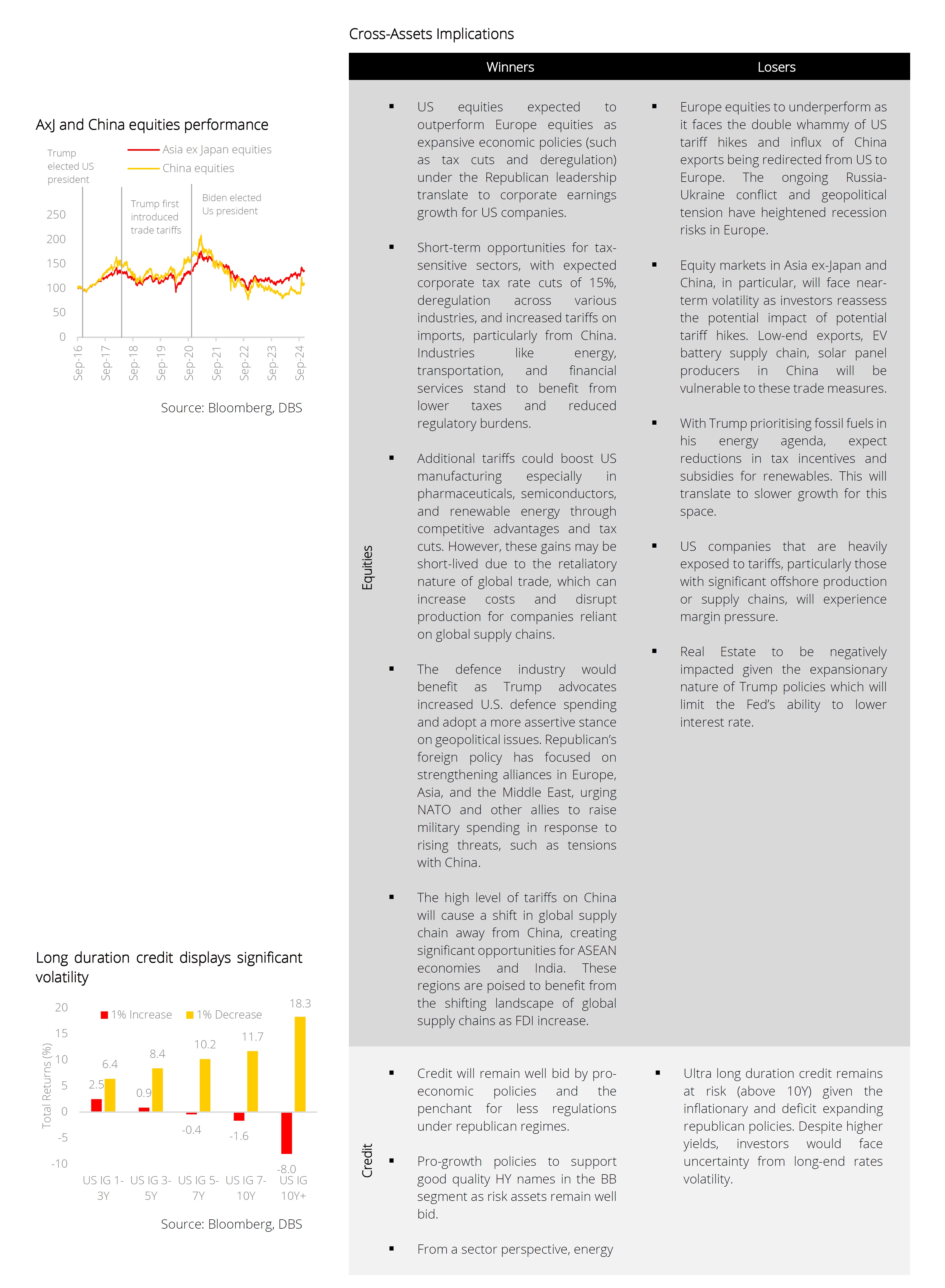

- Equites: The Republican sweep will translate to US outperformance over Europe as pro-growth policies will be fuelling economic and earnings growth in the US, while European markets face headwinds such as tariffs and geopolitical tension

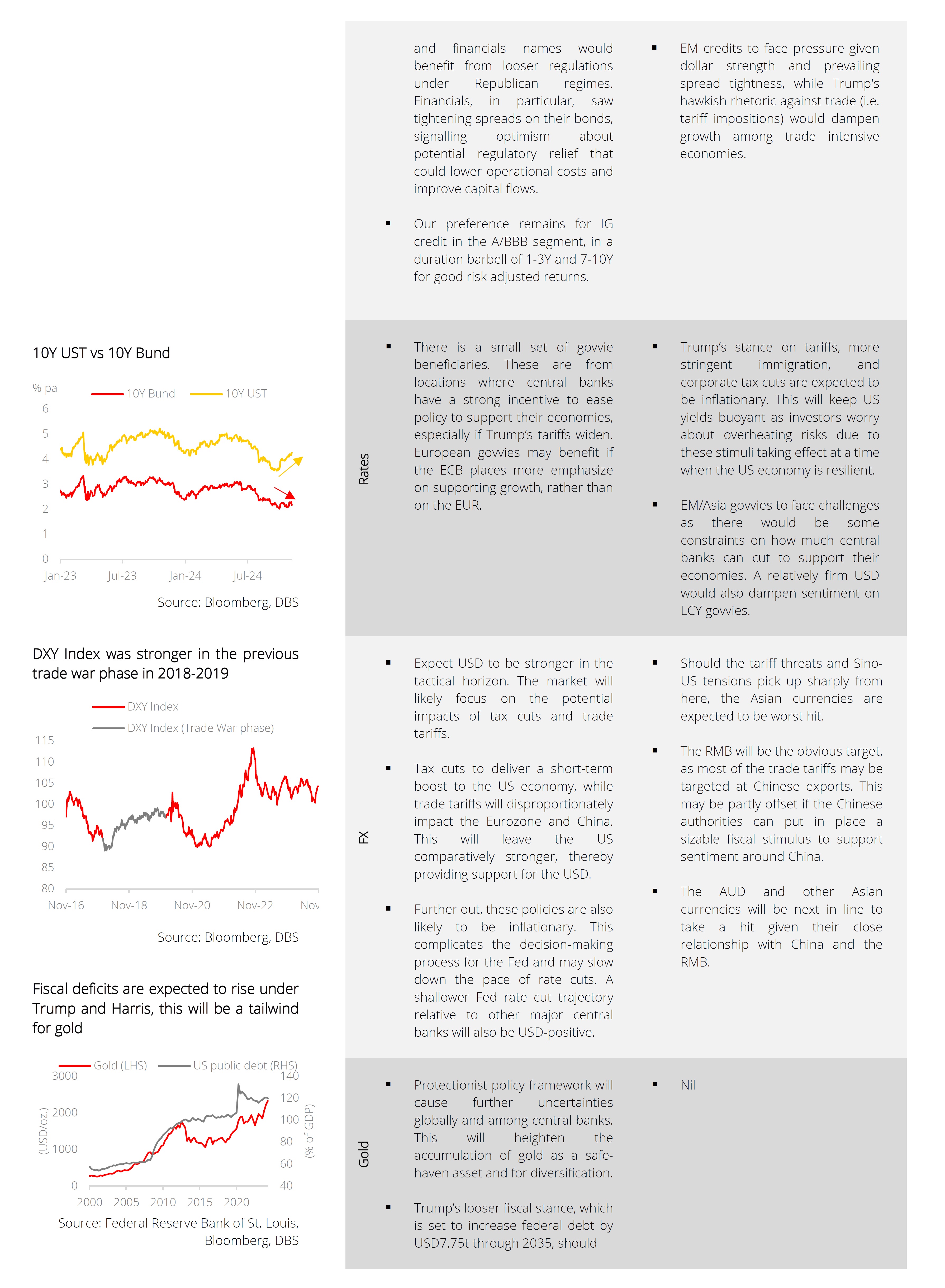

- Credit: Credit remains well bid by pro-economic policies and the penchant for less regulations under Republican regimes. IG and higher quality HY bonds (BB segment) will be well supported

- Rates: Central banks in regions that have a strong incentive to ease policy to support their economies will be key beneficiaries under a Republican sweep where tariff hikes are on the cards

- FX: Policies implemented are likely inflationary, which may slow down the pace of rate cuts by the Fed, making the USD stronger relative to other major central banks

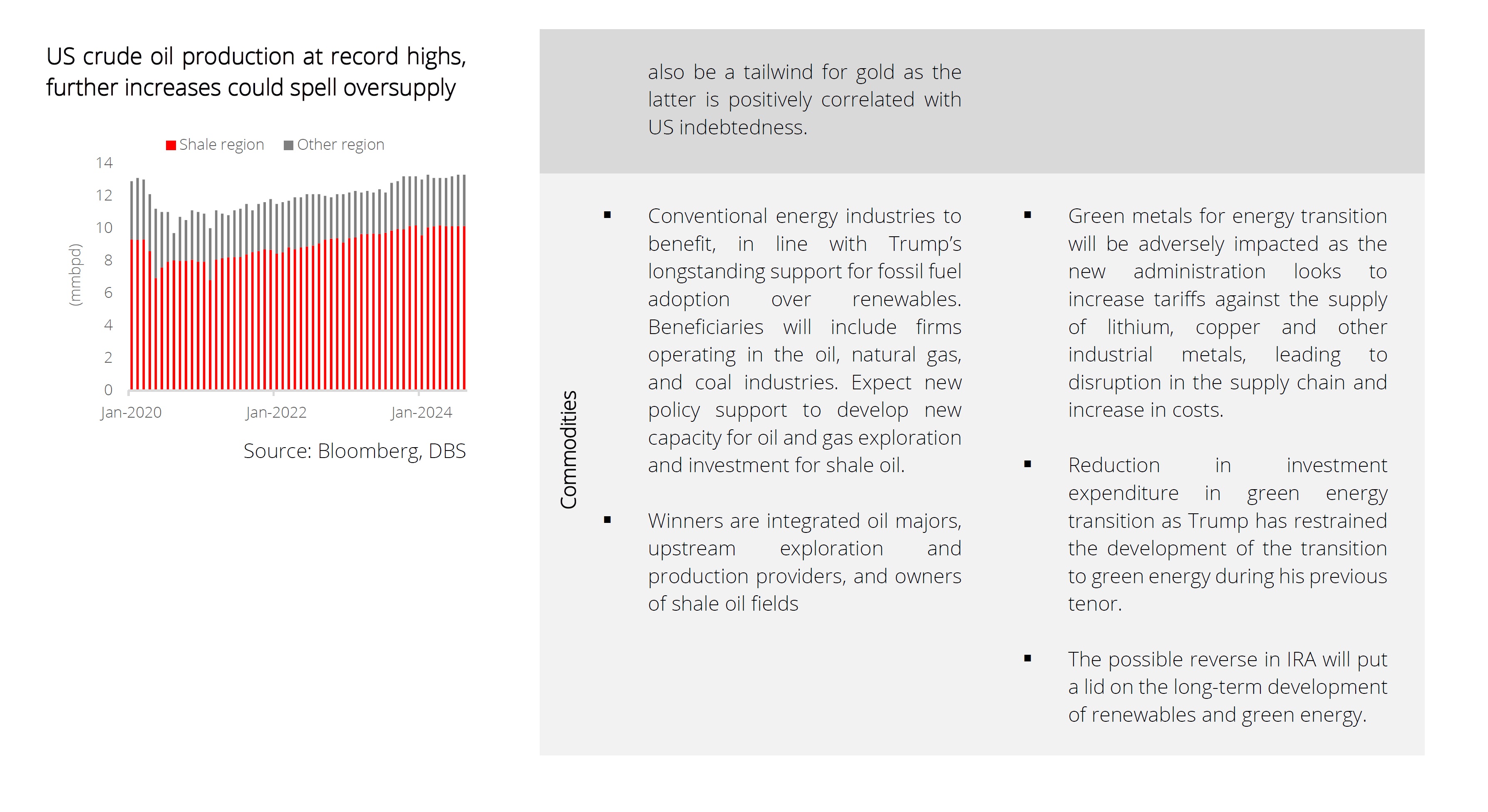

- Gold: Trump’s protectionist policies would result in uncertainties globally, boosting demand for gold as a safe-haven asset and tool for diversification purposes

Related insights

- Global Credit 1Q25 – Making Bonds Great Again23 Dec 2024

- Alternatives 1Q25: Gold – Resilience with Alternatives20 Dec 2024

- CIO Insights 1Q25: Game Changers20 Dec 2024

Red Sweep: Seismic change in US policies on the cards. The Americans have spoken. With Trump winning both the electoral college and popular vote, Americans have made themselves clear on who they want as the next President of the United States. The recapturing of the Senate means that Republicans are on course to vastly reshape Capitol Hill in the years to come while Democrats confront a looming existential crisis. Clearly, the election outcome shows that concerns over the economy and illegal immigration ranks high on voters’ agenda and so, expect significant policy changes to come as Trump assembles a new team to steer his presidency.

The Trump victory has already seen “Trump trades” going into overdrive with S&P 500 up 2.5%, US Dollar Index (DXY) rallying 1.6% and UST 10-year yield up 16 bps. Expect dollar strength to stay as the markets price in higher bond yields on expectations of rising tariffs and bond issuances to fund the taxation cuts. A Trump 2.0 will bring sweeping policies changes and these are the likely scenarios:

- Tax Cuts: To revitalise domestic manufacturing and jobs creation, Republicans are on course to lower corporate tax rates from 21% to 15% for US-based companies. This reduction in tax burden not only enhances the competitiveness of US companies, it also helps drive innovation as companies reinvest these savings into their businesses.

The Republicans are also on course to expand the Tax Cuts and Jobs Act (TCJA) across all income levels, which will support US domestic consumption. However, such tax cuts come at a price. According to estimates from the Committee for a Responsible Federal Budget, the tax reduction for individuals/business and the extension of TCJA will translate to USD9.35tn increase in fiscal costs. - Trade War: Trump’s protectionist stance is set to be revived and this could encompass the imposition of a blanket 10% tariff on most imports, along with significantly higher tariffs of up to 60% on Chinese goods. This, along with renegotiations of trade deals like the USMCA, are expected to escalate trade tensions.

On a global level, the IMF cautioned that the tariff hikes could potentially reduce global GDP by 0.8% in 2025 and 1.3% in 2026. But that said, we are also mindful that election rhetoric may not necessarily translate into actual implementation given the potential for retaliation from trade partners, and above all, Trump’s transactional style of policy making. The situation remains fluid on this front. - National Debt: Republican sweep is expected to add a net c.USD7.75tn to the national debt from 2026 to 2035, driven by policies such as the extension of TCJA and a reduction in business taxes.

To fund these taxation cuts, the Republicans will: (a) Increase revenue from tariffs, (b) Implement cuts to entitlement programs like Medicare and Medicaid which provide healthcare for seniors and low-income earners, (c) Eliminate energy-related tax credits used to incentivise renewable energy development. However, these initiatives will nonetheless be insufficient to offset revenue losses from the tax cuts. - Geopolitics: Expect geopolitical fragmentation to deepen, with exporters to the US to experience margin pressure. But the eventual outcomes remain fluid given the likelihood of retaliation from US’s major trading partners. Our economists, meanwhile, holds a sanguine view for Asia on the basis of the region’s strong ties with US and China. The region’s openness to trade and strong balance sheets will put them in good stead during Trump 2.0.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.

Related insights

- Global Credit 1Q25 – Making Bonds Great Again23 Dec 2024

- Alternatives 1Q25: Gold – Resilience with Alternatives20 Dec 2024

- CIO Insights 1Q25: Game Changers20 Dec 2024

Related insights

- Global Credit 1Q25 – Making Bonds Great Again23 Dec 2024

- Alternatives 1Q25: Gold – Resilience with Alternatives20 Dec 2024

- CIO Insights 1Q25: Game Changers20 Dec 2024