for AI development and commercialisation, such as prioritising efficiency, may emerge with DeepSeek’s successes, but it does not change the fact that the vast majority of AI development still relies squarely on advanced GPUs as its hardware backbone. Microsoft and Meta will release their results this week, and their projected capital expenditures are expected to surpass current market expectations — USD80bn/year for Microsoft and USD60-65bn/year for Meta. It is also anticipated that US-based cloud service providers (CSPs) will increase spending on inference optimisation. This will inevitably lead to a decrease in per-unit costs for AI over time. Examining the current charging models of OpenAI and Google Gemini, their advantages lie in system stability, which supports consistent enterprise output and drives significant B2B user subscription growth. With American CSPs continuing to expand capital expenditures, a portion will likely be allocated to enhancing service stability and supporting power supply, while further global data centre expansion will ensure more reliable system support. Overall, we remain bullish on US Big Tech, driven by a strong total addressable market and positive outlook on global technology spending.

Take a diversified approach with AI investing. We have long opined that while the AI story will continue to run, players within the ecosystem may change, and while US Big Tech appears to be firmly in pole position, this may not always be the case. DeepSeek and indeed other new entrants, will aim to disrupt this burgeoning market in pursuit of profits. As such, we advocate a diversified approach to investing within the technology space; continue to maintain exposure to US Big Tech for their moats of innovation and scale, but also ensure that such exposure is spread across various key verticals including, AI/machine learning, cloud computing, software applications, consumer technology, cybersecurity, etc. Stay invested with DBS I.D.E.A. (Innovators, Disruptors, Enablers, Adapters), a diversified strategy investing in secular growth themes encompassing the long runway of global digital transformation. The strategy was down 2.6% during the recent market rout, but is still up 2% year-to-date.

Key investment recommendations:

- Stay invested in profitable industry leaders, as they continue to lead AI innovation and commercialise their creations

- Be diversified across secular themes and winners, which span a wide range of verticals, not just semiconductors

- Stick with trend setters and price makers with established track records

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.