- Equites: A Republican sweep would offer short-term gains ford tax-sensitive sectors through tax cuts, deregulation, and tariffs, benefiting industries like energy and manufacturing, although these gains may be offset by trade retaliation. A Democratic sweep would see an expansion of Biden's policies, supporting sectors such as healthcare, semiconductors, and clean energy.

- Credit: A Republican sweep could boost corporate credit as business-friendly policies drive higher yields, offering opportunity in the 7-10Y duration. A Democratic sweep is expected to have neutral impact on credit, with corporate tax increases moderately affecting profits but not significantly impacting interest expense priorities.

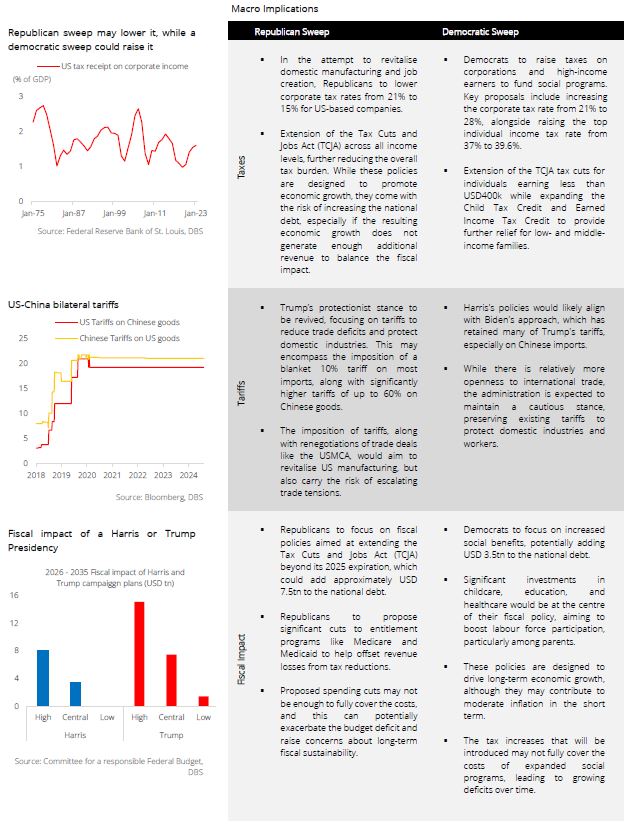

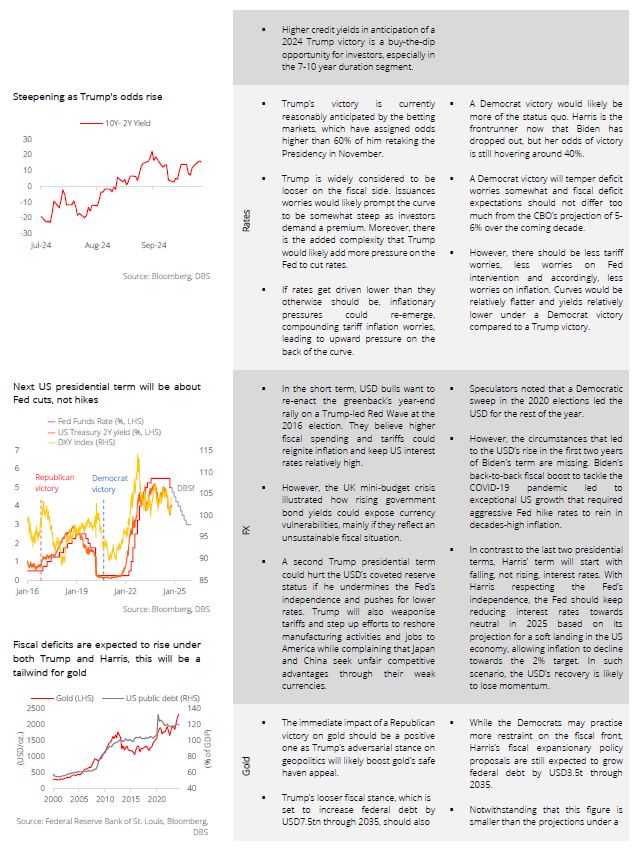

- Rates: A Republican sweep would likely steepen the yield curve, driven by fiscal looseness, inflationary concerns from tariffs, and pressure on the Fed to cut rates. A Democratic sweep would see yield curve relatively steeper and yields relatively lower as inflationary risk will be more contained.

- FX: USD recovery expected to fade out after the US elections as Trump’s policy bias will undermine the dollar’s reserve status while Harris’s support for Fed’s independency will support ongoing rate cuts.

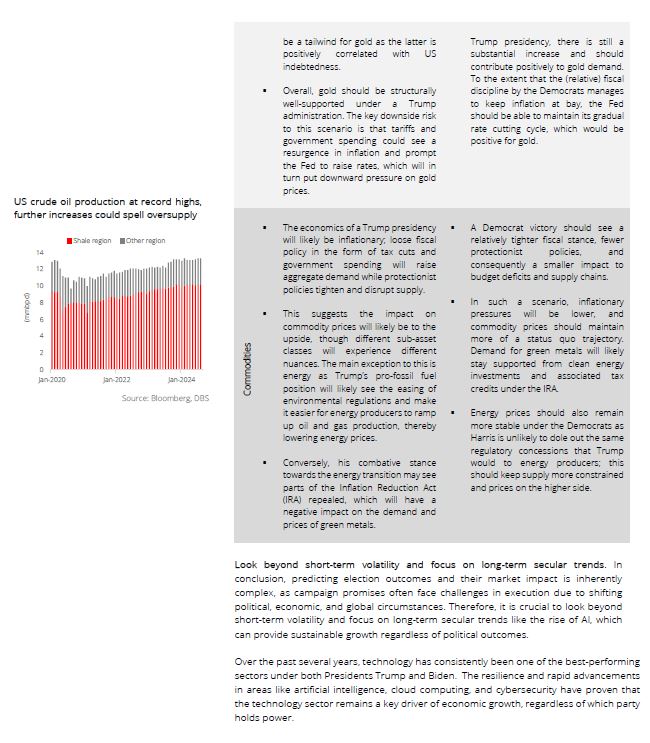

- Gold: A Republican sweep would boost gold given Trump’s adversarial stance on geopolitics and looser fiscal stance, while a Democratic sweep would also see gold benefitting as Harris’ fiscal expansionary policy will grow, albeit to a lesser extent.

Related insights

- Alternatives 1Q25: Gold – Resilience with Alternatives20 Dec 2024

- CIO Insights 1Q25: Game Changers20 Dec 2024

- Bank of America19 Dec 2024

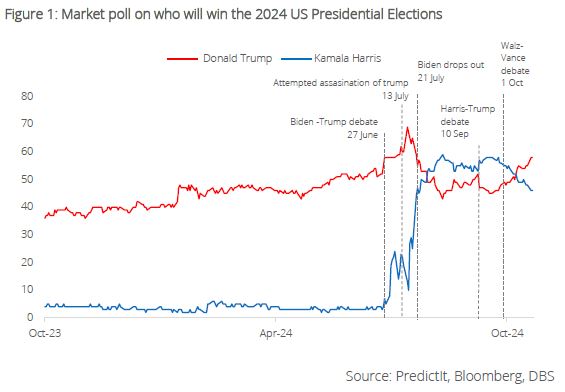

2024 US Presidential Election – Down to the wire. The 2024 US Presidential race begun with Trump leading the polls, fuelled by strong support and a campaign centered on economic nationalism. However, the race took a significant turn when President Joe Biden stepped down from seeking re-election, allowing Vice President Kamala Harris to secure the Democratic nomination. Since then, Harris had gained significant momentum, with early polls showing her taking the lead over Trump.

However, in recent weeks, the political landscape took a dramatic shift as Trump regained momentum and now finds himself in the lead once again. With less than two weeks until the election, much can still change, adding to market volatility as investors weigh the implications of different outcomes. In this CIO Perspective, we highlight the macro and cross assets implications in the event of either a Democratic or Republican sweep.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.

Related insights

- Alternatives 1Q25: Gold – Resilience with Alternatives20 Dec 2024

- CIO Insights 1Q25: Game Changers20 Dec 2024

- Bank of America19 Dec 2024

Related insights

- Alternatives 1Q25: Gold – Resilience with Alternatives20 Dec 2024

- CIO Insights 1Q25: Game Changers20 Dec 2024

- Bank of America19 Dec 2024