Related insights

- Asia ex-Japan Equities10 Mar 2025

- Procter & Gamble10 Mar 2025

- The USD’s weak momentum carries potential risks too10 Mar 2025

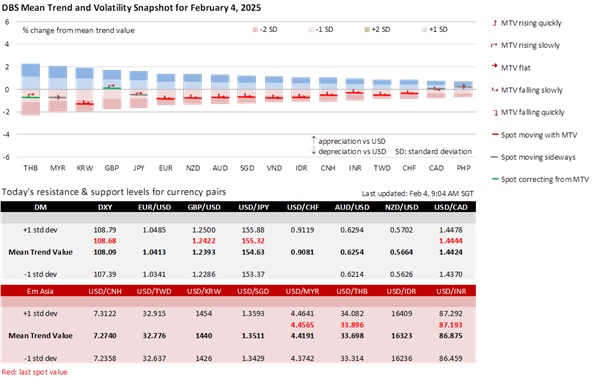

The DXY Index returned gains after US President Donald Trump agreed to delay the 25% tariffs on Mexico and Canada for 30 days in exchange for commitments to enhance border control efforts to crack down on drug trafficking and illegal immigration. The DXY Index initially spiked 1.4% to almost 110 in anticipation of the February 4 deadline for the tariffs to take effect. It ended the overnight session at 108.40, near last Friday’s closing level. USD/MXN pulled back to 20.3, a five-day low, after initially climbing to a 3-year high of 21.3. USD/CAD was poised to establish a new uptrend if it surpassed the 1.47 highs in 2016 and 2020. However, after briefly reaching 1.48, it retreated to 1.44, the mid-point of the 1.43-1.45 range where it traded for most of January.

However, it is too early to celebrate at the outset of US-led global trade tensions. We see the USD maintaining its haven status in 1H25 while acknowledging volatility from Trump’s unpredictability.

Although the S&P 500 Index trimmed its initial overnight loss from -1.9%, it still closed the session 0.8% lower at 5995, worse than last Friday’s 0.5% decline. Trump gave notice that the European Union was next in line for US tariffs. European Commission President Ursula von der Leyen said after an informal gathering of EU leaders in Brussels that the EU would respond firmly to Trump’s tariffs. There was also no 30-day reprieve for the additional 10% tariff on Chinese imports, with markets awaiting responses from the Xi administration.

Given Trump’s outrage against America’s major deficits with Canada and Mexico, stock investors reckoned that Canada and Mexico still needed to do much more to avert tariffs altogether. According to the Financial Times, Trump stated that Canada had a 30-day window to finalize an economic deal. However, Canada is going through a political transition that could complicate or delay this process. Prime Minister Justin Trudeau will step down after a new Liberal leader is selected on March 9. Leading candidates Mark Carney and Chrystia Freeland are vocal critics of Trump’s trade policies and provocation of Canada’s sovereignty. Unfortunately, the ruling Liberal Party is badly trailing the opposition Conservative Party ahead of the October general elections. Opposition leader Pierre Poilievre firmly opposes Trump’s tariffs and is committed to defending Canada’s economic interests through “dollar-for-dollar” retaliatory tariffs on US goods and policy reforms.

The bond market was also unconvinced that the tariff threat to inflation was over. The US Treasury 10Y bond yield rose by 1.6 bps to 4.555% a second session. Fed Presidents Austan Goolsbee (Chicago) and Raphael Bostic (Atlanta) urged caution in lowering interest rates because of inflation risks driven by Trump’s policies. Bostic is paying attention to how tariffs drive inflation expectations, which he reckons clarity would be lacking at the FOMC meeting on March 18-19. Fed Chair Jerome Powell’s semi-annual congressional testimonies on monetary policy next week have become a significant event. Meanwhile, market expects Friday’s US nonfarm payrolls to moderate to 170k in January, after the surprise jump to 256k in January, with the unemployment rate staying unchanged at 4.1%.

Quote of the Day

“Move fast and break things. Unless you are breaking stuff, you are not moving fast enough.”

Mark Zuckerberg

February 4 in history

Mark Zuckerberg launched Facebook from his Harvard dormitory room in 2004.

Topic

GENERAL DISCLOSURE/ DISCLAIMER (For Macroeconomics, Currencies, Interest Rates)

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

[#for Distribution in Singapore] This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 11th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.

Related insights

- Asia ex-Japan Equities10 Mar 2025

- Procter & Gamble10 Mar 2025

- The USD’s weak momentum carries potential risks too10 Mar 2025

Related insights

- Asia ex-Japan Equities10 Mar 2025

- Procter & Gamble10 Mar 2025

- The USD’s weak momentum carries potential risks too10 Mar 2025