Related insights

We do not rule out the USD’s appreciation in the first half of the year reversing in the second half. Fed Chair Jerome Powell may start paving the ground for its first interest rate cut in 3Q24 when he testifies before the US Senate Banking Committee on July 9. More Fed officials see US inflation falling in the second half of the year and do not consider it necessary for inflation to hit the 2% target before removing top level policy restriction. Friday’s US PCE deflators should mirror the slower CPI inflation a fortnight ago. Consensus expects headline inflation to slow to 0% MoM (21.6% YoY) in May from 0.3% MoM (2.8% YoY) in April and the core deflator to 0.1% MoM (2.6% YoY) from 0.2% MoM (2.8% YoY).

Fed officials were more attentive to the higher unemployment rate at 4% in May. They see monetary policy working to slow consumer spending and forcing retailers to lower prices. Hence, stay alert to a drop in the US Conference Board’s Consumer Confidence Index on June 25, especially after the University of Michigan’s Consumer Sentiment Index fell a fourth month to a seven-month low of 65.6 in June.

GBP/USD depreciated for a third week by 0.3% to 1.2645 last week. Although UK CPI inflation hit the 2% target in May, the Bank of England did not lower rates at its meeting on June 20. Core and services inflation remained lofty at 3.5% and 5.7%, respectively. According to the Decision Maker Panel (DMP) survey in the three months to May, UK businesses expected the frequency of services price increases to normalise further over the course of this year.

Polls predict a historic victory by the opposition Labour Party at the UK snap elections on July 4. However, the election appears more about a referendum against the ruling Conservative party than one of popular support for the opposition. Labour needs to overcome the fiscal constraints standing in the way of its promise of a British rebirth and renewal. Labour Party leader Keir Starmer has ruled out reopening the Brexit debate, but Brussels was hopeful of better relations with London under him.

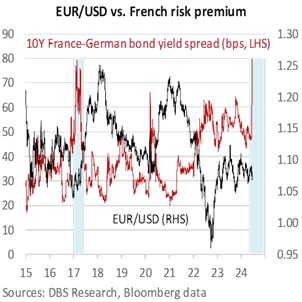

EUR/USD faces downside pressure in the lower half of this quarter’s 1.06-1.09 range. The polls do not rule out the far-right National Rally (RN) party winning a majority in the French snap elections that will be held in two rounds on June 30 and July 7. RN leader said he would not become prime minister if his party and allies did not win an absolute majority. The next government is set to clash with the European Commission, which launched an “excessive deficit procedure” against France for breaching fiscal deficit and public debt rules.

The outcome of the French elections will be of significant interest to the European Central Bank at its forum on central banking in Sintra during the first week of July. Despite fears of France exiting the EU or ending up with a gridlock government, 2017 demonstrated that the EUR could recover quickly if the 10Y yield differential between French and German bonds pulls back after widening to 80 bps.

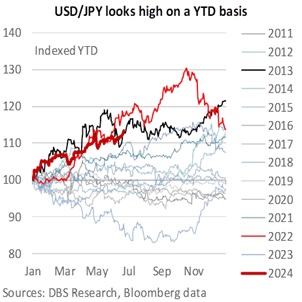

USD/JPY rose 1.5% to 159.80 last week, its highest close since April 1990. On June 20, the US Treasury Department (USTD) added Japan to the currency monitoring list. However, the USTD clarified that the decision was not attributed to Japan’s interventions in April-May to prop up the JPY but for meeting two of the three mechanical criteria, i.e., a bilateral trade surplus of USD62.4bn (vs. USD20bn criteria) with the US and a current account surplus of 3.5% (vs. 2% criteria) of GDP in 2023. The USTD considered Japan to be transparent in its forex operations, i.e., the recent interventions were carried out after the Washington-Tokyo-Seoul joint statement to consult closely on forex. All said, USD/JPY looks toppish on a year-to-date basis. The third quarter could see the Fed paving the way for rate cuts alongside the Bank of Japan hiking rates again and reducing JGB purchases.

Quote of the day

“You cannot change the beginning, but you can start where you are and change the ending.”

C.S. Lewis

24 June in history

Siam was renamed Thailand in 1939, seven years after a bloodless coup that ended the absolute power of the King.

Topic

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). This report is intended for “Accredited Investors” and “Institutional Investors” (defined under the Financial Advisers Act and Securities and Futures Act of Singapore, and their subsidiary legislation), as well as “Professional Investors” (defined under the Securities and Futures Ordinance of Hong Kong) only. It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 13th Floor One Island East, 18 Westlands Road, Quarry Bay, Hong Kong SAR

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.