- Obesity affects c.650mn patients globally

- Weight-loss drugs are spiking in popularity with Wegovy by Novo Nordisk generating USD4.5bn in sales in FY23 and Zepbound by Eli Lilly generating USD176mn in sales in FY23

- Breakthrough in MariTide by Amgen, world’s first biologic weight-loss drug, which reduces body weight comparable to Wegovy and Zepbound requires 4x less doses

- Other companies developing biologic weight-loss drugs will benefit as well

Related insights

- Global Credit 1Q25 – Making Bonds Great Again23 Dec 2024

- Alternatives 1Q25: Gold – Resilience with Alternatives20 Dec 2024

- CIO Insights 1Q25: Game Changers20 Dec 2024

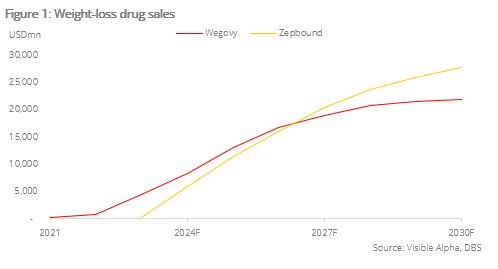

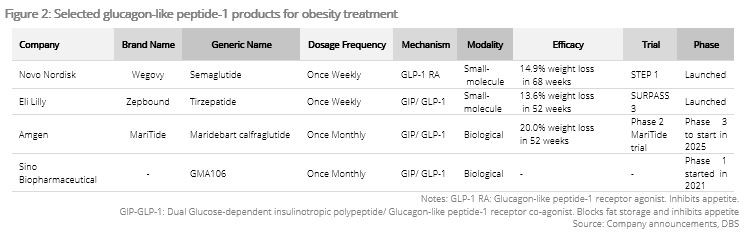

Rise in popularity of weight-loss drugs due to simple usage and high efficacy. Obesity, often defined as having a body mass index (BMI) of over 30, affects c.650mn patients globally. The current weight-loss drug market is a duopoly dominated by Novo Nordisk (NOVOB DC) and Eli Lilly (LLY US). In 2021, Novo Nordisk launched Wegovy, its first glucagon-like peptide-1 (GLP-1) receptor agonist for treatment of obesity. GLP-1 drugs work by activating the GLP-1 receptor which inhibits appetite, effectively leading to weight loss. Wegovy skyrocketed in popularity, generating USD4.5bn in sales in FY23 and is expected to bring in USD13.0bn in FY25F, according to estimates by Visible Alpha. In 2023, Eli Lilly launched Zepbound, its first dual glucose-dependent insulinotropic polypeptide/glucagon-like peptide-1 receptor co-agonist (GIP/GLP-1). GIP/GLP-1 drugs work by blocking the GIP receptor (which leads to less fat storage) and activating the GLP-1 receptor (which inhibits appetite), leading to weight loss. Zepbound brought in USD176mn in FY23 and is expected to bring in USD11.3bn in FY25F, according to estimates by Visible Alpha.

Breakthrough in weight-loss drugs industry. Wegovy and Zepbound are both small-molecule drugs injected weekly, reducing body weight by 14.9% in 68 weeks and 13.6% in 52 weeks, respectively. The breakthrough comes in the form of MariTide by Amgen (AMGN US) which is a large-molecule drug injected monthly, reducing body weight by 14.5% in 12 weeks, significantly sooner than Wegovy and Zepbound. Its molecular size is 31-36x larger than that of Wegovy and Zepbound, which allows it to stay in the human body longer, resulting in less frequent injections. We expected Amgen to start phase 3 clinical trials in early 2025, with interim results expected to be released in 2H25 on indications such as obesity, type 2 diabetes, cardiovascular disease, and chronic kidney disease. The data is expected to be positive, as Amgen has axed R&D of other weight-loss drugs to focus on MariTide.

Other companies developing biologic GLP-1 drugs will benefit as well. Apart from Amgen, Sino Biopharmaceutical is the only company globally developing a biologic weight-loss drug (GMA106) with a formula similar to that of MariTide (GIP/GLP-1). Amgen’s share price surged 12% in one day when it reported positive Phase 2 interim data. Phase 2 clinical data is expected in 4Q24. The positive clinical data of MariTide will raise market confidence in its mechanism which could spill over to the GMA106 drug. Visible Alpha estimates GMA106 will generate sales of USD54-493mn in 2028F-30F, equivalent to 1-13% of 23A sales.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.

Related insights

- Global Credit 1Q25 – Making Bonds Great Again23 Dec 2024

- Alternatives 1Q25: Gold – Resilience with Alternatives20 Dec 2024

- CIO Insights 1Q25: Game Changers20 Dec 2024

Related insights

- Global Credit 1Q25 – Making Bonds Great Again23 Dec 2024

- Alternatives 1Q25: Gold – Resilience with Alternatives20 Dec 2024

- CIO Insights 1Q25: Game Changers20 Dec 2024